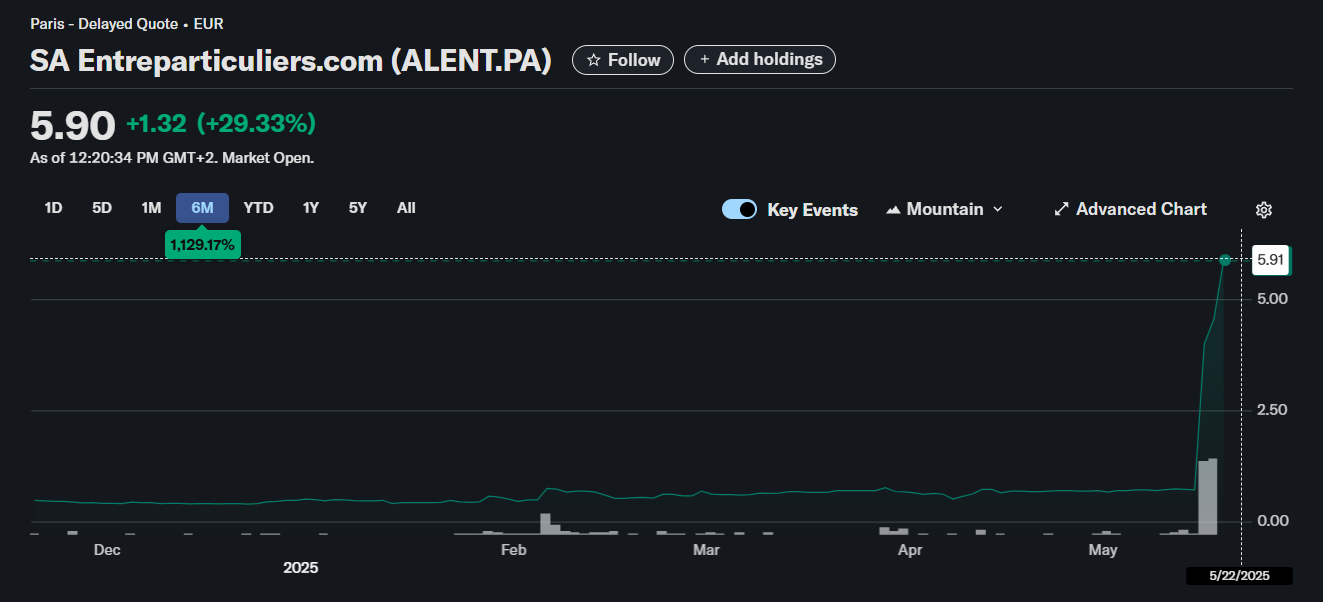

French real estate firm Entreparticuliers saw its shares climb 800% amid news of a strategic move to accumulate Ethereum.

Shares of French public real estate platform Entreparticuliers jumped over 800% in the past week after the company revealed it’s turning into an Ethereum Treasury Company. The stock soared over 800% in just five days amid the announcement, boosting the company’s market value to around €23.44 million (about $25.78 million), up from roughly $1.35 million in January, an increase of more than 1,800%, per data from Google Finance.

In a Monday press release, the company informed the market that it has launched a purchase program for an initial tranche of €1 million worth of Ethereum (ETH), a program financed by majority shareholder Stéphane Romanyszyn.

To support the continued growth of this strategic Ethereum reserve, Entreparticuliers said it’s structuring various financial instruments aimed at professional investors and financial partners. However, the company and Romanyszyn ruled out the “use of excessively dilutive instruments such as equity lines.”

Entreparticuliers said its further capital contributions are subject to approval at the general meeting on June 18, with resolutions covering up to €150 million in funding.

Founded in 2000 by Stéphane Romanyszyn, Entreparticuliers has historically operated as a real estate search platform since its listing on Euronext Growth in 2007. The platform connects private individuals to buy, sell, or rent properties without intermediaries.

The move is part of a broader transformation. According to the company’s separate crypto-focused website, it’s shifting “from a real estate platform to a pioneer in digital finance, real estate tokenization, and asset management.” It markets itself as a way to gain “simple and regulated exposure to Ethereum through a publicly listed stock on Euronext Growth.”

The firm’s new direction seems to be focused on ETH investments, staking, and building tokenization tools for real-world assets like real estate and bonds.

Source link