BitMine Chairman Tom Lee predicted that Bitcoin and Ethereum could become the standout trades in the next three months if the Federal Reserve decides to cut interest rates. What will the rally look like?

Summary

- BitMine Chair Tom Lee said that he foresees “monster moves” in the next three months for Bitcoin and Ethereum if the Fed decides to cut interest rates.

- The overall crypto market seems to be bracing for the impact of the Fed rate decision, with polls showing strong optimism for an interest rate cut.

In an interview with CNBC, Ethereum treasury BitMine Chairman Tom Lee said that digital assets are among the sectors that may get a big boost in the next three months. If the Federal Reserve decides to go forward with the interest rate cuts, the sector may see big moves in the coming weeks.

He stated that both Bitcoin (BTC) and Ethereum (ETH) are “seasonally strong,” and poised to make even larger leaps following a Fed interest rate cut.

“I think they could make a monster move in the next three months, like huge,” said Tom Lee in his interview.

According to CBS, the Fed will announce its next rate decision at 2 pm EST on Sept. 17. The CME FedWatch cites the the probability of a 0.25% point cut stands at a 96% chance, which relies on 30-day Fed Funds futures prices to determine the likelihood. Crypto traders are bracing themselves for the Fed decision, by placing more funds into the stablecoin market to deploy on-chain.

In addition, the biggest beneficiaries also include Nasdaq 100, especially the MAG7 and AI stocks which will get a lift off from the interest cuts. The points of reference that Tom Lee used to make his prediction are what happened in September last year as well as in September 1998.

Because during both years, the Fed held off on making major moves before deciding to cut interest rates in the middle of the month. Aside from tech and crypto, Tom Lee noted that small caps and financial stocks may also benefit from rate cuts.

Is the crypto market ready for Tom Lee’s predicted Fed rally?

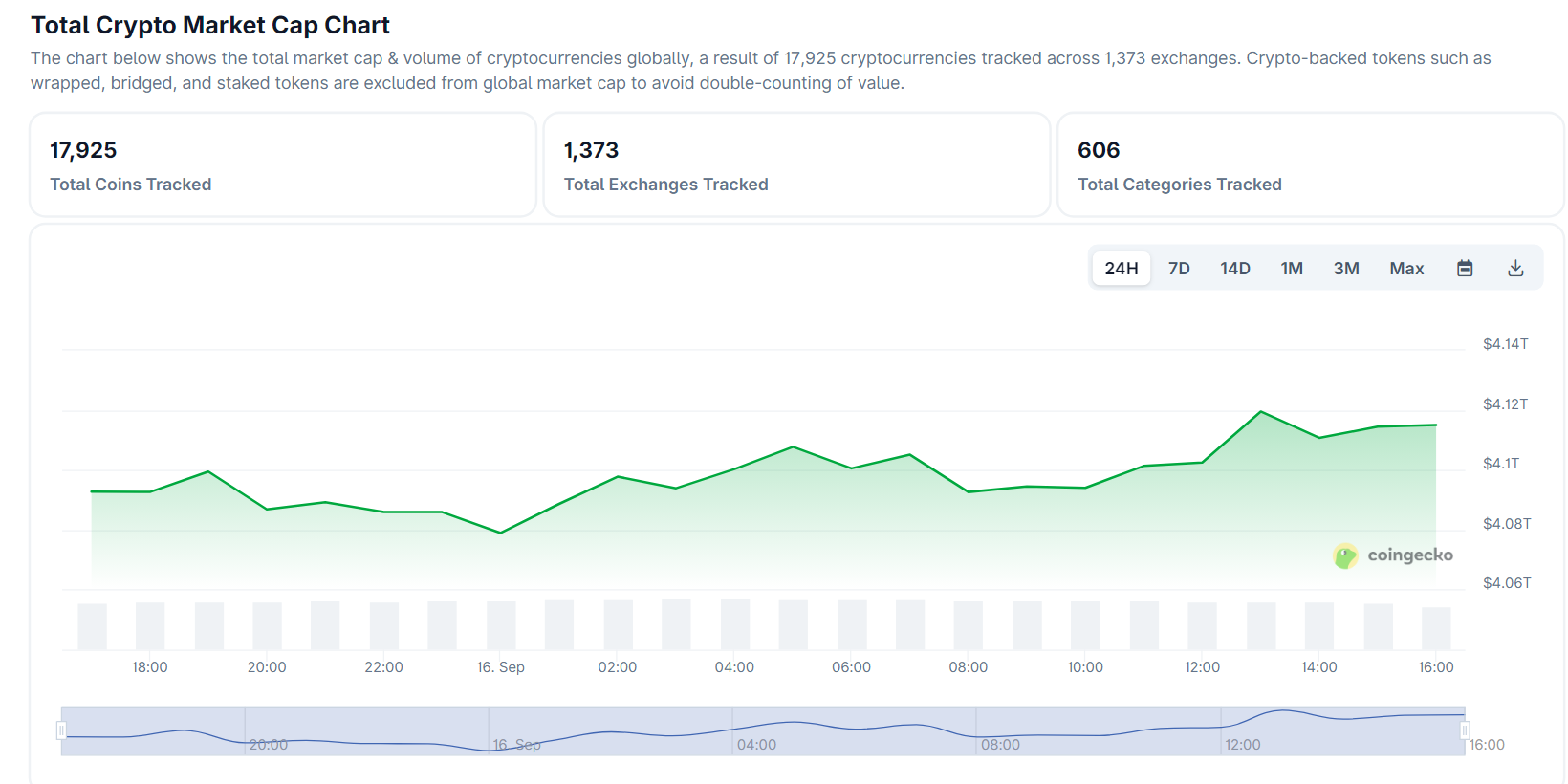

On Sept. 16, a day before the Fed interest rate decision, the overall crypto market cap stands well above the psychological $4 trillion barrier. At press time, the overall crypto market cap has reached $4.11 trillion, which is a good sign that ample liquidity is flowing through the markets.

Bitcoin continues to dominate the market at 55.43%, while Ethereum’s dominance stands at 13.05%.

According to data from TradingView, Bitcoin is currently trading at around $115,498, consolidating just below the $116,000 level after showing steady upward momentum earlier this month. The chart reflects a period of choppy price action, with multiple retests of the $116,000 resistance zone and solid support forming near $114,000.

Meanwhile the Relative Strength Index or RSI sits at around 51, signaling a neutral stance that sits neither in the overbought nor oversold zone. This suggests that the market is bracing itself for the Federal Reserve’s interest rate cut decision.

If the Fed follows through with a rate cut, Bitcoin may benefit from increased liquidity and a weaker dollar, potentially fueling a breakout above the $116,000 resistance barrier. Such a move could open the door for BTC to reach the $118,000 to $120,000 range.

On the other hand, Ethereum is trading near $4,508, pulling back after reaching highs above $4,700 earlier this month. The chart shows a recent decline with momentum weakening, as reflected in the RSI at 40, which suggests bearish sentiment and that ETH is approaching oversold conditions.

Key support lies around $4,400, with resistance moving backwards to near $4,650. Price action indicates hesitation, as traders remain cautious ahead of the Fed rate decision. A meaningful rate cut is likely encourage liquidity inflows into risk assets, potentially sparking a rebound and helping ETH to reclaim the $4,600 to $4,700 range.

Source link