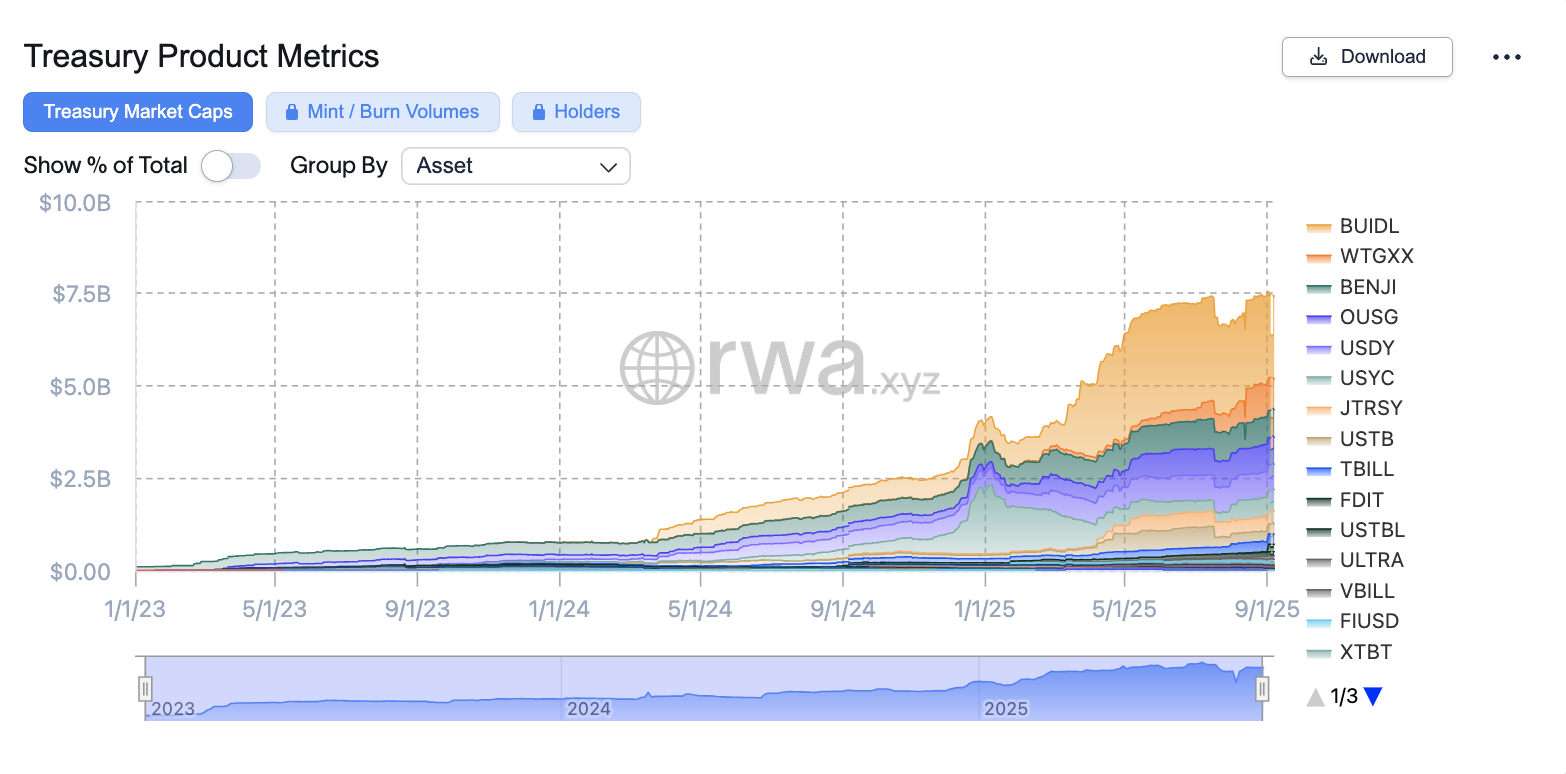

Fidelity Investments has introduced the FDIT, a tokenized share class of its Treasury fund on Ethereum, marking its entry into the fast-growing $7.4 billion tokenized Treasuries market.

Summary

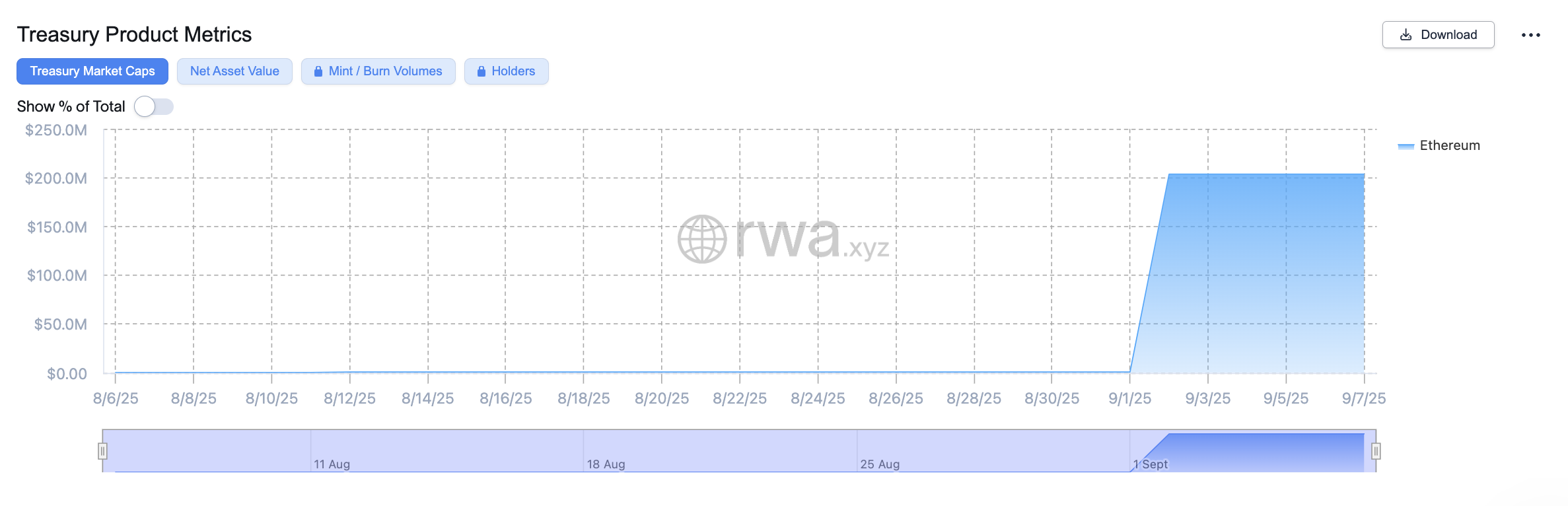

- Fidelity’s FDIT holds over $200 million in short-term U.S. Treasuries and money-market assets, with 203M tokens already issued.

- Early adoption remains concentrated among a small number of holders, while Fidelity has not issued a public statement.

- Fidelity’s FDIT joins BlackRock’s BUIDL, Ondo’s OUSG, Circle’s USYC, and Franklin’s BENJI in the expanding tokenized Treasuries space.

Fidelity Investments has quietly launched a tokenized version of the Fidelity Treasury Digital Fund (FYOXX) on Ethereum (ETH), introducing a new share class called the Fidelity Digital Interest Token (FDIT). The fund’s underlying assets consist of short-duration U.S. Treasury securities and money-market instruments, structured to provide a daily-accruing yield with no lockup periods.

FDIT currently holds over $200 million in assets, with more than 203 million tokens outstanding. Early participation appears concentrated, with just a couple of holders, according to rwa.xyz data.

Fidelity has not yet publicly commented on the fund’s rollout.

FDIT launch brings Fidelity into on-chain treasury market

The FDIT launch follows Fidelity’s March filing with the U.S. Securities and Exchange Commission, where the firm sought approval to add an on-chain share class to its Treasury fund. At the time, the proposal detailed the use of the Ethereum network, with potential for future expansion to other blockchain platforms.

By launching FDIT, Fidelity enters a growing market for tokenized Treasury products, a space currently dominated by BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), which manages over $2.2 billion in assets. Alongside BUIDL, offerings such as Ondo’s OUSG, Circle’s USYC, and Franklin Templeton’s BENJI have steadily grown their share of the market.

Source link