Bonk has shown strong performance in July, with analysts suggesting the memecoin still has fuel left in the tank.

According to data from crypto.news, Bonk (BONK) has rallied 100% over the past 14 days, hitting a 5-month high of $0.000028 last check Tuesday, July 15. The meme coin had previously been in a downtrend that began in May, when it traded around $0.000024, before falling to a low of $0.000011 on June 23, before buyers regained momentum.

As of press time, BONK remains 50% below its all-time high of $0.000058, recorded in November last year. Despite this, Bonk’s recent gains have firmly established it as the top memecoin on the Solana blockchain, with a market cap of $1.57 billion, well ahead of its peers, except for Pudgy Penguins (PENGU), its closest contender with a market cap of $1.45 billion.

On the daily chart, BONK seems to have entered an ascending broadening wedge pattern, which is a bearish reversal chart pattern characterized by two diverging trendlines moving upwards, creating a widening wedge shape.

Despite being a bearish reversal pattern, Bonk still has room to rise before encountering resistance at $0.000040, where a potential reversal may occur. The target lies nearly 43% above the current price level.

Technical indicators seem to favor the positive outlook. The Supertrend line lies below the price and has turned green, indicating bulls are still in control and could push prices further in the short term. Momentum indicators like MACD and RSI are trending upwards, which is also seen as a buy signal by traders.

Some analysts have set an even more bullish target for BONK at $0.000060, citing the recent breakout above the upper trendline of an ascending triangle pattern.

Bullish catalysts at play

A few catalysts could support Bonk’s rally in the short term. According to data from CoinGlass, BONK’s weighted funding rate has continued to remain positive for the last 9 days.

A positive funding rate means long traders are paying short traders to hold their positions, which shows that most futures traders are betting on the price going up. If this keeps up, it could attract more retail investors, fueling Bonk’s price ahead.

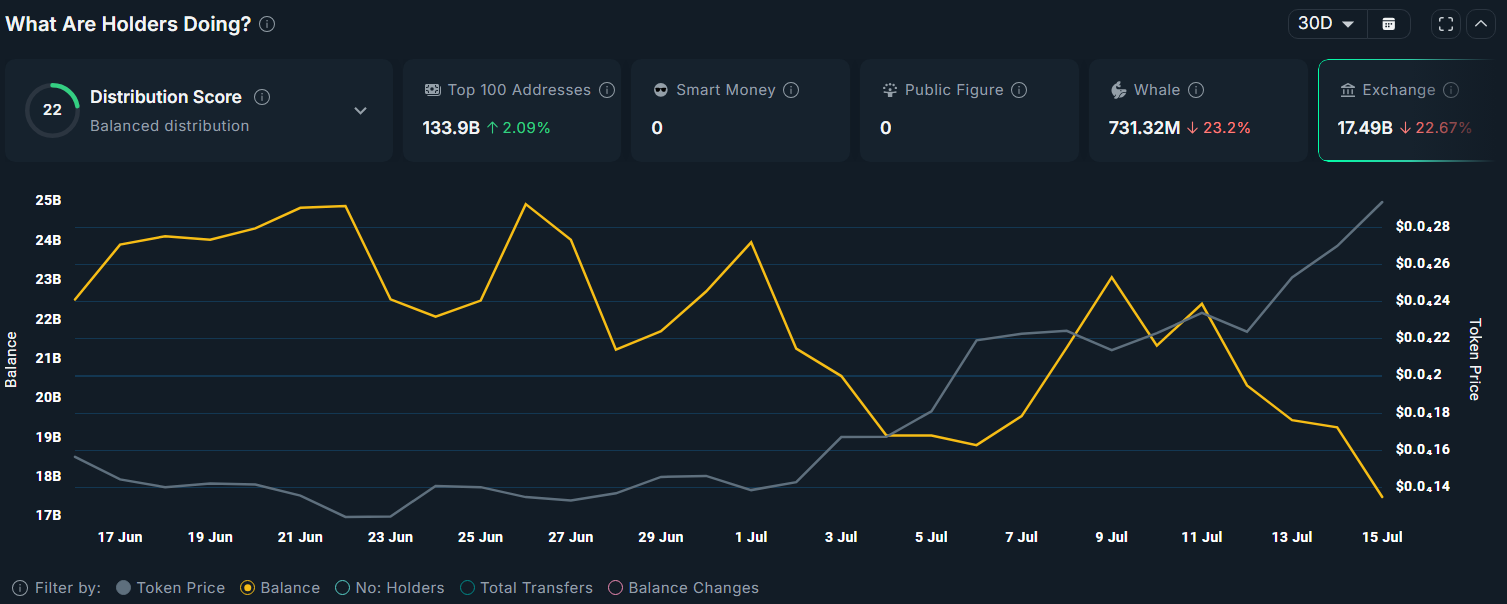

Additional data from Nansen shows that the total amount of BONK held by exchanges fell 22% over the past 30 days to 17.63 billion tokens. A drop in exchange balances could mean that traders are opting to transfer their holdings to private wallets, indicating they are less likely to sell them in the short term. Such outflows help reduce immediate sell-off risk while reducing supply.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link