Summary

- Introduction: Amid shaky technicals and mixed emotions, ETH is trading close to $4,377.

- Present situation: Although institutional inflows of about $500 million into ETFs indicate ongoing confidence, price pressure is still present for the current ETH price prediction.

- Positive outlook: A possible recovery is supported by Ethereum’s use in DeFi, NFTs, and scaling solutions, as well as capital inflows.

- Risks: Sell-side pressure and a decline in momentum relative to Bitcoin could affect larger markets, such as stocks.

- Overall outlook: Neutral to cautious; there are still significant short-term concerns.

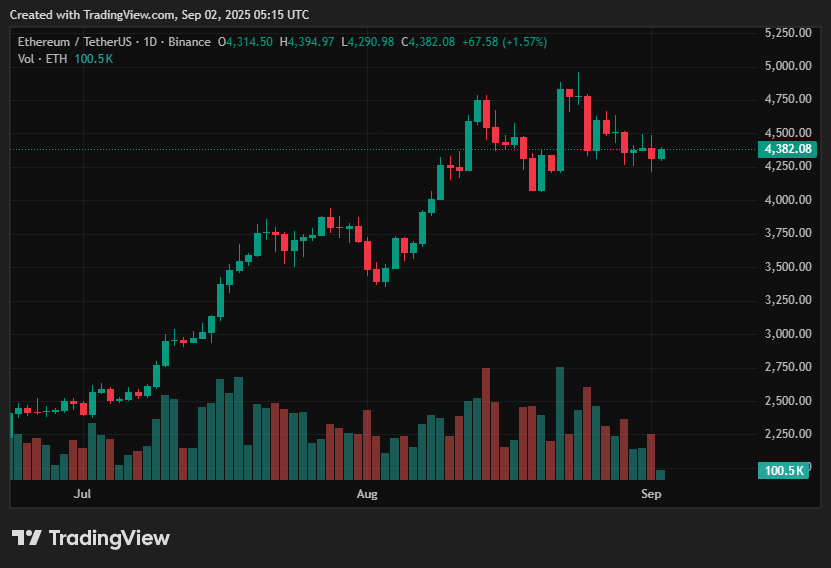

Ethereum is currently trading at $4,384, indicating a slight decrease of roughly 1.34% from its last close, underscoring the widespread volatility of the major cryptocurrencies.

The short-term market structure places the current ETH price prediction as close to critical levels, but if important support is broken, there is a greater chance of liquidation.

Participants in the market are divided; some see the current levels as a continuation of the bear market, while others expect a possible recovery bolstered by on-chain accumulation signals and institutional inflows.

In this article, we’ll discuss the Ethereum price prediction in the short term, which may help investors to align their expectations for the coming weeks.

Current ETH price action

Due to sell-side pressure and general market stagnation, Ethereum has been trading around the $4,290–$4,340 range recently. Long-term optimism endures in spite of these challenges since Ethereum’s ecosystem is supported by strong demand signals.

Even if Ethereum’s large market capitalization may dampen expectations for sharp movements, the growing inflows into ETH-tracking ETFs, which recently totaled close to $500 million, highlight ongoing institutional trust in the cryptocurrency. This adds weight to the Ethereum coin price forecast, which balances cautious short-term sentiment with supportive long-term demand.

ETH price catalysts

Ethereum’s continuing success is linked to its fundamental function in Web3 apps, NFTs, and decentralized finance (DeFi), which is supported by Layer-2 scaling solutions like Optimism and Arbitrum.

This solid infrastructure foundation, bolstered by robust ETF inflows, indicates that a recovery is still possible should sentiment become favorable. Overall, the Ethereum outlook remains constructive for the long term, despite near-term volatility.

What could make ETH go lower?

Conversely, if broader risk-off sentiment persists, further sell-side pressures may push ETH lower. Analysts warn that a declining ETH/BTC ratio could portend volatility in equity markets in addition to endangering cryptocurrency outlooks.

Historical gains in ETH relative to BTC have occasionally preceded notable declines in the S&P 500, possibly ranging from 10% to 20%, according to Tom Essaye of Sevens Report.

ETH price prediction based on current levels

Ethereum is still torn between stress and support. The coin might find a launching pad for a rebound if it can stabilize between $4,300 and $4,400. However, the bullish case may be compromised by a break below current levels, which would be exacerbated by risk-off sentiment and weak technical structure.

The Ethereum prognosis is cautiously neutral until more directional clarity is obtained; it is backed by long-term fundamentals but susceptible to short-term volatility.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link