The crypto market is going up today, Nov. 23, as investors buy the recent dip and as stablecoin supply in exchanges start rising.

Summary

- The crypto market is going up today, with Bitcoin hitting $86,000.

- This rally is happening as investors buy the recent dip.

- Futures open interest and stablecoin supply in exchanges have been rising.

Bitcoin (BTC) price rose to $86,000, up by nearly 8% from the lowest level this year. Top altcoins like Zcash (ZEC), Cronos (CRO), Monero (XMR), and Aerodrome Finance were up by over 10% in the last 24 hours.

Data compiled by CoinMarketCap shows that the market cap of all coins rose by nearly 3% to over $2.9 trillion.

Crypto market is going up as investors buy the dip

One potential reason why the crypto market is going up is that investors are buying the dip after most coins dived by double digits in the past few weeks.

It is common for crypto and stock market investors to go bargain hunting after a big decline. This dip-buying is common when these assets move to the oversold levels. The Relative Strength Index of the crypto market dropped to the oversold level of 25 this week.

This dip buying has also been prompted by the fact that American stocks ended the week in the green. The Dow Jones Index rose by 493 points, while the S&P 500 and Nasdaq 100 Indices jumped by 65 and 195 points, respectively.

However, the main risk for the ongoing crypto market rally is that it may be a dead-cat bounce or a bull trap. A bull trap is a situation where a falling asset rebounds briefly and then resumes the downtrend.

Crypto prices rally as open interest and stablecoin inflows rise

The ongoing crypto market rebound is happening as activity in the futures market improve. Data compiled by CoinGlass shows that the futures open interest jumped by 3.3% in the last 24 hours to over $125 billion.

Another data shows that the 24-hour liquidations dropped by 88% in the same period to $207 million. A combination of rising leverage and low liquidations always leads to substantial upward. Still, it is common for liquidations to fall during the weekend.

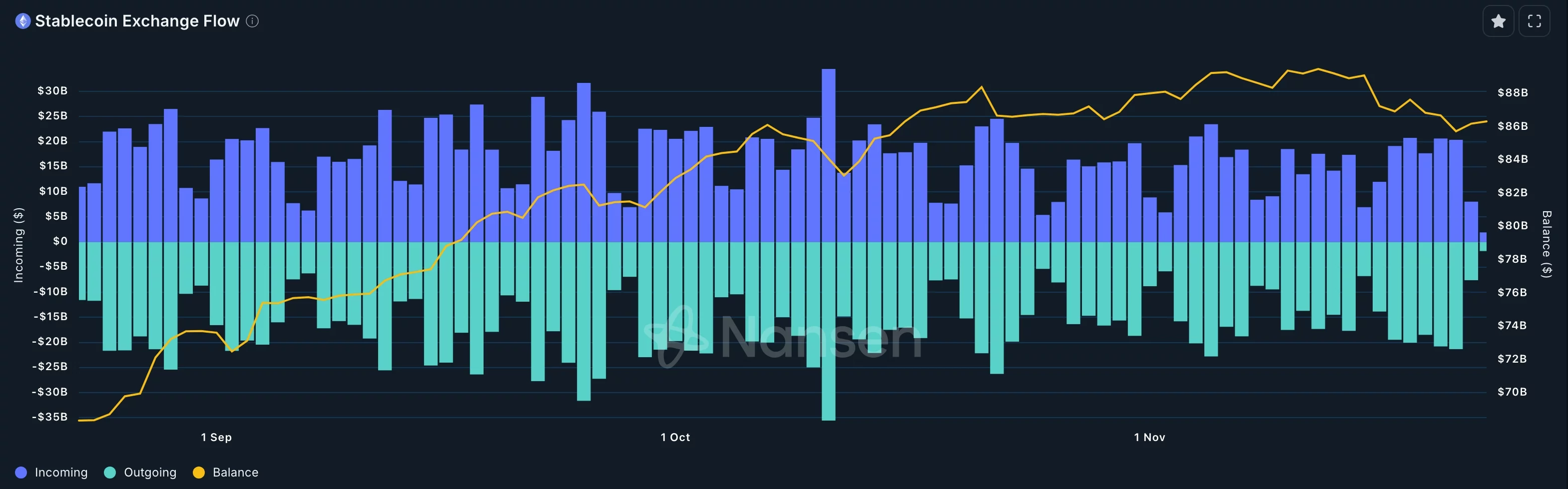

Meanwhile, Nansen data shows that stablecoins are moving back to exchanges. There were $86 billion worth of stablecoins in exchanges, up from the Friday low of $85 billion.

The other potential catalyst for the ongoing crypto market rally is that there will be some notable altcoin ETF approvals this week. Graycale, 21Shares, and Franklin Templeton will list their XRP ETFs this week.

Recent data shows that there is a strong demand for XRP ETFs, with the cumulative inflows rising to over $400 million. Grayscale and 21Shares will also list their Dogecoin ETFs.

Source link