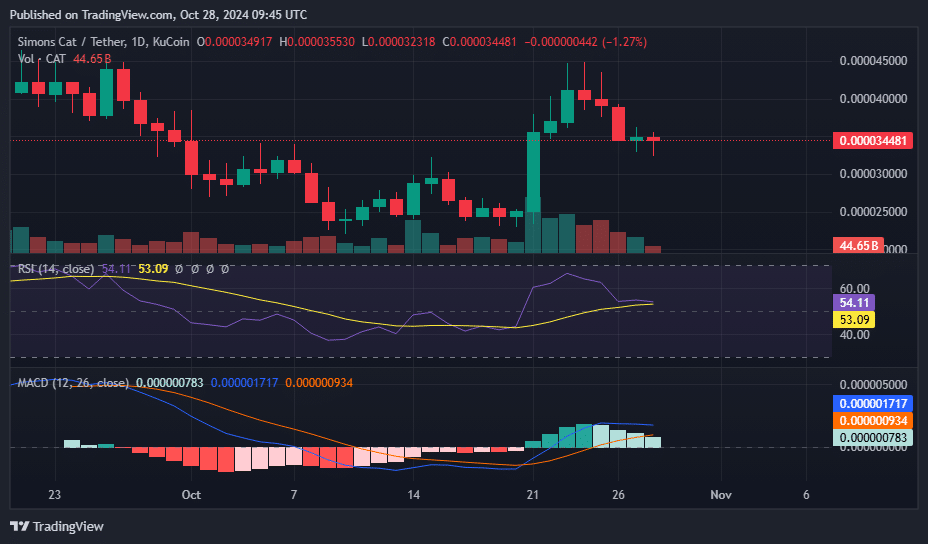

Simon’s Cat was trending on Google as a bull flag pattern formed on the meme coin’s 1-day chart.

Pseudo-anonymous trader Zak recently noted in an X post that Simon’s Cat (CAT) has formed a bull flag pattern. On Oct. 21, CAT surged from $0.000024 to $0.000035, creating a large green candle that forms the flagpole.

After reaching a high of $0.000038, the token pulled back to $0.000034, shaping the characteristic flag. A breakout from this pattern usually signals a continuation of an uptrend, which could lead to further price gains.

Another trader, Mr. Albert, observed that the meme coin had been consolidating between Oct. 23 and Oct. 26 within a tight range of $0.000038 to $0.000044, finding strong support above $0.000033. He noted that a breakout above this consolidation range could trigger a continued upward move in the short term.

The meme coin was up 37.6% over the past 7 days, with its market cap reaching $233 million when writing, up from $166 million on Oct. 21. This rise was accompanied by a jump in daily trading volume, which was hovering above $60 million at press time.

CAT’s recent listing on the crypto exchange OKX has also sparked optimism within the crypto community, as an uptick in buying activity was seen among investors.

Pseudonymous trader Crypto Bull disclosed buying $250,000 CAT. Another community member pointed out that a whale had picked up $26,000 worth of the meme coin days after the OKX listing.

Alongside this buying activity, CAT’s price rally coincided with a rise in the number of addresses holding the token, increasing from 231,676 on Oct. 21 to 235,666 on Oct. 28, as more investors seek to capitalize on its growing popularity.

Despite the positive developments, technical indicators suggest that the trend might be losing steam in the short term.

On the 1-day CAT/USDT chart, the Relative Strength Index has dropped from nearly overbought levels of 66 on Oct. 23 to a neutral 54, suggesting the recent bullish trend is waning.

The MACD further supports the bearish outlook, with the MACD line (orange) crossing below the signal line (blue) and a decreasing histogram, signaling potential consolidation or slight downward movement in the short term unless substantial buying interest emerges.

Source link