crypto.news caught up with CoinW Chief Strategy Officer Nassar Achkar to discuss the current crypto market climate, Bitcoin’s possible trajectory, ongoing macro tensions, and the beleaguered altcoin landscape.

Bitcoin (BTC) broke below $81,000 again on March 10, falling 5% in the past 24 hours amid a broad market downside, while the total crypto market capitalization slid to $2.7 trillion as digital asset investors liquidated virtual currencies to protect capital.

Nassar Achkar, representing the Dubai-based crypto exchange CoinW discussed many topics with crypto.news in an interview, including how $100,000 remains a psychological hurdle for Bitcoiners and dipping below $70,000 is unlikely. Below is a transcript of the interview.

Q – Based on exchange activity (volumes, inflows, withdrawals), are crypto investors buying this dip?

A – The current crypto market is showing a new norm—investors are buying BTC instead of altcoins. This shift has led to a clear seperate between Bitcoin and the broader altcoin market.

First of all, following the Bybit incident, Binance saw an inflow of nearly $4 billion in a single week, significantly outpacing other major exchanges. Rather than a classic buy-the-dip scenario, this surge appears to be driven by risk-off sentiment, with large amounts of capital consolidating within a single exchange for safety.

Meanwhile, Ethereum (ETH) has been on a downward trend, and SOL faces a significant token unlock, prompting investors to wait for lower entry points. Even as BTC sees slight recoveries, the overall market sentiment remains cautious, with investors opting to hold assets rather than aggressively investing.

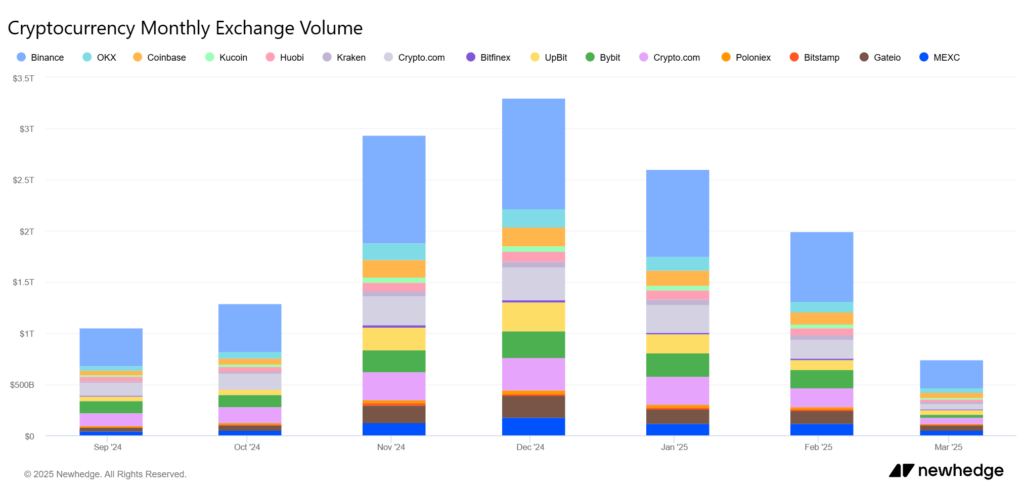

Trump’s recent pro-crypto stance has further reinforced Bitcoin’s dominance, drawing more attention and liquidity toward BTC rather than altcoins while traders await clearer signals before making significant moves. In fact, the past three months have seen a steady decline in overall CEX trading volumes, reflecting the prevailing uncertainty and fear emotion in the market.

Q – Bitcoin is 23% down from its ATH. Fundstrat’s Tom Lee said we could drop another 24% to $62,000, maybe this week or March. Does CoinW’s BTC order book paint a similar picture? Are there strong bids and buy orders around those levels?

A – Predicting price movements is always a risky endeavor, but CoinW’s order book suggests that the real tipping point between buyers and sellers is centered around $100,000, rather than a drop below $70,000.

While BTC temporarily dipped into the $70K range, it has since rebounded above $90,000, reinforcing the belief that $100,000 is both a psychological milestone and a strong support level in this cycle. Based on current market performance, we do not anticipate BTC dropping significantly below $70K in the near term.

Q – Are there any indicators to a possible market bottom? Are traders hedging bets for further downside price action or accumulating tokens at these levels?

A – CoinW is closely watching Trump’s potential influence on the market. Historical trends indicate that BTC’s price is highly correlated with U.S. stock market movements and M1 money supply. Given that U.S. equities have shed $3 trillion in value, it is not surprising to see BTC experiencing price fluctuations as well.

Additionally, Binance has recently liquidated its self-held assets, while ETH and SOL are facing continued sell pressure. Even Trump-affiliated funds like WFLI, which previously invested in altcoin portfolios, are currently in a loss.

At this stage, the market remains in a period of uncertainty, awaiting on key macroeconomic factors such as interest rate adjustments, digital asset reserves, and Ethereum’s potential resurgence. Given these circumstances, it is reasonable to remain cautious and anticipate further downside in the short term.

Q – Some are saying we’re in a cyclical bottoming channel, others argue macro factors have depressed crypto market prices. Why is crypto going down?

A – As previously mentioned, BTC is increasingly separating from the broader crypto market, with the traditional four-year cycle theory proving ineffective. Instead, BTC’s price action is now more closely tied to the U.S. dollar, equity markets, and ETF flows.

If we still classify BTC as a crypto asset, then the broader crypto market’s weakness can be attributed to macro policy uncertainty. However, when BTC is analyzed separately from altcoins, a different picture will be:

- The altcoin market, led by ETH, lacks a strong narrative or buy momentum.

- ZK, Layer-2, and VC-backed tokens are no longer favored by the market.

- Solana (SOL) and other alternative chains have been highly speculative, primarily driven by meme coins.

- Liquidity dried up completely after Trump’s token launch, leaving altcoins without a strong support base.

The combination of external macroeconomic pressures, BTC’s separation from altcoins, high ETH costs, and meme coins draining liquidity may be the real reason behind the crypto market’s current downturn.

Source link