Solana price is stalling at the $200 psychological level, supported by Fibonacci and VWAP confluence. With open interest resetting to neutral levels, conditions are favorable for a bullish rotation toward higher levels.

Summary

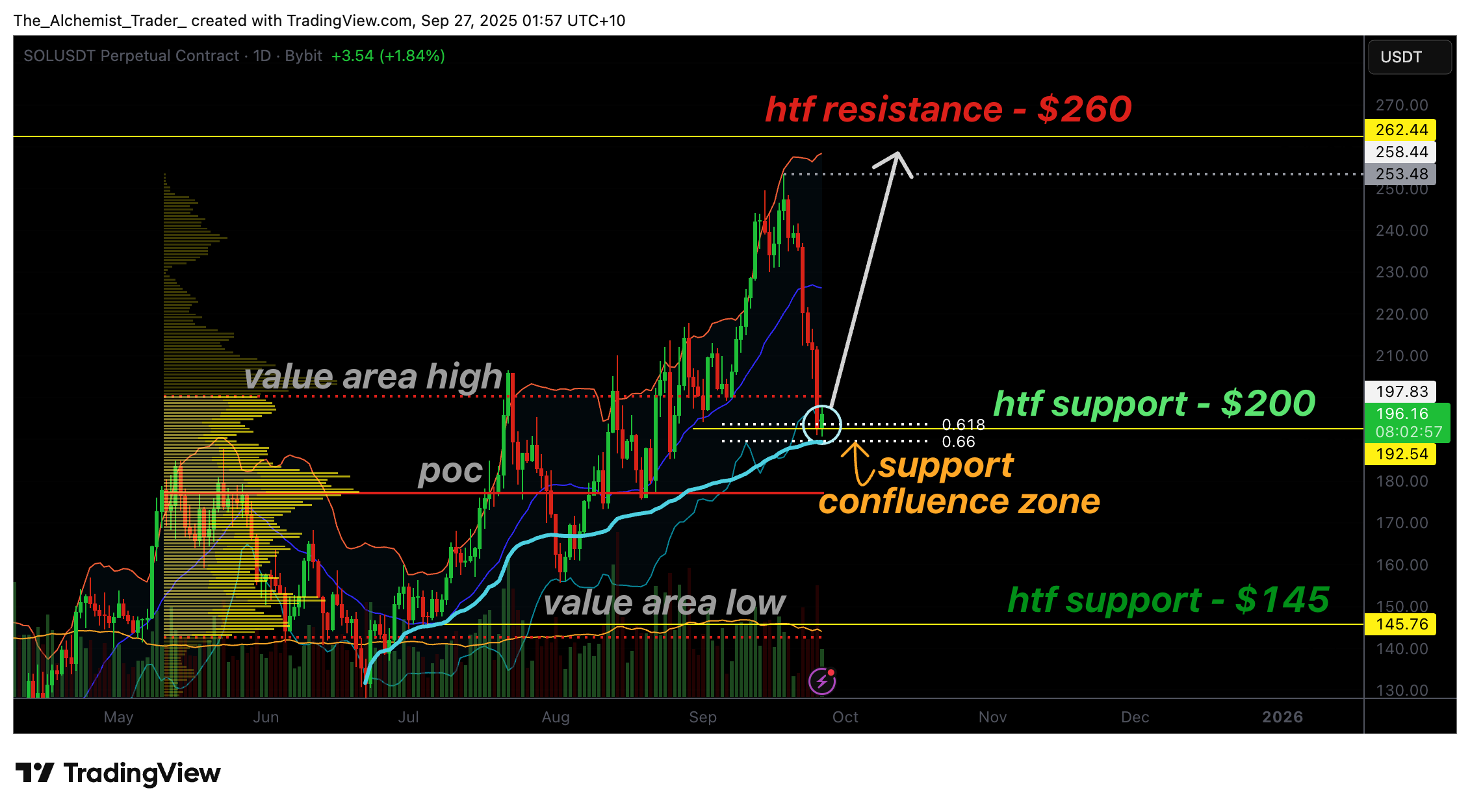

- Solana stalls at the $200 psychological level, aligning with the 0.618 Fibonacci retracement.

- Open interest has reset to neutral levels, creating healthy conditions for fresh positions to fuel upside momentum.

- Market structure remains bullish, with consecutive higher highs and higher lows pointing toward continuation toward $260.

Solana (SOL) is consolidating at a crucial support zone following its recent correction from near $260. After a sharp pullback, price action has reclaimed the $200 psychological level, which aligns with multiple technical confluences. The overlap of high-timeframe support, the 0.618 Fibonacci retracement, and VWAP has reinforced $200 as a critical level for the bullish trend to continue.

Adding to this, open interest has reset to neutral levels, providing fresh conditions for new positions to build as price stabilizes. At the same time, Kazakhstan is rolling out a stablecoin backed by Solana, Mastercard, and a major domestic bank, a development that could further strengthen Solana’s ecosystem and long-term adoption narrative.

Solana price key technical points

- $200 Support Zone: Solana is holding at $200, supported by the 0.618 Fibonacci retracement, VWAP, and high timeframe levels.

- Open Interest Reset: Contracts have been closed following the correction, setting the stage for new positions to fuel the next move.

- Bullish Structure: Higher highs and higher lows remain intact, supporting continuation toward $260 resistance and beyond.

The correction from Solana’s attempt to test the $260 resistance led to a sharp decline, sending price directly into the $200 region. This level, now reinforced by the 0.618 Fibonacci retracement and VWAP support, has acted as a strong floor for buyers.

The psychological significance of $200 has further enhanced its role as a pivot for potential reversal. Price has stalled here over the past sessions, suggesting market participants are waiting for confirmation before committing to the next trend move.

From a structural perspective, Solana’s broader uptrend remains intact. The sequence of consecutive higher highs and higher lows has not been broken, which means the current move can still be classified as a higher low in the context of the larger bullish trend. Holding above $200 increases the probability of continuation toward $260 and potentially higher resistance levels.

One of the most notable developments during this correction has been the reset of open interest. As price fell, many active contracts were closed, returning open interest to neutral levels. This is a healthy sign for market structure because it clears excessive leverage and creates the conditions for fresh positions to open.

When open interest begins to rise again alongside increasing price, it will indicate new bullish flows entering the market, adding momentum for continuation higher.

What to expect in the coming price action

If Solana continues to defend the $200 support, the probability of a bullish rotation increases. With market structure intact and open interest reset, conditions favor another leg higher toward $260.

A sustained breakdown below $200 would weaken the bullish outlook, but for now, the confluence of support and reset positioning points to continuation of the broader uptrend.

Source link