PI remains locked in a tight sideways range, but weakening momentum indicators are signaling a potential breakdown, as dilution risks weigh on the circulating supply.

Pi Network (PI) has been trading in a sideways consolidation range since mid-April, fluctuating within a ~14% band between $0.59 and $0.67. The price is now testing the lower boundary of that range — currently at $0.58, raising the risk of a breakdown to a lower level.

The RSI sits at 38, well below the neutral 50 level and not far from oversold territory. MACD is also showing signs of fatigue. Although the MACD line remains slightly above the signal line, they seem to be approaching a bearish crossover, hinting at a possible momentum shift to the downside.

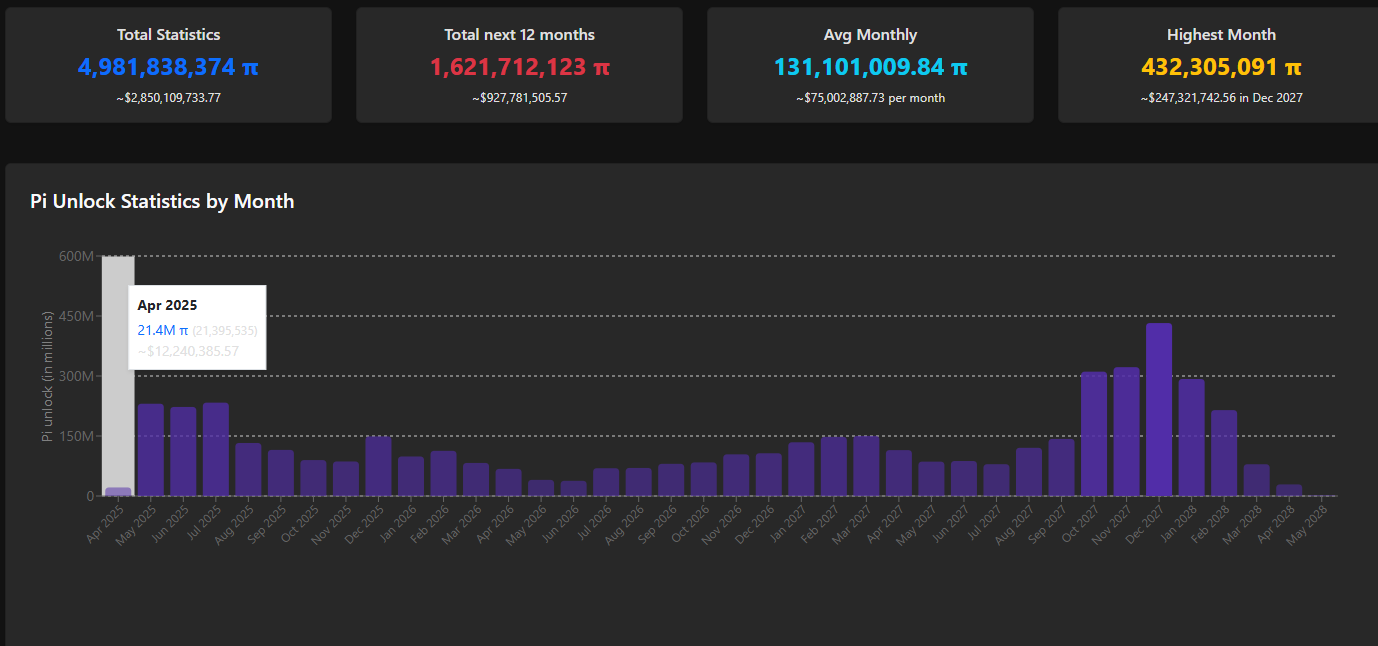

PI price decline and technical weakness are likely underpinned by the fundamental dilution risk. This month, 21.4 million PI tokens have been unlocked, equivalent to ~$12.3 million at current market prices. Although the April unlock may be relatively modest, investors are likely pricing in heavier future unlocks. The total monthly unlock trend shows a steady supply increase over time, with an expected average of over 131 million PI/month over the next year.

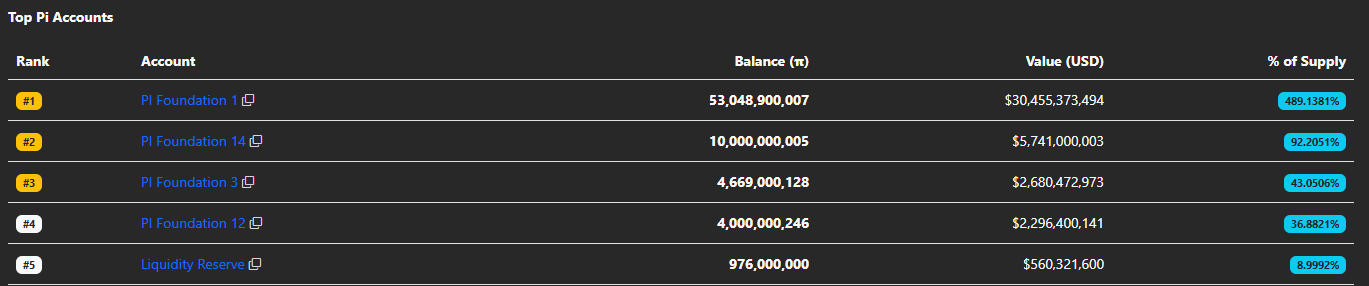

Unless a major update is introduced or the PI Foundation burns a significant portion of its nearly 72 billion PI (71,991,181,249 π) holdings across their wallets, the risk of sustained downward pressure on PI remains high.

Source link