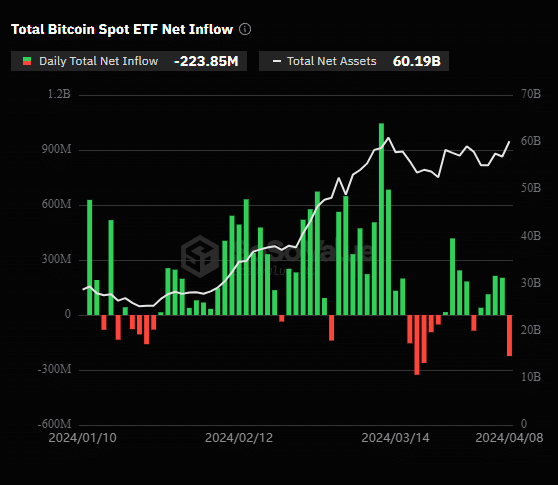

Bitcoin ETFs saw a net outflow of $223 million on Monday after four consecutive days of net inflow.

According to SoSo Value, Monday was the most significant outflow for Bitcoin ETFs in over two weeks. Last week, BTC ETFs saw four days of consecutive inflows totaling nearly $570 million, driving Bitcoin’s price to $72,000.

However, Monday’s outflow caused BTC’s daily trading volume to decline by 6%, forcing the price to retrace to $69,000.

Bitwise’s ETF saw the most significant single-day net inflow at $40.3 million. However, nearly $303 million was withdrawn from Grayscale’s ETF, GBTC.

Since the SEC approved ETFs in January, Bitcoin’s market movements have driven mainly the net asset inflow into these instruments. Institutional funds will likely continue to play a larger role in the token’s market performance, as the London Stock Exchange is also preparing to launch Bitcoin ETNs next month.

With the halving approaching, analysts are divided on how the BTC market will perform in the short term. Industry experts like Anthony Scaramucci and Mark Plamer emphasized that the market is in an early bullish cycle, continuing after the halving, driving the largest cryptocurrency to over $150,000.

However, not all investors share the same sentiment. Earlier today, a survey released by Deutsche Bank showed that 30% of its investors see Bitcoin dipping below $20,000 by the end of this year.

Source link