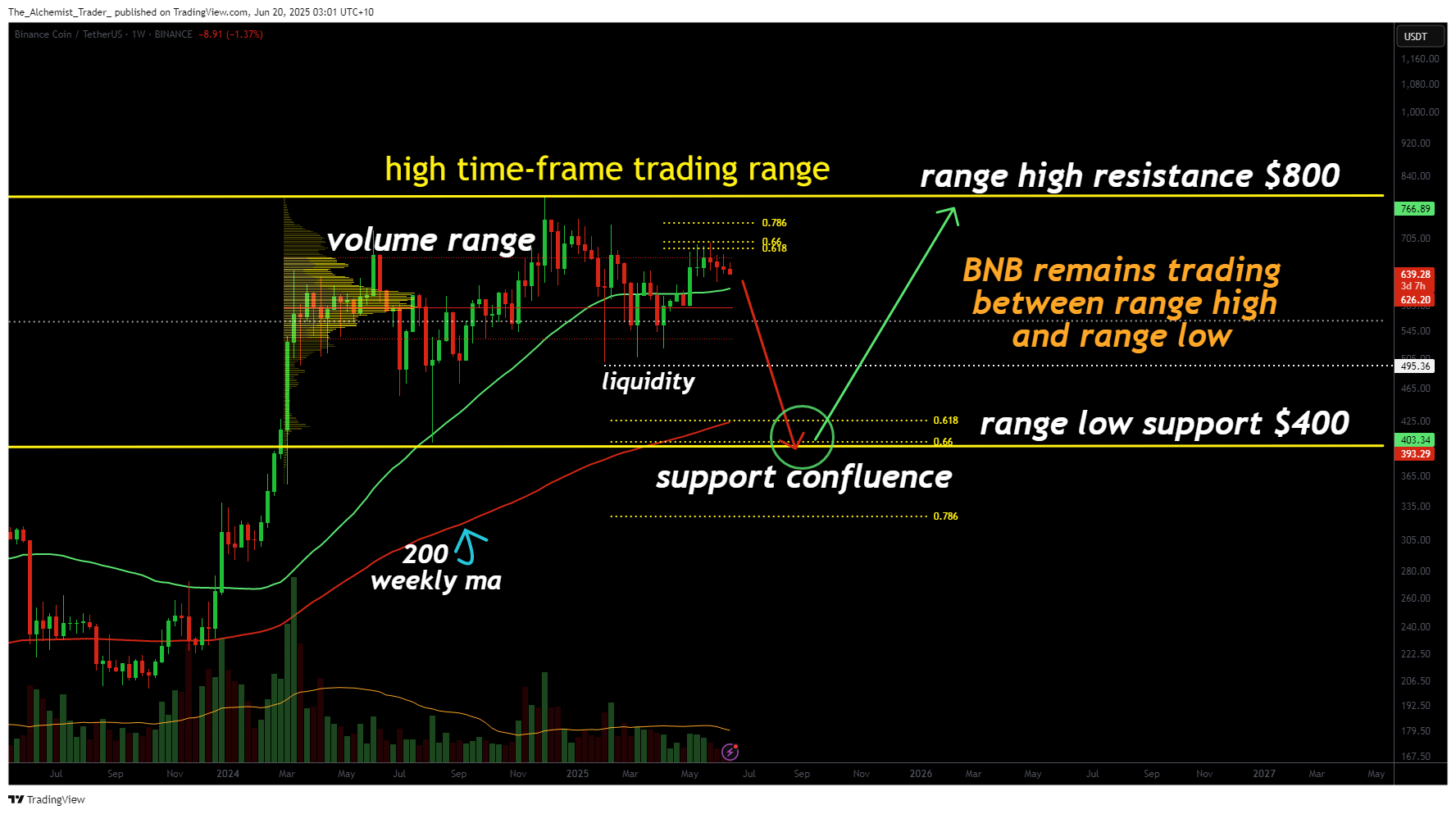

Binance continues to trade sideways in a tightly defined high time frame range, with $800 as resistance and $400 as support. As this range matures, the likelihood of a major breakout, or breakdown, increases. Until then, traders should prepare for continued oscillation and plan around key levels.

Binance (BNB) has been consolidating for weeks, and the structure shows no signs of an immediate breakout. However, the ongoing sideways action is setting the stage for a larger volatility expansion in the near future once resistance or support breaks.

Key technical points

- Range High: $800 resistance with deviation and rejection confirmed

- Range Low: $400 support, aligning with the 200 MA and 0.618 Fibonacci retracement

- Rotational Structure: Price action has respected both edges of the range, creating a clear oscillation pattern

The $800 region is acting as a strong resistance level, with price failing to close convincingly above it. A clear deviation from this level has already occurred, confirming a rejection and a rotation back into the mid-range. This resistance aligns with the value area high and sits just above the 0.618 Fibonacci retracement, both adding to its technical significance.

If price continues to reject around this high time frame resistance, the probability increases for a full range rotation back to the $400 support. This support is a key technical zone, it coincides with the 200-day moving average and another 0.618 Fibonacci level, and it also holds untapped liquidity built over the past several months. A test of this area would offer a clean sweep of downside liquidity, potentially setting the stage for a stronger bullish reaction.

BNB remains firmly within a rotational range structure, and no breakout has yet occurred. For long-term investors and swing traders, the optimal long opportunity likely lies near the $400 mark, should price revisit that level with confirmation. Until then, entering mid-range positions carries unnecessary risk.

What to expect in the coming price action

Unless BNB breaks above $800 or loses the $400 support, price is expected to continue ranging. Traders should focus on the edges of the range for positioning, with $400 acting as the ideal accumulation zone and $800 as the breakout trigger.

Until a clear shift in structure appears, range-bound strategies remain favorable.

Source link