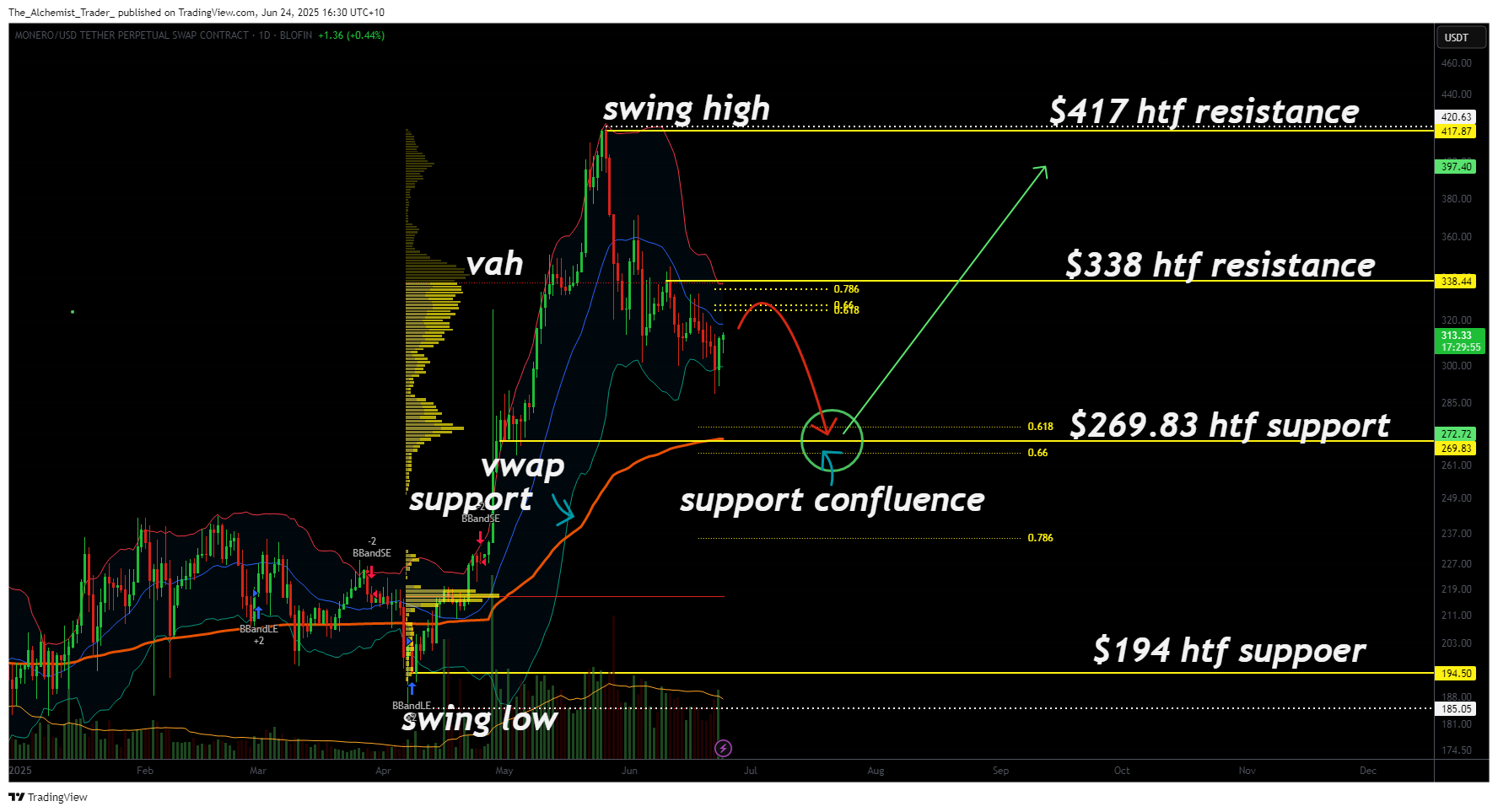

Monero remains in a strong high-timeframe uptrend despite a recent pullback. Price is now approaching a critical confluence zone at $269 that could trigger the next leg higher, if it holds.

Monero (XMR) has been undergoing a steady decline but remains within the boundaries of a high-timeframe bullish trend. The current move is being viewed as a corrective phase rather than a full reversal. Price is now closing in on the $269 support zone, a key level that aligns with the VWAP, the 0.618 Fibonacci retracement, and a major high-timeframe support region. If this area holds, it may serve as the foundation for a strong continuation toward the $417 resistance and potentially higher.

Key technical points

- Major Support: $269; confluence of VWAP, 0.618 Fibonacci, and historical high timeframe support.

- Uptrend Still Intact: Current move is a correction, not a trend reversal.

- Target to Watch: $417; macro resistance if higher low is established.

- Volume Profile: Currently above average; must remain strong near support to confirm demand.

The $269 support zone carries significant technical weight. It has served as a volume-supported region in past rallies and is now reinforced by the VWAP and key Fibonacci levels. Historically, price action has reacted positively to this area, and the likelihood of a bounce is high, provided volume confirms it.

From a structural standpoint, Monero has not invalidated its uptrend. The correction, while notable, still fits within the context of forming a higher low. For this to be confirmed, traders will need to see consolidation or signs of accumulation on the lower timeframes once $269 is tested. This would indicate a shift in sentiment and a potential setup for a reversal back toward the $417 resistance zone.

Volume remains a major factor. The current profile is above average, which is a positive sign in any uptrend. However, if the test of $269 occurs without volume support and price fails to hold, it could break the bullish structure and lead to a deeper corrective move, likely invalidating the current higher low thesis.

It’s worth noting that the recent bullish candlesticks have not been enough to confirm a full reversal. Monero is still searching for a clear bottom in this correction. As long as the $269 support holds and demand returns visibly through volume, the bullish outlook remains valid.

What to expect in the coming price action

Watch how Monero behaves around the $269 support level. A bounce supported by strong volume and accumulation could kick off a fresh rally toward $417. But if volume fades and support breaks, a deeper correction may follow before bulls can regain control.

Source link