Over a third of Bitcoin’s circulating supply is now held by centralized treasuries, including centralized exchanges, exchange-traded funds, and governments.

According to the recent Gemini and Glassnode’s Report, over 30% of Bitcoin (BTC) circulating supply is now held by just 216 centralized entities across six categories: centralized exchanges, ETFs and funds, public companies, private companies, DeFi protocols, and governments. This consolidation of Bitcoin into institutional hands coincides with its rapid price appreciation—from under $1,000 in 2015 to over $100,000 today, suggesting that major institutions now view Bitcoin as a strategic, long-term asset.

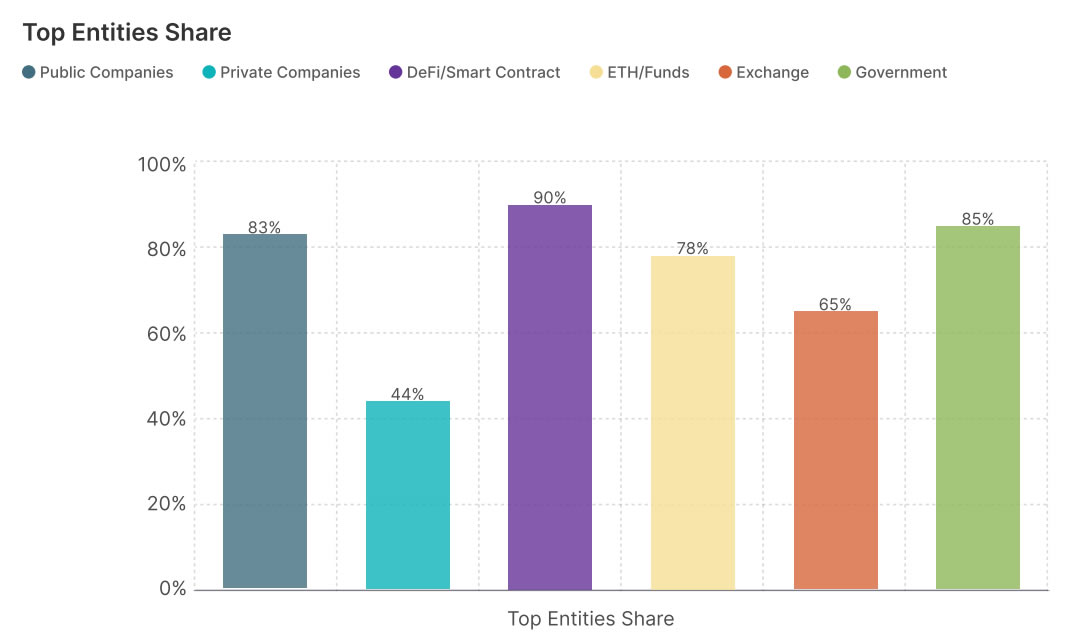

Across nearly all categories, with the exception of private companies, the top three entities hold between 65% to 90% of the total assets, reflecting the outsized role of early movers, especially in the DeFi, public company, and ETF categories, in shaping the early trajectory of institutional Bitcoin adoption.

The report also notes that over the past two years, Bitcoin balances on CEXs have declined, which has frequently been mistaken for an imminent supply shortage. However, the majority of that BTC has shifted to ETFs and funds, especially U.S. spot ETFs.

Since June 2021, the total BTC held by this spot trading sector has remained relatively stable, fluctuating between 3.9 million and 4.2 million BTC. This stability indicates that the decrease in exchange balances reflects a structural redistribution of custody rather than a reduction in overall supply. The increasing share held by ETFs signals greater adoption by TradFi, yet the total liquidity available to spot buyers has stayed largely consistent.

The report also highlighted that the creation of the U.S. Strategic Bitcoin Reserve has significantly boosted institutional confidence in Bitcoin as a sovereign-grade asset. Following the SBR announcement, public and private companies have significantly increased their Bitcoin purchases.

The report concludes that with over 30% of Bitcoin’s circulating supply held by centralized entities, the market has undergone a structural shift catalyzed by long-term investments and strategic custody. While early adopters continue to dominate holdings, Bitcoin’s acceptance as a sovereign-grade asset—marked by the SBR—has boosted institutional confidence. Even as custody moves from exchanges to ETFs and other custodians, the overall supply available for spot trading has remained stable.

Source link