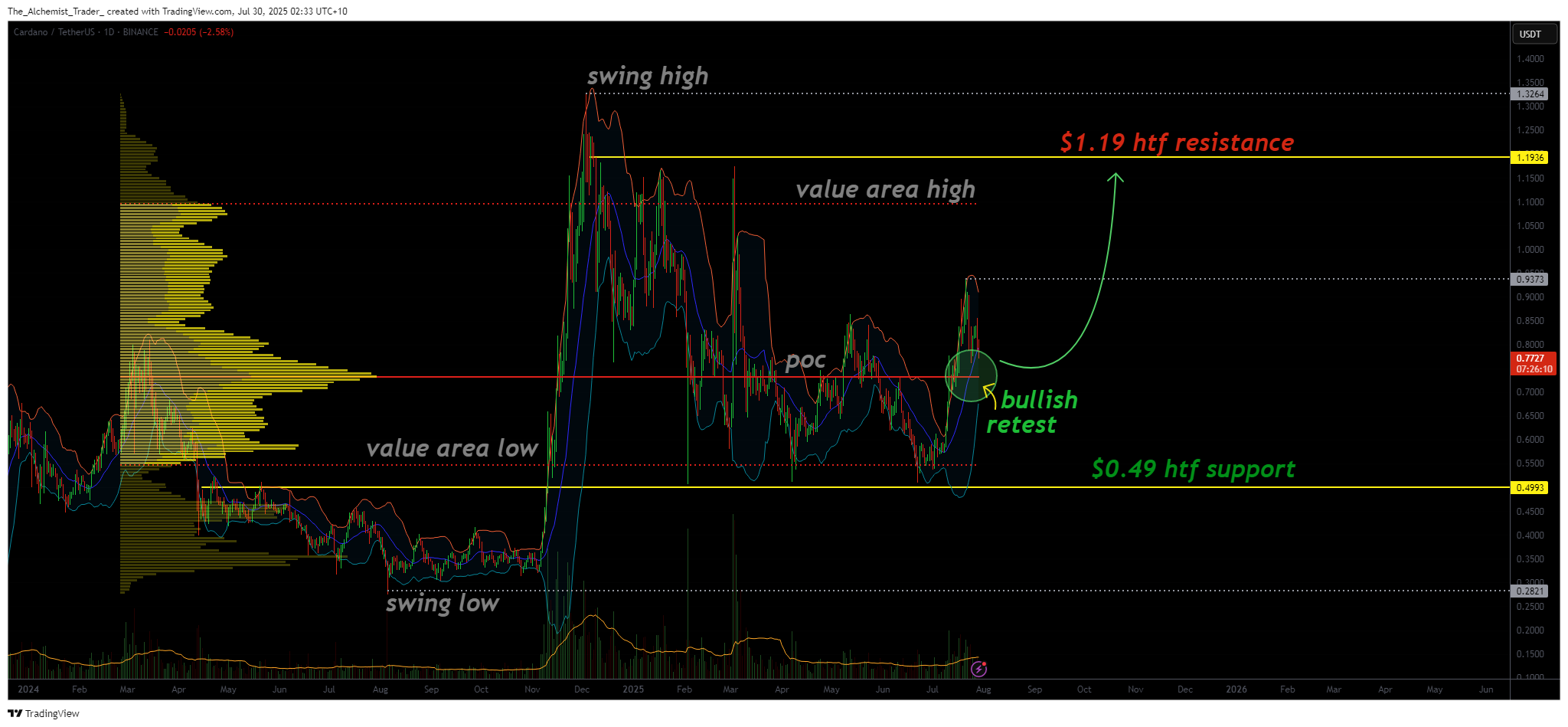

Cardano is retesting a major structural level with strong volume backing. If this point of control holds, Cardano could be on track for a rally toward the $1.19 high-timeframe resistance.

Summary

- ADA has reclaimed the point of control with strong bullish volume, marking a key retest.

- The next upside target is $1.19, where the value area high and high-timeframe resistance converge.

- Continued volume inflows are essential to sustain the bullish momentum and avoid a failed breakout.

Cardano (ADA) is currently in the process of confirming a key bullish retest after reclaiming the point of control, a level that had rejected price multiple times in recent months. This time, the reclaim occurred with impulsive momentum and a clear influx of volume, signaling growing demand and renewed strength in ADA’s market structure.

Key technical points:

- POC Reclaimed with Volume: A decisive bullish retest has emerged after multiple failed attempts.

- $1.19 Resistance in Sight: Value area high and high-timeframe resistance converge at this level.

- Sustained Demand Required: Bullish volume must continue to support price as it climbs.

The successful reclaim of the point of control marks a significant shift in ADA’s mid-term structure. Price action has shown impressive respect for technical pivots, and the latest move is no different. The reclaim was not only clean but also backed by a notable spike in volume, suggesting real demand rather than a low-volume push.

If ADA can maintain this level as support in the coming sessions, it sets the stage for a continued rally toward the value area high, which currently aligns with the $1.19 high-timeframe resistance. This region is a key target for bulls and marks a full structural rotation from the recent lows. For this to play out, however, the point of control must hold on a weekly closing basis to confirm sustained momentum.

The volume profile also supports the bullish case. We’re seeing consistent bullish inflows, reinforcing the idea that buyers are active and absorbing supply. This demand will need to persist as price approaches higher resistance zones, particularly as sellers begin to step in near historical rejection levels. If volume remains strong and the structure continues to respect each bullish pivot, a move to $1.19 becomes increasingly likely.

What to Expect in the Coming Price Action

ADA’s next major move hinges on its ability to hold the point of control as a base of support. If successful, the path toward $1.19 opens up with strong technical alignment. However, any weakness or volume drop could delay the move, requiring a new consolidation phase before another attempt higher.

Source link