French banking institution ODDO BHF has recently launched a new euro-backed stablecoin, EUROD. The token will be listed on the Madrid crypto platform Bit2Me.

Summary

- French banking giant ODDO BHF has launched its euro-backed stablecoin, EUROD, marking its first move into the crypto market.

- The launch comes amid a broader push by European banks to develop euro-pegged stablecoins to challenge the dominance of U.S. dollar tokens.

According to a recent report by CoinDesk, the French banking giant has launched its own stablecoin pegged to the euro. The token will be dubbed EUROC and is set to be listed on the Madrid-based crypto exchange Bit2Me. The token is meant to be a “low-volatility” digital asset version of the euro that is compliant with the EU’s MiCA regulatory framework.

EUROD will be backed on a 1:1 ratio and is aimed at both retail and institutional users.

The move marks a significant step for the traditional financial institution, which manages more than €150 billion or approximately $173 billion in assets across Europe. ODDO BHF aims to provide a secure and regulated digital asset option for investors seeking stability within the volatile crypto market.

“The listing of ODDO BHF’s euro stablecoin is another important step in Bit2Me’s mission to offer trusted, regulated digital assets,” said Bit2Me CEO Leif Ferreira in a press release sent to CoinDesk.

Earlier this year, Bit2Me successfully raised €30 million or $35 million in an investment round led by the stablecoin issuer tycoon Tether. Through the listing of ODDO BHF’s EUROD, it hopes to narrow the gap between tradition finance and the crypto market.

ODDO BHF’s first venture into crypto

The launch of the euro-backed stablecoin marks the first dive into the crypto space. The firm joins a number of financial institutions in Europe that have jumped on the stablecoin bandwagon. Earlier this month Societe Generale’s digital asset arm launched its U.S dollar-backed and euro-pegged stablecoins on Morpho and Uniswap.

As previously reported by crypto.news, SG-FORGE aims to position is stablecoins as options instead of replacements for fiat currency. The firm views stablecoins as regulated instruments meant for specific use cases.

On the other hand, nine European banks including UniCredit SpA, ING Groep NV, DekaBank, Banca Sella, KBC Group NV, and Danske Bank AS have teamed up with the intention of launching a joint-stablecoin venture powered by the euro. The token will also be MiCA-compliant.

A few days prior, Citigroup announced that it would be joining the consortium of nine banks to launch a euro-backed stablecoin.

The heightened interest surrounding euro-backed tokens is influenced by the need to challenge the U.S dollar’s domination in the stablecoin market. According to data from DeFi Llama, the number one stablecoin in the world by market cap is Tether’s USDT (USDT), with a market domination of 59.01%.

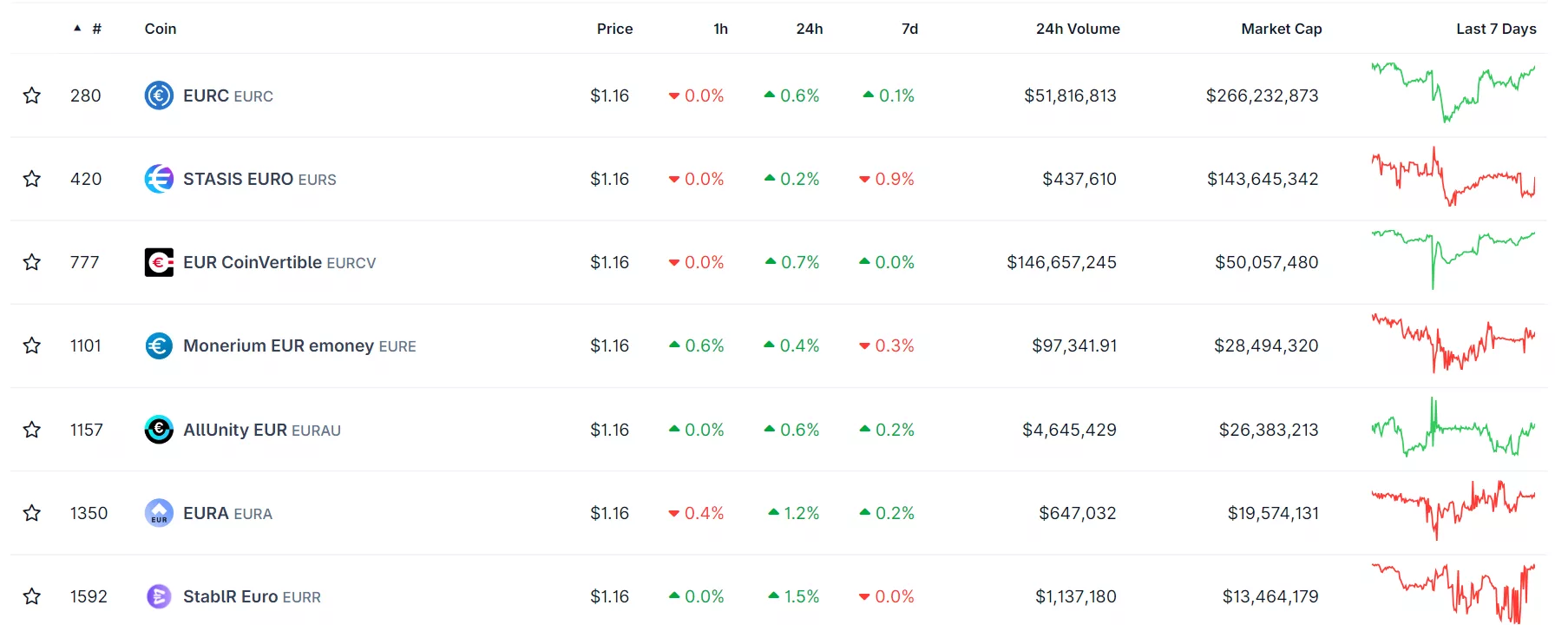

Meanwhile, euro-backed stablecoins only contribute around $573.9 million out of the total $306 billion stablecoin market cap. The largest euro stablecoin is Circle’s EURC (EURC) with a market cap of $266 million. In second place is EURS (EURS), followed by EUR CoinVertible’s EURCV (EURCV).

Source link