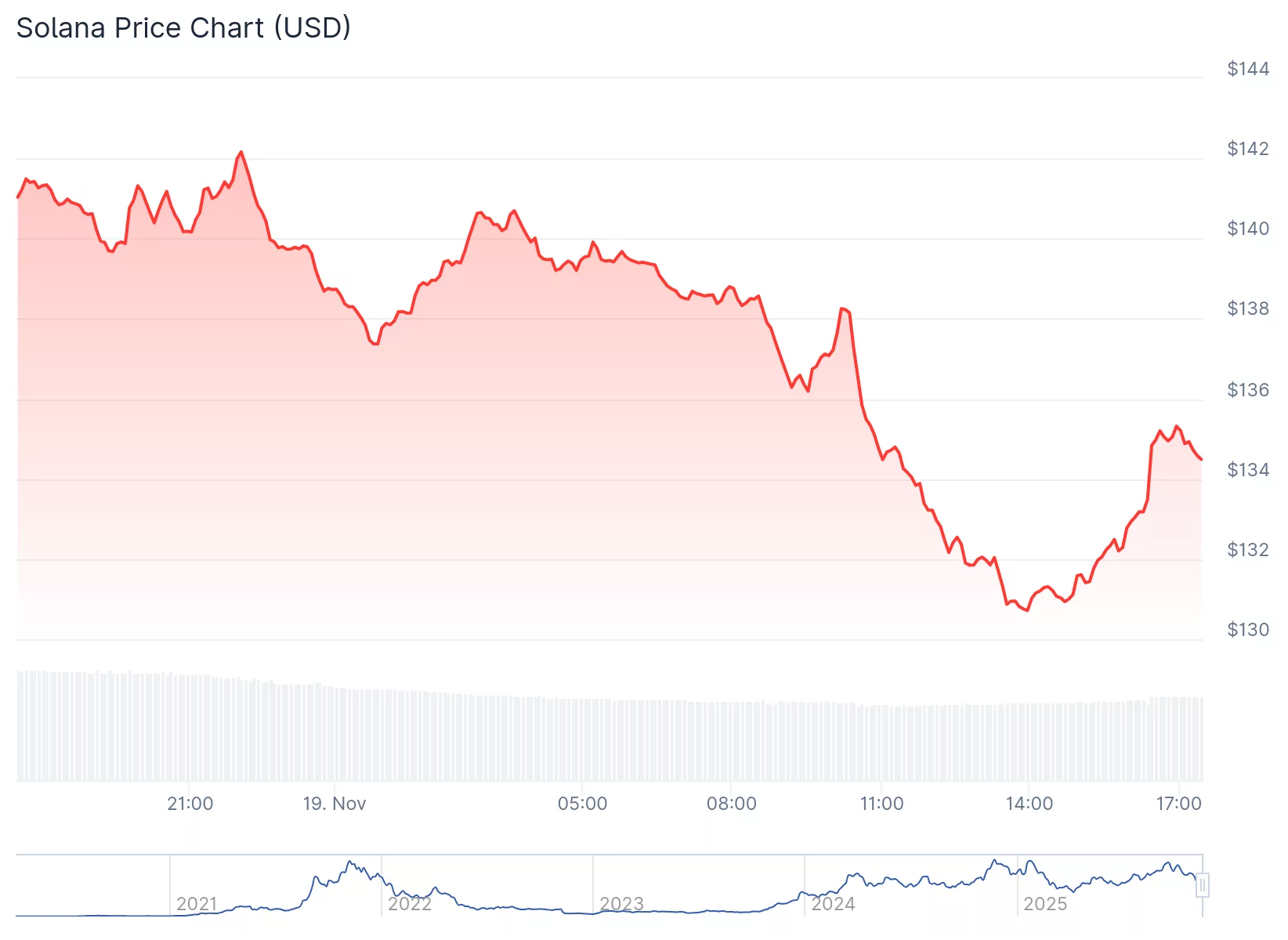

Solana declined on Tuesday, reaching $134 as the cryptocurrency extended its multi-day retreat to a 13.4% weekly loss, according to market data.

Summary

- Solana extended its weekly decline to 13.4% after breaking below a key psychological support level, triggering automated selling.

- Trading volume dropped 26.7%, and Solana is now trading below major short-term moving averages.

- Analysts say the next major support lies near late-October levels; a reversal would require a daily close above the 7-day simple moving average to avoid further downside.

The digital asset broke below a key psychological price level that served as both support and resistance throughout the fourth quarter, according to technical analysis. The breakdown triggered automated selling and stop-loss orders, accelerating the decline toward the lower end of its recent trading range.

Trading volume for Solana (SOL) decreased 26.7% over 24 hours, indicating reduced market participation during the downturn. The decline occurred alongside broader cryptocurrency market weakness, driven by Bitcoin price pressure and exchange-traded fund outflows.

At last check late Wednesday, Solana was trading at around $134, down 4.6%.

Solana’s next real safety net

Solana has slipped beneath every major short-term moving average, and even the modest seven-day trend line is now acting as a ceiling rather than a floor. The MACD is still firmly in the red, though it’s beginning to curl upward — a hint that selling momentum may be losing steam.

Analysts say the charts are flashing clear breakdowns across both the 4-hour and daily timeframes. That leaves Solana leaning on its next real safety net: a support zone it last clung to in late October. If that level doesn’t hold, they warn, the slide could deepen.

A reversal would require a daily close above the seven-day simple moving average, according to technical analysts. Without reclaiming that level, price rallies are expected to face rejection and potential retreats toward prior support zones.

Short-term sentiment remains weak across the altcoin market. Solana’s recent ETF inflows and ecosystem developments have not offset the current market-driven decline, according to market observers.

Just this week, VanEck introduced a Solana ETF on Nasdaq, offering institutional access, with initial fees waived and staking rewards passed to investors. Grayscale launched a spot Solana fund in late October, quickly raising significant assets and sharing staking yields with investors after reducing fees.

The cryptocurrency is approaching oversold conditions on lower timeframes, though bulls must reclaim the seven-day simple moving average to invalidate the bearish technical structure, analysts said.

Source link