U.S. government debt is rattling investors, contributing to a sharp decline in the markets—even as Bitcoin reached a new all-time high.

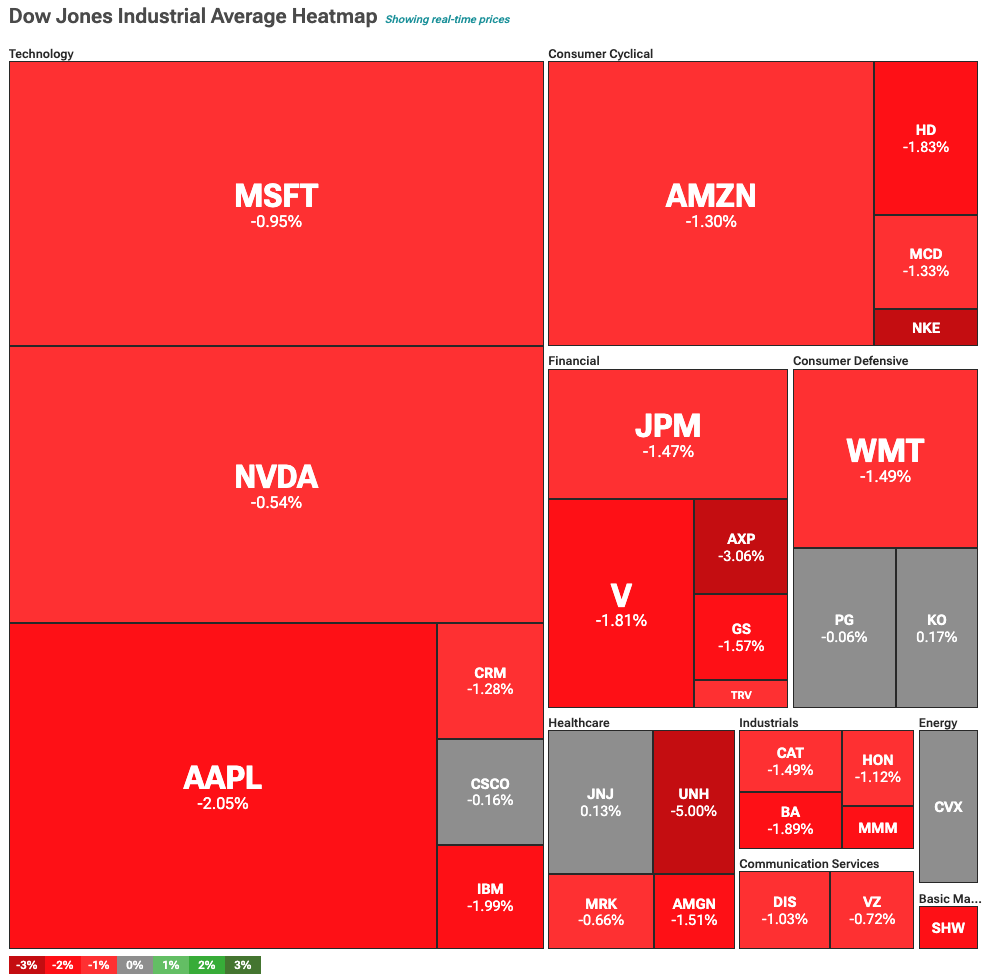

U.S. public debt has ignited investor concerns, even as Bitcoin (BTC) reached its all-time high. On May 21, the S&P 500 traded at 5,882.35 points, down 0.98%, while the tech-heavy Nasdaq was at 21,232.05, down 0.63%. At the same time, the Dow Jones was deep in the red at 42,059.08, losing 620.63 points, or 1.46%.

Investor focus is primarily on U.S. debt, as rising bond yields threaten to push the government deficit even higher. The latest $16 billion auction of 20-year Treasury bonds attracted little demand from investors, sending bond yields higher. This came after the U.S. suffered a credit rating downgrade from Moody’s, losing its perfect score.

At the same time, the U.S. Congress is pushing a new bill to extend Trump-era tax cuts. These cuts would increase disposable income, especially for high-income earners, but also raise concerns about further widening the federal deficit.

Still, this uncertain macroeconomic environment appears to be working in Bitcoin’s favor. The largest crypto asset reached a new all-time high, while gold also showed strong performance—rising 0.94% to $3,313.5 per ounce.

Tech stocks, healthcare down, Google stock up 4%

Almost all the top 30 companies listed on the DOW Jones were in decline, including tech, major retailers, and healthcare. However, the Nasdaq-listed Alphabet stock rose 4% on Google’s new AI announcement. The tech giant is working on redefining search, making it work similarly to the big AI models.

UnitedHealth continues its decline, with scandal on top of scandal. Most recently, reports revealed that the company attempted to cut insurance payouts by paying nursing homes to reduce transfers of patients to hospitals. This exposes the insurance giant to potential litigation, and its stock dropped 6% on the news.

Source link