A post from Sam Bankman-Fried’s (SBF) X account is stirring the crypto community once again, this time claiming that FTX never needed to file for bankruptcy in the first place.

Summary

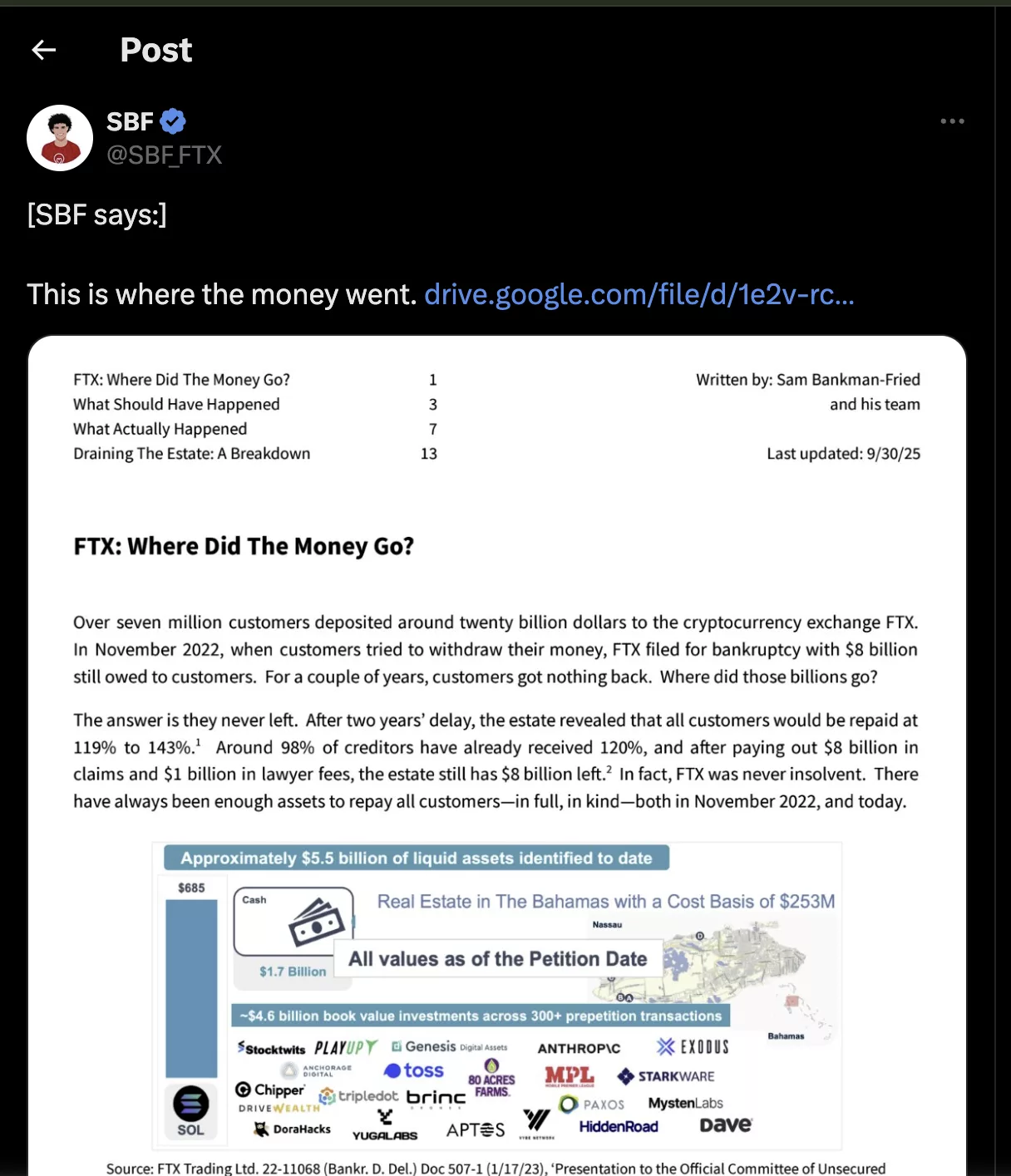

- Sam Bankman-Fried’s X account posted a 15-page document titled “FTX: Where Did The Money Go?”

- The document claims FTX faced a liquidity crisis, not insolvency, when it filed for bankruptcy in November 2022.

- It alleged the estate now holds $8B even after repaying creditors and legal fees, highlighting stake in firms and crypto holdings.

- FTT token briefly surged to $0.84 following the post before cooling off.

A controversial new document posted via Sam Bankman-Fried’s X account has reignited debate over the collapse of FTX, claiming the exchange was never actually bankrupt. The post, made by a friend operating the account on Oct 31, linked to a 15-page report titled “FTX: Where Did The Money Go?” which argues that FTX always had sufficient assets to repay customers even at the time of its Nov 2022 Chapter 11 filing.

The document challenges the findings of a Manhattan jury that convicted Bankman-Fried in 2023 of orchestrating a multibillion-dollar fraud. It claims that the crisis was purely a liquidity issue and blames FTX’s external counsel for prematurely forcing bankruptcy. “FTX was never bankrupt, even when its lawyers placed it into bankruptcy,” the report states, alleging that the company held enough assets to fully repay customers “in full, in kind” from the beginning.

Among the assets highlighted were significant stakes in companies like Anthropic ($14.3B), Robinhood ($7.6B), Ripple, SpaceX, and Genesis Digital Assets. The document also highlighted major crypto holdings like 58 million SOL, 205,000 BTC, and over $1.7 billion in cash and stablecoins. Combined, the report estimates that FTX’s portfolio, if left intact, would now be worth $136 billion.

Over seven million customers deposited around $20 billion, and although $8 billion was owed at the time of the filing, subsequent estate disclosures show that 98% of creditors have now received 120% of their claims. The document further claims that, after settling $8 billion in liabilities and $1 billion in legal fees, the estate still holds another $8 billion.

The latest news echoes past claims made by Bankman-Fried, where he argued FTX had enough to repay every customer. He blamed legal advisors for seizing control and liquidating high-value investments instead of managing the liquidity crunch internally.

Sam Bankman-Fried (SBF) faces criticism as FTT price rises

Notably, SBF’s post triggered a brief price reaction. The FTX Token surged to an intraday high of $0.84 before cooling off. The post also triggered speculation across the crypto community.

Crypto investigator ZachXBT responded to the post, arguing that repayments were made at 2022 prices, not accounting for the rising value of crypto assets since then. He also criticized Bankman-Fried for continuing to spread misinformation.

One user expressed anger over lack of compensation in regions like mainland China, while others criticized SBF for signing bankruptcy documents. Adding to the controversy, rumors are swirling of a well-funded effort to secure a presidential pardon for Bankman-Fried. These reports intensified following President Donald Trump’s recent pardon of Binance founder Changpeng Zhao, Bankman-Fried’s former rival.

With SBF’s sentencing scheduled for Nov. 4, the crypto community is closely watching whether these new claims and rumored political maneuvers will impact his future. For now, the FTX saga continues to raise deeper questions about corporate governance, regulatory enforcement, and accountability in the crypto space.

Source link