This article outlines a Solana (SOL) price prediction for the near future as well as potential price trends in the coming years. We explored SOL’s potential performance, influencing factors, and market expectations.

Let’s take a look at the coin’s estimated trajectory based on current market trends and technical analysis.

What is Solana (SOL)?

Solana (SOL), a high-performance blockchain platform, has garnered substantial attention in the cryptocurrency sphere. Known for its exceptional speed and scalability, Solana has positioned itself as a formidable contender in the market, often dubbed the “Ethereum Killer.”

This platform’s ability to process thousands of transactions per second with minimal fees has attracted a wide range of developers, investors, and decentralized applications (dApps), solidifying its place in the digital asset ecosystem.

Solana (SOL) price analysis

As of mid-May 2024, Solana (SOL) is trading at approximately $167.87. The recent price action of Solana has shown significant volatility, characteristic of the broader cryptocurrency market. Over the past few months, Solana’s price has experienced both bullish and bearish trends, influenced by various technical indicators and market sentiments.

Moving average convergence divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of Solana’s price. The MACD line is derived by subtracting the 26-period EMA (Exponential Moving Average) from the 12-period EMA, and the signal line is the 9-period EMA of the MACD line.

Recently, the MACD for Solana has been indicating bullish momentum. The MACD line crossed above the signal line, suggesting potential upward price movement. Additionally, the histogram, which represents the distance between the MACD and signal lines, has been positive, further confirming the bullish trend. This crossover indicates increasing buying pressure and is often interpreted as a signal for potential price gains.

Relative strength index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements on a scale of 0 to 100. An RSI above 70 is typically considered overbought, while an RSI below 30 is considered oversold.

For Solana, the RSI has been trending around 58.89, suggesting that the asset is currently neither overbought nor oversold. This level indicates that while there is buying pressure, it has not yet reached an extreme level that would typically precede a reversal. An RSI reading above 50 also supports the presence of bullish momentum.

Moving averages

Moving averages smooth out price data to identify the direction of the trend. The relationship between the short-term and long-term moving averages can indicate the overall market sentiment.

Solana’s 50-day MA recently crossed above its 200-day MA, forming a “Golden Cross,” which is a strong bullish signal. This crossover suggests that Solana’s price trend may continue to rise in the near term. The current price is also trading above both the 50-day and 200-day MAs, indicating sustained bullish sentiment in the market.

Support and resistance levels

Support and resistance levels are key price points where Solana’s price historically tends to reverse direction. Identifying these levels helps traders make informed decisions about entry and exit points.

Solana has established a significant support level around $135.89. This level has held firm during recent price dips, providing a strong foundation for potential upward movements. On the upside, resistance is currently observed near $174.35. A breakout above this resistance could lead to further gains, potentially pushing the price towards the next resistance level at $200.

Key factors influencing Solana’s price

While the technical analysis can provide helpful market insights, it’s also useful to gain a sense of how the project is doing from a broader perspective.

Technological Advancements and Strong Market Sentiment

Solana’s robust blockchain technology, which offers high transaction speeds and lower fees, is a major factor contributing to its growth. As Solana continues to enhance its infrastructure and resolve past issues such as network outages, its appeal to developers and users is expected to increase.

The recent announcement of a cross-chain bridge between Solana and Bitcoin by the Zeus Network is likely contributing to positive market sentiment for Solana. The cross-chain bridge will enable atomic swaps between SOL and BTC, creating interoperability between both networks.

Community and ecosystem

The active involvement of the Solana community and the expansion of its ecosystem are vital for sustained growth. Community-driven initiatives and partnerships within the DeFi space are likely to enhance Solana’s utility and adoption, further driving its price upward.

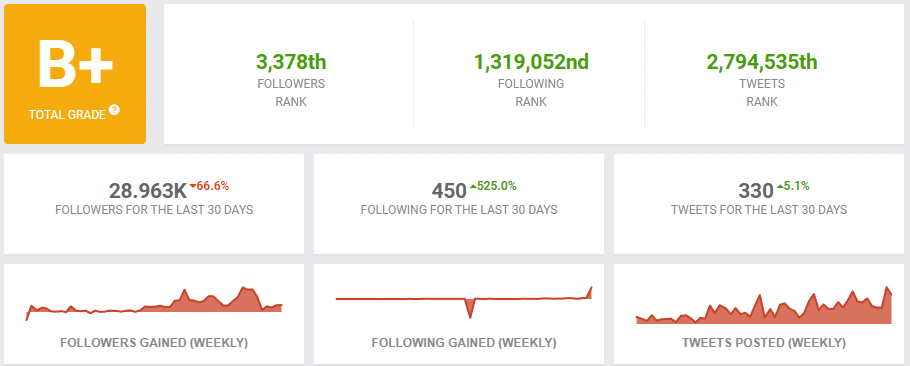

Social media analysis indicates that Solana has gained almost 30,000 followers in the last 30 days, a strong sign of both sentiment and community engagement.

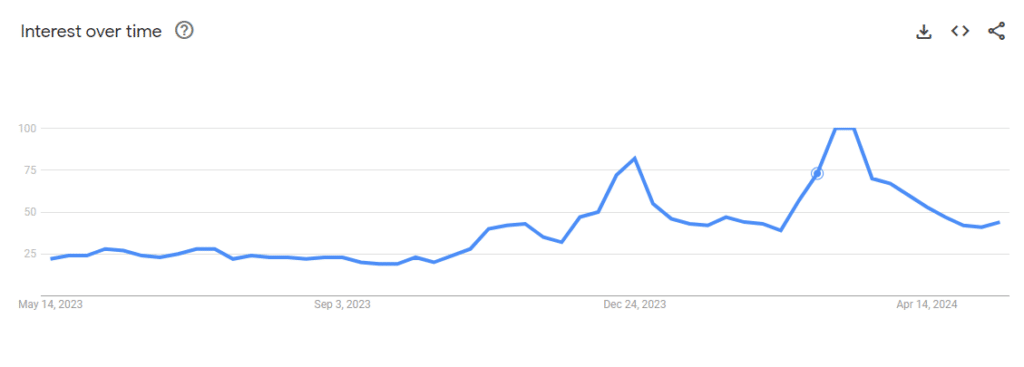

We can also assess interest and engagement with the Solana project by taking a look at the Google Trends results for the word “Solana”.

Solana price prediction 2024

As of mid-May 2024, Solana (SOL) is trading at approximately $168.68 with a market capitalization of $75.7 billion. Analysts predict a range of outcomes for Solana’s price by the end of 2024. Optimistic forecasts suggest that SOL could reach as high as $200, while conservative estimates place it around $150 to $170.

This potential growth is driven by Solana’s strong fundamentals, including its high speed and scalability, which continue to attract both retail and institutional investors.

It’s important to note that the 2024 price prediction for SOL, along with the other predictions in this article, are simply estimates based on current trends and technical analysis. Cryptocurrencies are extremely volatile, and unforeseen events could cause the price of any crypto to drop significantly below the more conservative estimates outlined here.

Solana price prediction 2025

Looking ahead to 2025, the projections for Solana’s price are even more varied. Some analysts expect the price to benefit significantly from the broader market trends, especially the anticipated effects of the Bitcoin halving. Predicted prices for Solana in 2025 range from a conservative $200 to an optimistic $750.

This bullish outlook is based on Solana’s continued network improvements and increasing adoption within the DeFi sector. Of course, anything could happen in a year, and it’s entirely possible that a black swan event could negatively impact the price of SOL, or of any crypto asset.

Solana price prediction 2030

For a longer-term perspective, the Solana price prediction for 2030 is highly speculative but generally positive. By 2030, Solana could have solidified its position in the crypto market as a major competitor to Ethereum. It’s too early to speculate where SOL prices will head, although supporters and advocates of the project expect it to be successful.

While some projections predict that Solana’s innovations and expanding ecosystem could drive significant price increases over the next decade, others are more conservative.

Risks to consider

As a highly volatile asset class, crypto investment carries risk, and investors are often cautioned not to invest more than they can afford to lose. SOL prices are subject to major price swings, and can be impacted by market events not directly connected to the performance of the Solana network.

Is Solana a good investment?

Solana is considered a strong investment due to its advanced technology, high scalability, and growing adoption. However, as with all cryptocurrencies, it carries inherent risks and volatility.

Will Solana’s price go up or down?

Many analysts are optimistic about Solana’s price increasing in the coming years due to its strong fundamentals and market position. However, predictions vary. As with any asset class, it’s impossible to accurately forecast price action for SOL, and a common practice among investors is to implement proper risk management at all times.

Should I invest in Solana?

Investing in Solana could be beneficial if you believe in its long-term potential and are prepared for the volatility typical of cryptocurrencies. It’s important to conduct thorough research and consider your risk tolerance.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link