The latest upswing in the crypto market rattled leveraged positions on both sides of the aisle, but short traders took the day’s biggest hit.

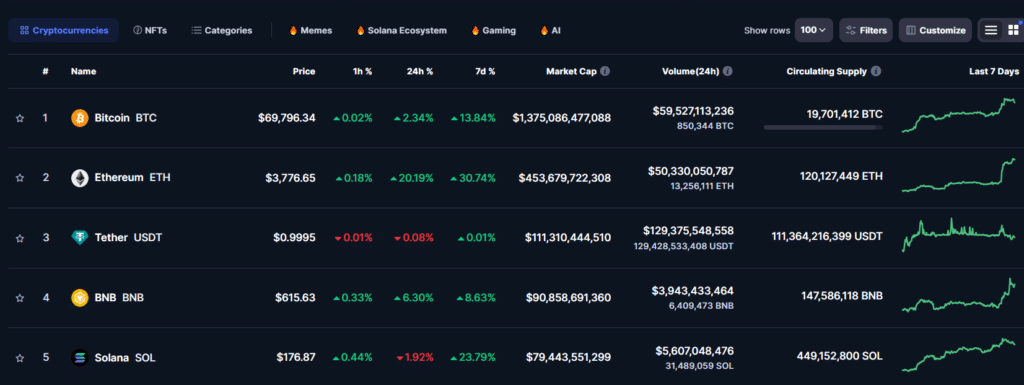

Bitcoin (BTC) rallied over 13% in the past week, breaking above $70,000 for the first time since before the halving event last month. According to CoinMarketCap, the leading blockchain asset was less than 5% below its all-time high (ATH) set in March.

Ethereum (ETH), the second-largest cryptocurrency, surged 30% over the week, reclaiming a $450 billion market and can soon test the $4,000 level.

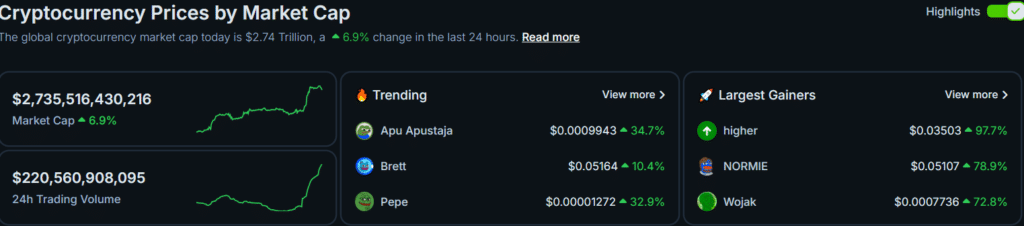

A market-wide recovery accompanied the price hikes, with the total cryptocurrency market cap jumping more than 7% in 24 hours to reach $2.7 trillion per CoinGecko. Trading volumes also doubled to $220.5 billion .

This surge in the market brought volatility that rocked investors betting on higher or lower prices. In financial markets, traders anticipating price increases go long, while betting on price declines is termed a short position.

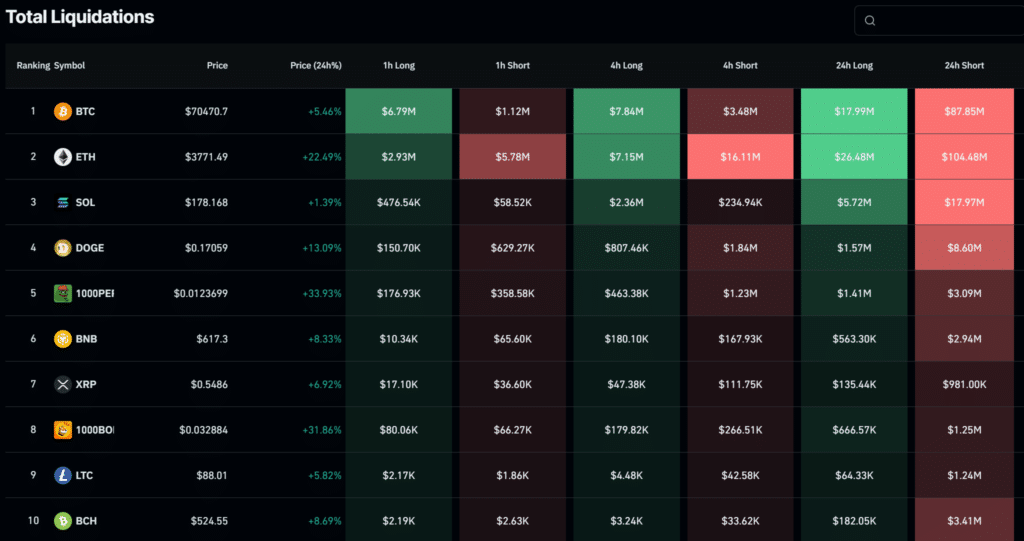

CoinGlass liquidation data on May 21 showed that over $380.5 million in leveraged positions were wiped out, with short trades compromising over $294.3 million, and around $97.2 million representing liquidated long positions.

Ether shorts accounted for over $104.9 million in liquidations, the largest of any crypto asset. Bitcoin shorts followed with $83.1 million, and Solana (SOL) $16.9 million short trades came second and third respectively.

Source link