Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Citigroup enters stablecoin custody and blockchain payments, signaling a major leap for crypto adoption.

Summary

- Citigroup enters stablecoin custody, signaling crypto’s move into mainstream finance.

- Little Pepe presale surges as investors eye high-potential tokens.

- With exchange listings secured, LILPEPE aims to lead 2025’s top crypto performers.

The digital asset market is preparing for its next major leap as Citigroup, a $2.57 trillion banking giant, confirms its push into stablecoin custody and blockchain-based payments.

With Wall Street preparing to integrate crypto into mainstream finance, investors are searching for tokens positioned to ride this momentum.

Here are five cryptos to buy right now:

- Little Pepe (LILPEPE): The memecoin rewriting the rules with sniper bot resistance, zero tax, and $20.6 million+ presale raised.

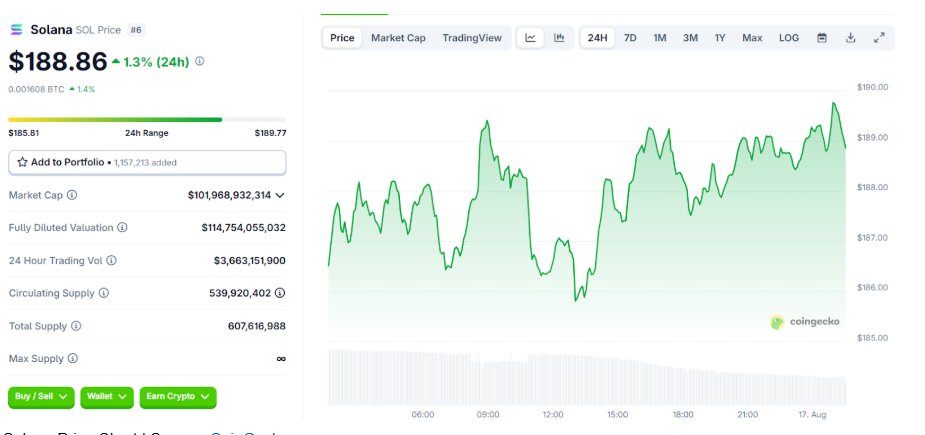

- Solana (SOL): Breaking past $200 with ETF inflows and a $1,000 long-term target.

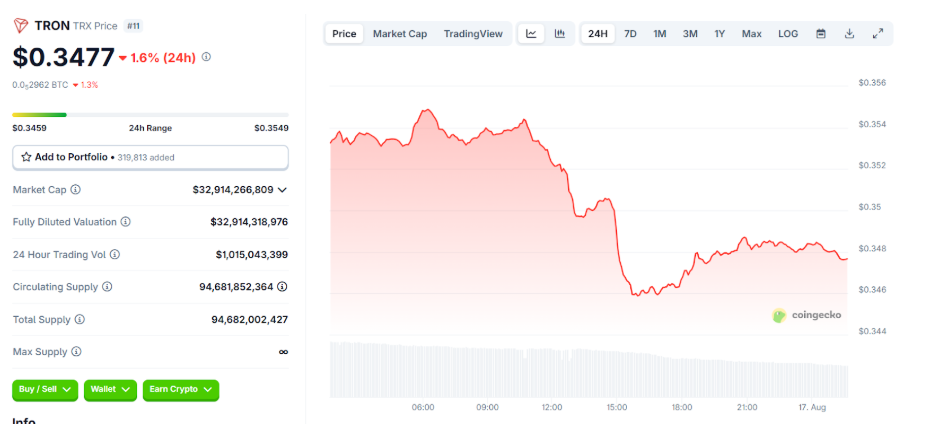

- Tron (TRX): Building structural demand with resilient on-chain growth and a path toward $1.

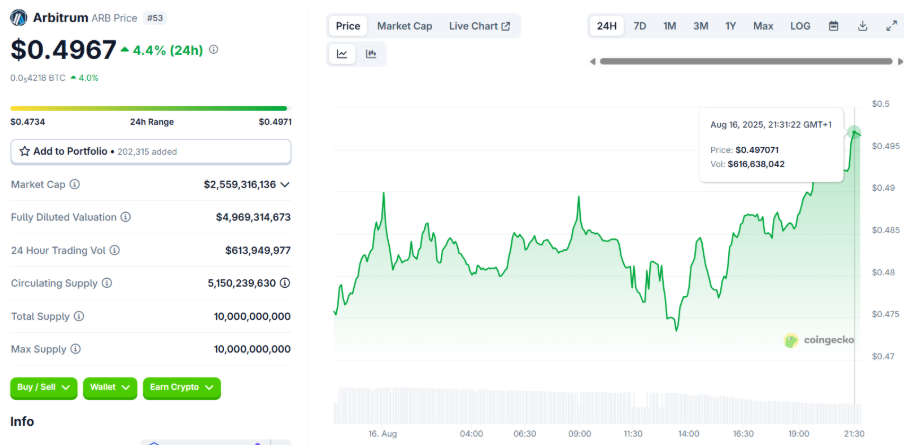

- Arbitrum (ARB): Up 50% weekly as ETH nears $5k, boosted by PayPal and Robinhood integrations.

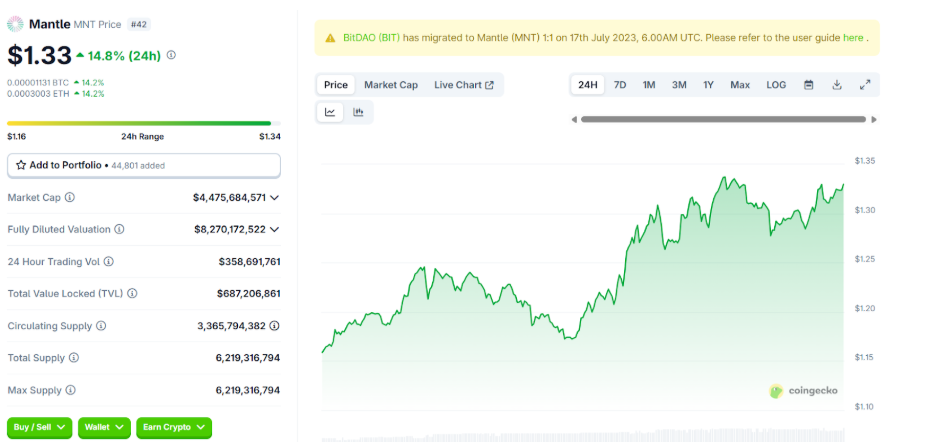

- Mantle (MNT): Surging 30% in 48 hours on Bybit partnerships and MiCA-compliant staking demand.

Impending Citigroup big stablecoin move

With $2.57 trillion in assets under custody, Citigroup has confirmed it’s exploring custody services for stablecoin reserves, crypto ETF infrastructure, and tokenized payments.

The plan aligns with the U.S. GENIUS Act, which requires issuers to back tokens with safe assets like Treasuries or cash. The bank already uses blockchain to transfer USD across financial hubs and is considering establishing a stablecoin.

Citi might become a primary stablecoin payment provider if it performs fully, boosting crypto adoption and investor trust. This backdrop makes the following five cryptos highly relevant in the current environment.

Little Pepe: Memecoin meets institutional-grade strategy

While Citi is shaping the payment rails, Little Pepe is leading a parallel revolution in memecoins. Unlike Dogecoin or Shiba Inu, LILPEPE is not just a meme but a Layer-2 blockchain ecosystem designed for speed, low fees, and community empowerment.

The presale has been remarkable: $20.6 million raised, 13.4 billion tokens sold, and Stage 11 now live at $0.002 per token, already up 100% from its Stage 1 entry price. With demand accelerating and multiple stages left, LILPEPE is building momentum that often fuels massive post-listing rallies.

What makes LILPEPE unique is its sniper bot resistance, the world’s only chain where bots can’t exploit early trading. Combine that with zero buy/sell taxes, a dedicated meme launchpad, and confirmed listings on two top-tier CEXs at launch, and there is a meme token positioned more like a high-growth tech play.

Backing from anonymous experts who helped scale other top memecoins adds credibility, while the recently completed Certik audit strengthens investor trust. Little Pepe’s roadmap also includes a plan to hit a $1 billion market cap and climb into the CMC Top 100 immediately post-listing.

LILPEPE could be the one to deliver 100x returns from launch. In a market where institutions seek stability, LILPEPE demonstrates that memes with robust infrastructure are enduring.

Solana: Can SOL soar to $1,000?

Solana has been one of the strongest large-cap performers this cycle, climbing above $200 with nearly 28% gains in 30 days. The launch of the Solana + Staking ETF has fueled institutional FOMO, while $13b in trading volumes confirms liquidity support.

Analysts see a short-term correction to $190, but the larger target remains clear: $500 within 6 months and potentially $1,000 long-term if ETF demand and adoption sustain. With the market set to welcome significant capital from Citigroup, Solana is already emerging as a top crypto to buy in 2025.

Tron: The path to $10 looks clear

Tron has quietly become one of the most resilient performers of this market cycle. Trading at $0.36, TRX has grown over 50x since launch while maintaining a strong uptrend channel. Analysts point to consistent accumulation and 11.1 billion+ on-chain transactions, confirming structural adoption across payments and stablecoin transfers.

The projection for this cycle? A breakout toward $2 in the short term, with the psychological $10 target in sight. With futures markets showing balance and no signs of overheating, TRX remains a reliable bet for investors looking for steady upside.

Arbitrum: Layer-2 leverage on Ethereum’s surge

Arbitrum has surged 50% in the past week, breaking above resistance as Ethereum nears $5,000. As one of the top Ethereum Layer-2s, ARB benefits directly from higher transaction volumes and institutional demand.

Big partnerships fuel the rally: PayPal is integrating the PYUSD stablecoin on Arbitrum, and Robinhood has tapped the network for tokenized assets. With volume up 133% to $1b and resistance at $0.55–$0.60, analysts believe ARB could climb toward $3+ this cycle as ETH adoption cascades through its ecosystem.

Mantle: New utility, new momentum

Mantle has been one of the biggest surprises of August, rallying 30% in just 48 hours. The surge came after Bybit EU launched MiCA-compliant staking for MNT, marking its first regulated staking product in Europe.

With additional integrations into structured products and creator economy tools, Mantle is expanding its utility base. Trading volumes surged to nearly $600 million daily, and derivatives data suggest a potential breakout above $1.40, with a path toward $2 if shorts get squeezed. As a newer Layer-2 solution, Mantle could carve out a strong niche this cycle by positioning itself as a compliance-first blockchain for utility-driven demand.

From Citi to Pepe: The next big cycle winners

Citigroup’s entry into stablecoin custody highlights one undeniable truth: crypto is no longer fringe; it’s the future of global payments. While large caps like Solana, Tron, Arbitrum, and Mantle are primed to benefit, the real asymmetric bet remains with Little Pepe. With exchange listings locked in and community momentum building, LILPEPE could lead the top cryptos to buy this cycle. Don’t miss the chance to buy before the subsequent presale price increase.

To learn more about Little Pepe, visit the website, Telegram, and X.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Source link