The Pepe price remains in a bear market after crashing by over 43% from its peak in March.

Pepe Coin (PEPE) has fallen to a low of $0.0000090, bringing its market capitalization to approximately $3.86 billion, down from its all-time high of $10 billion.

The decline follows broader weakness in the cryptocurrency market, with most altcoins experiencing significant pullbacks. Ethereum (ETH) has dropped to $2,435 from a monthly high of $2,800, while the total market capitalization of all crypto tokens has slipped to $3.28 trillion.

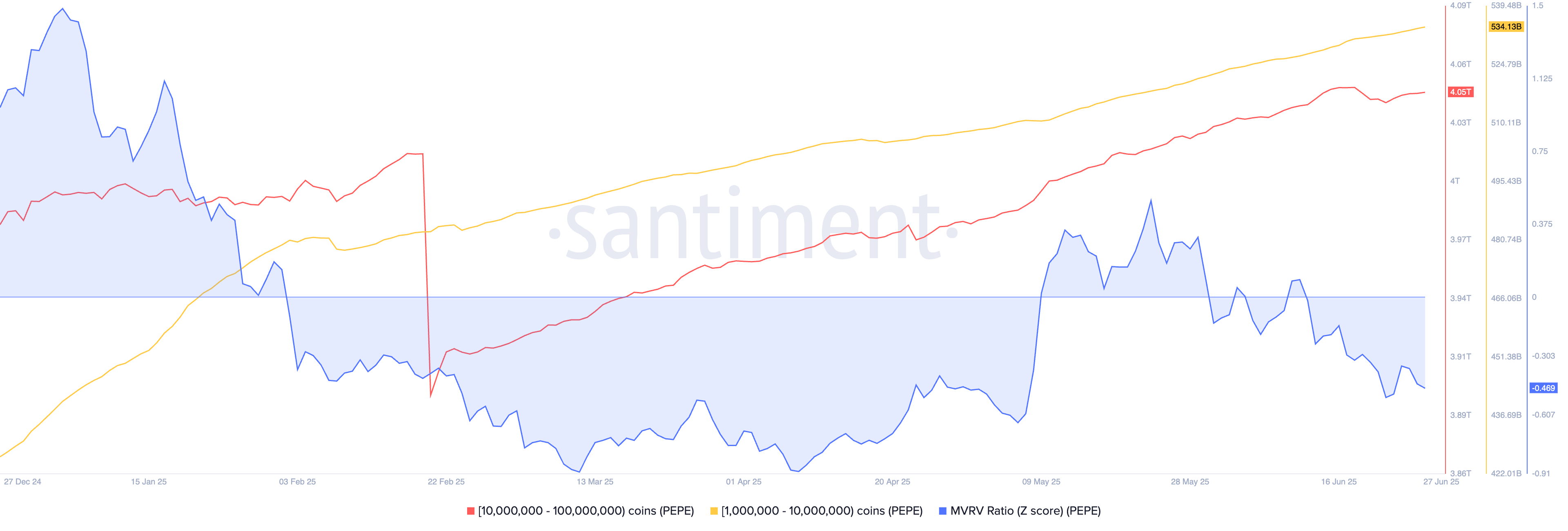

Still, PEPE is flashing some bullish signals that may support a rebound in the coming weeks. Whale holdings have increased by 7.20% over the past 30 days, rising to 7.61 trillion tokens, a sign that large holders expect a recovery. This accumulation trend has continued even as prices declined.

Additionally, the top 100 PEPE addresses have grown their positions by nearly 4% over the same period, holding a total of 303.95 trillion tokens. Exchange balances have also dropped to 248.1 trillion, down 2.3% in 30 days. Investors typically withdraw tokens from exchanges when they anticipate higher prices ahead.

Another potential bullish catalyst is the token’s undervaluation. The MVRV indicator has dropped to -0.45, meaning PEPE’s market value is lower than its realized value. Historically, a falling MVRV score often precedes bullish reversals.

Pepe price technical analysis

From a technical perspective, PEPE is showing signs of a potential rebound. The token has been forming a falling wedge pattern, defined by two descending, converging trendlines. The upper trendline connects lower highs since May 23, while the lower trendline tracks support levels from May 11.

Meanwhile, the Relative Strength Index is nearing oversold territory, indicating that the ongoing downtrend may be close to exhaustion. If this pattern resolves to the upside, as falling wedges often do, PEPE could rally toward the key resistance level at $0.000015, a move that would represent a 65% gain from current levels.

Source link