IDEX price rose sharply as whales showed renewed interest in the token. Will it face a pullback or see more gains ahead?

Summary

- IDEX price has hit a five-week high of $0.039 today.

- With no immediate catalysts at play, the rally was fueled mainly by whale buying.

- Technical indicators are in support of more gains in the short-term.

According to data from crypto.news, IDEX (IDEX) rallied as high as 50% to a five-week high of $0.039 on Sep. 1 morning Asian time, before settling at $0.036 at press time.

The surge came in a high-volume trading environment. Its trading volume was up nearly 550% over the last 4 hours at nearly $66 million, while its market cap stood at $36 million.

While there were no major catalysts such as significant developments or new partnerships driving the gains, the surge appears to have been fueled by renewed interest from whale investors.

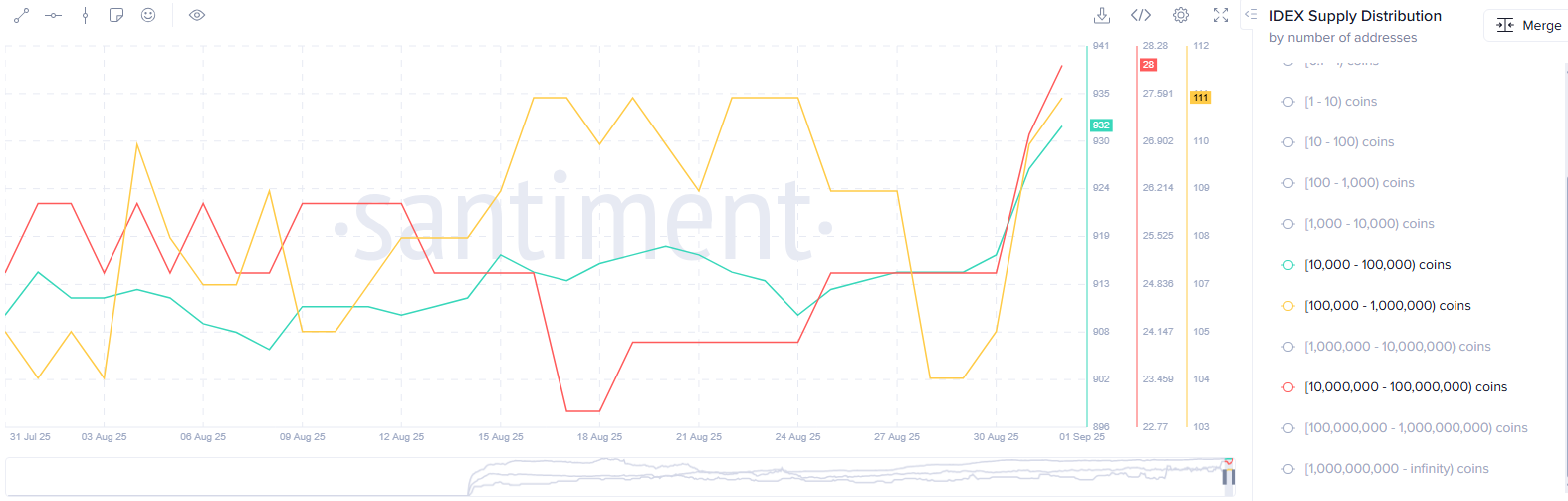

According to data from Santiment, the number of whale wallets holding 10,000 to 100 million IDEX tokens has increased over the last two days. Such whale accumulation often increases token visibility and signals confidence from large investors, factors that also tend to attract retail traders, who often follow due to FOMO and momentum-driven sentiment.

Demand from derivatives traders also appears to have played a significant role in IDEX’s gains today. According to data from CoinGlass, open interest in IDEX futures surged by 185% to $5 million as of press time. Meanwhile, the token’s weighted funding rate has turned negative. This indicates that short sellers are paying long positions to keep their trades open—signaling that many traders are anticipating a short-term pullback in IDEX’s price.

However, if the IDEX price continues to rise, this imbalance could trigger a short squeeze, potentially fueling further price appreciation for the token.

Despite this, the token’s rally remains at risk owing to the absence of any strong potential drivers, such as any major developments or partnerships in the short term.

On the daily chart, IDEX has formed a descending triangle pattern over the last 5 weeks. Such a bearish structure is typically defined by a flat support base and a series of lower highs, which reflect sustained selling pressure and signals more decline ahead.

However, IDEX invalidated the bearish setup as it broke above the upper trendline of the triangle yesterday, marking the beginning of a potential trend reversal.

Momentum indicators support this bullish breakout. Both the MACD lines and the Relative Strength Index are trending upward, indicating growing positive momentum.

More importantly, IDEX has also confirmed a golden cross, as the 50-day simple moving average crossed above the 200-day one. The classic bullish signal typically marks the beginning of a longer-term uptrend.

Based on the height of the triangle and the strength of the breakout, the next likely target for IDEX stands at $0.048, which would represent the projected move based on the breakout from the triangle pattern and implies a 33% jump from current levels. A decisive move above that level could pave the way for a rally toward the $0.050 psychological resistance.

On the contrary, if the hype around whale accumulation fails, IDEX could likely drop to $0.023, which has stood as a strong support level for the last couple of weeks.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link