Markets have continued their bullish momentum after positive signs on trade and Trump’s impending tax cuts.

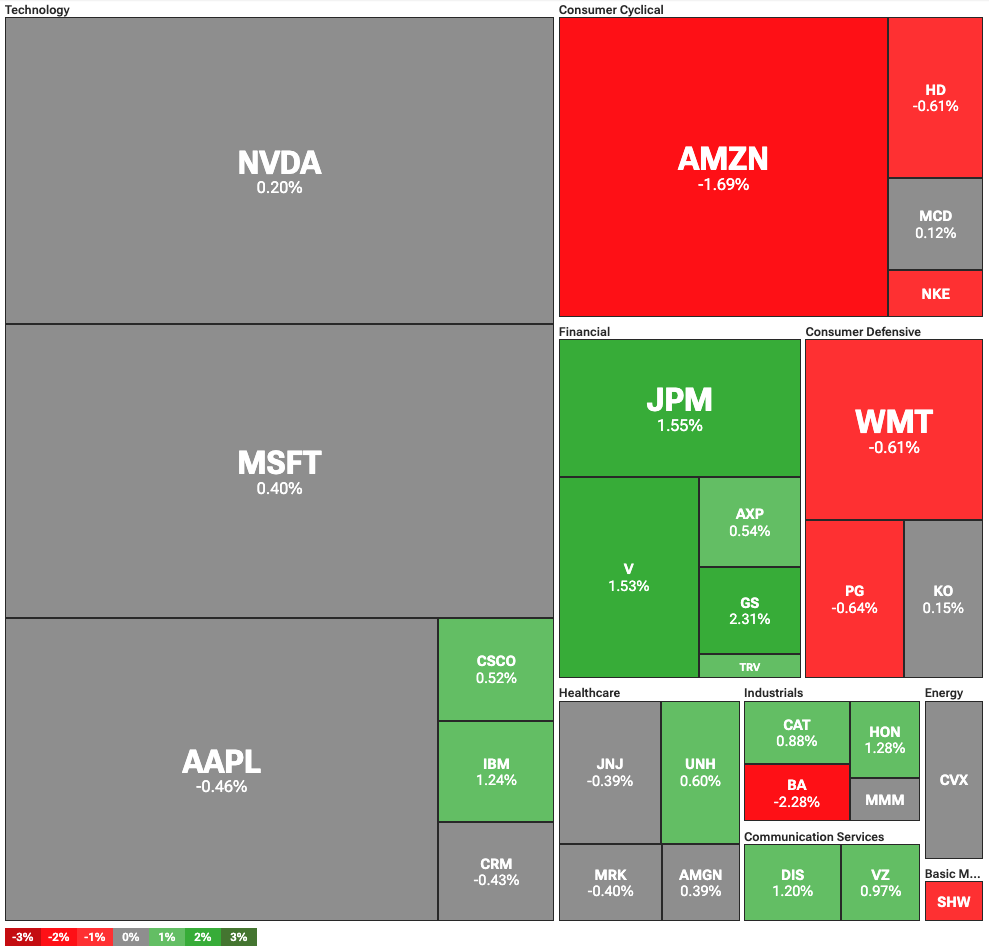

U.S. stock indices are up on positive developments in trade and taxes. On Monday, June 30, Dow Jones was up 171 points or 0.39%, the S&P 500 was up 0.28%, while the tech-heavy Nasdaq was up 0.27%.

President Donald Trump signalled that trade talks with major trading partners are going forward at a good pace. On Sunday, June 29, Trump stated that he doesn’t expect he will need to extend the July 9 deadline on trade negotiations.

The deadline, which Trump implemented earlier, is when the 25% tariffs on most of the U.S. trading partners kick back in. However, he did signal that the White House could do anything it wanted, either extending the deadline or even shortening it.

In other trade news, the White House announced that the U.S. will restart its trade talks with Canada. Earlier, Canada agreed to remove its digital services tax, which would apply to U.S. tech firms. Once the tax is removed, the U.S. will get back to the negotiations immediately, the White House economic adviser Kevin Hassett stated.

The U.S. trade war has put major pressure on U.S. stocks, as investors are concerned about the impact it might have on inflation and growth. Coupled with tax cuts, the markets are now on track to hit new all-time highs.

Trump’s ‘big, beautiful’ draws criticism from Musk

A part of what’s driving the bullish momentum is Trump’s “big, beautiful” budget, which proposes $4.5 trillion in tax cuts. Republican party leaders are now trying to convince party holdouts in the Senate with a range of last-minute changes.

Still, some of these changes have drawn intense criticism, including from the tech-billionaire Elon Musk. Notably, the new tax bill will phase out tax credits for clean energy, while giving support to the fossil fuel industry.

Musk, who controls the EV manufacturer Tesla, called the bill “utterly insane and destructive,” and suggested it would put the U.S. in a worse position strategically.

Source link