Bain & Co. predicted the AI sector is burning through their pockets, as the industry is expected to fall $800b short of its $2 trillion target. How will the projected slip-up affect the AI-crypto market?

Summary

- Bain & Co. projects that AI will face an $800 billion revenue shortfall over the next five years as rising infrastructure costs outpace monetization, raising doubts about the industry’s sustainability.

- This uncertainty is spilling into the crypto sector, where AI-linked tokens and projects show mixed performance despite growing integrations between artificial intelligence and blockchain.

Artificial intelligence is not doing as well as its growth demonstrates. Although companies like OpenAI are rolling out plans to spend hundreds of billions of dollars, the revenue flow is not showing results that match the output; much to investors’ dismay.

The consulting firm Bain & Co., recently projected that the industry will fall short of reaching its initial target by a considerably large margin. The firm predicts that in five years time, AI companies will need to shell out a combined annual revenue of $2 trillion in order to keep funding the computing power needed to meet projected demand.

Services like OpenAI’s ChatGPT and Google’s Gemini, as well as other AI companies across the planet, means demand for computing capacity and energy is rising at a rapid rate. However, the funds needed to sustain the power needed is lagging behind compared to the surge in demand.

According to Bain & Co.’s annual Global Technology report, AI companies will have a hard time reaching the $2 trillion target. In fact the firm predicted that AI’s revenue will fall $800 billion short of that mark as efforts to monetize services like ChatGPT and Gemini trail the spending requirements for data centers and related infrastructure.

Will Bain & Co.’s negative outlook on AI affect the crypto market?

At the moment, AI and crypto’s growth has been expanding with more projects combining AI agents as well as AI platforms and web3 continue to emerge.

Most recently, 0G Labs released the Aristotle mainnet; which hinges on becoming the first AI-powered blockchain with a complete modular decentralized operating system. Another project that focuses on becoming an AI solution is the collaboration between Flagship and the Virtuals Protocol, which launched a token to expand its suite of AI agents.

With a growing number of AI and crypto projects, the two sectors are becoming more interlinked overtime. However, this growth is not fully reflected in its value.

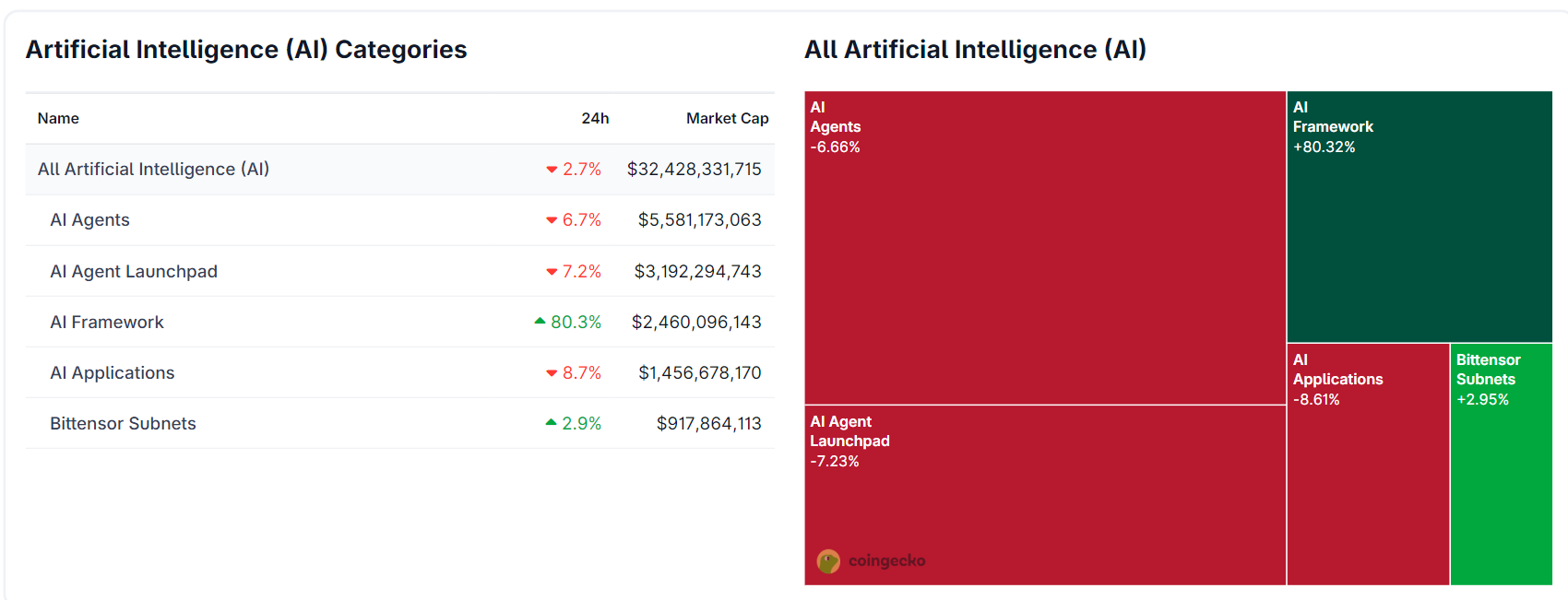

According to data from CoinGecko, the overall value of the AI crypto sector has fallen by 2.7%, amounting to $32.4 billion. The AI Agents market has dropped by 6.7% to $5.5 billion, losing $200 million in the process. AI Agent Launchpads have dipped lower as much as 7.2%. Meanwhile, AI Applications have decreased by 8.7% in the past 24 hours.

The only two sub-sectors that appear to be doing well include AI Frameworks, which have surged up by 80.3%, reaching nearly $2.5 billion. Bittensor Subnets is also doing modestly well, having increased by 2.9%. This could signal a bit of hope in the darkness for the AI and crypto sector, though it could also be short-lived.

If demand for AI-powered projects continue to grow without a proper stream of revenue to back it up, Bain & Co.’s prediction could bring investor confidence even lower as the attractive promise of AI technology appears to be waning in the market.

Source link