Altcoins are heating up as the Altcoin Season Index surges closer to the altseason threshold. However, a market analyst has issued a serious warning.

Summary

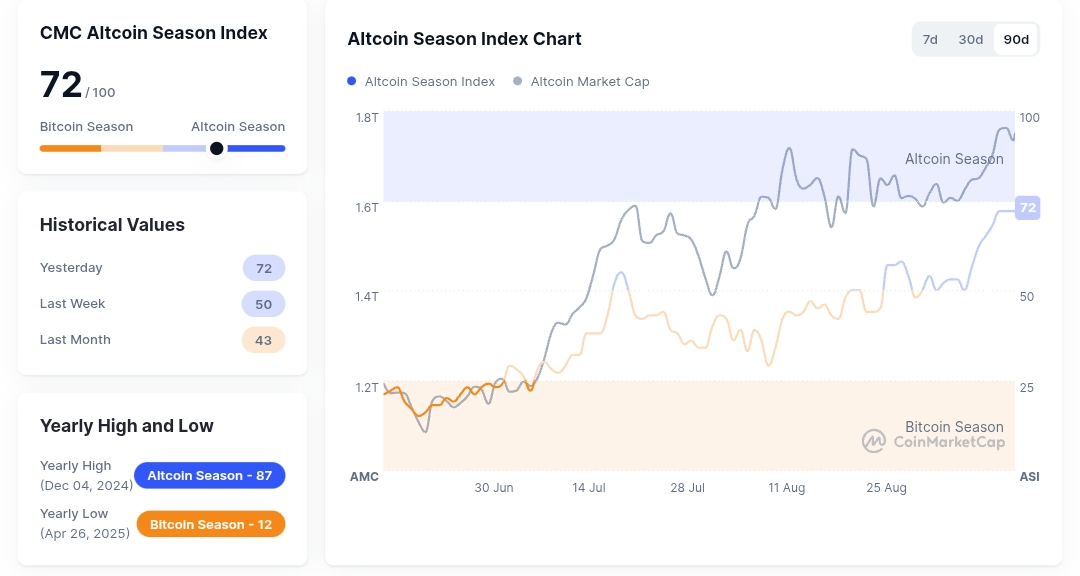

- The Altcoin Season Index has surged to 72, nearing the critical 75 level that signals full altseason.

- Solana led large-cap gainers, rising 17% in the past week and overtaking Binance Coin in market cap.

- Small caps like MYX and MemeCore soared, fueling market-wide excitement.

- Analyst Maartunn warns of parallels with December 2024’s market correction, urging investors to stay alert and manage risk carefully.

The altcoin season is approaching a key inflection point. Following a massive uptick to 68 last week, the Altcoin Season Index now sits at 72, just shy of the 75 level that officially signals an “altseason.” This development has ignited fresh excitement among traders, especially as several large-cap altcoins are beginning to show strong performance.

Over the weekend, Ethereum (ETH) surged past the $4,600 mark, Ripple (XRP) reclaimed $3.00, Dogecoin (DOGE) is trading above $0.28, and Cardano (ADA) has surpassed $0.90. However, the standout performer has been Solana (SOL), which climbed over 17% in the past week to reach a new peak of $248. Solana’s market cap soared to $135 billion, overtaking Binance Coin (BNB) to become the fifth-largest cryptocurrency.

This bullish move follows Galaxy Digital’s notable accumulation of $6.5 million in SOL, signaling heightened institutional confidence. Meanwhile, small-cap coins are also making waves. MYX Finance (MYX) has recorded a huge increase with others like MemeCore (M) and OKB (OKB) following closely. These price movements point to an increasing risk appetite among crypto investors as momentum builds across altcoins.

Analyst warns of risks amid altcoin season buzz

Despite this surge, analysts are urging caution. CryptoQuant researcher Maartunn recently issued a warning in an X post, highlighting troubling similarities between current market dynamics and those that preceded the major correction of early 2025.

According to him, altcoin speculation soared in December 2024 while Bitcoin’s (BTC) open interest remained flat. This disconnect became a precursor that led to a sharp correction of 30% in early 2025. Following the crash, the market entered a prolonged “chop” phase with sideways price action lasting for three months.

Maartunn notes that similar conditions are unfolding again in September 2025. Altcoin’s Open Interest is soaring while Bitcoin stays flat. This deviation is mounting pressure in the market and may result in a sharp unwind, especially if macroeconomic conditions change or some unexpected regulatory announcement is made.

“We’ve seen this before. It doesn’t mean it will play out the same way, but you should know where your exits are.” Maartunn noted.

He also likened the situation to a game of musical chairs when the music stops, not everyone will be sitting comfortably. While the Altcoin Season Index is at its highest level since December and top tokens like Solana, Ethereum, and Ripple are pushing higher, the market still faces considerable risks.

Compared to past altseasons, the current rally remains relatively modest. A sharp correction remains possible if institutional support weakens or macro volatility returns, and whether the rally bursts in or fades into another “false start” depends on the days ahead.

Source link