Chainlink price stabilized around the $14 support level as the crypto market rally faded. It has formed a highly bullish chart pattern as LINK ETF inflows soar and as the supply in exchanges drops.

Summary

- Chainlink price has formed the bullish falling wedge pattern on the daily chart.

- The Grayscale LINK ETF has accumulated over $48 million in assets.

- The Strategic LINK Reserves have crossed the 1 million tokens mark.

Chainlink price chart points to a rebound

The daily timeframe chart shows that the Chainlink (LINK) price has formed a few highly bullish chart patterns. It formed a double-bottom pattern at $11.56 and a neckline at $13.50. A double-bottom is one of the most common bullish reversal signs in technical analysis.

Chainlink price has also formed a giant falling wedge pattern, which is made up of two descending and converging trendlines. It has already moved above the upper side of the wedge pattern.

The token is also about to move above that Supertrend indicator, a sign that the bullish breakout is happening. It is also about to move above the 50-day moving average.

Therefore, the token will likely continue rising as bulls target the next key resistance level at $20, up by 45% above the current level. A drop below the key support at $11.56 will invalidate the bullish outlook.

LINK ETFs near $50 million milestone

The main catalyst for the Chainlink price is that the top LINK ETF has been received well by market participants. Data compiled by SoSoValue shows that the spot LINK ETF had inflows in all days since it was launched.

The fund had over $48 million in assets, bringing its assets to over $70.6 million, representing 0.75% of its market capitalization. This means that it has more gains to go in the coming months as it targets the 5% value that Bitcoin and Ethereum have.

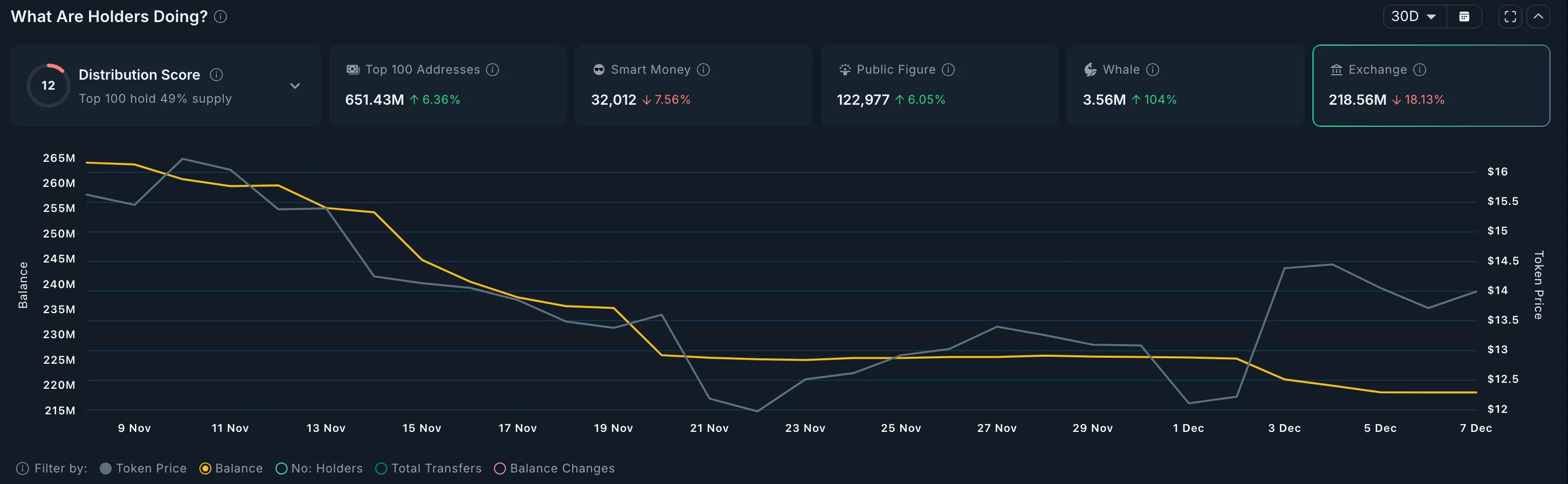

Meanwhile, there are signs that the supply of LINK tokens in exchanges has continued falling in the past few months. Data shows that the supply stands at 218 million, down from the November high of 264 million.

At the same time, whales have continued accumulating their tokens. Data shows that these whales now hold 3.56 million tokens, up from 1.73 million tokens in November, a sign that demand is soaring.

Mode data shows that the Chainlink team is continuing to accumulate tokens as part of the Strategic LINK Reserves. The amount of tokens in these reserves has jumped to 1 million, worth about $14.7 million, a few months after launch.

Chainlink started accumulating the tokens in August, channelling the fees it makes from the network to these purchases.

Source link