The price of Solana plunged, underscoring deeper turmoil in its ecosystem, as weakness in meme coin markets, DeFi activity, and stablecoin transactions converge to pressure the once high-flying blockchain.

With SOL shedding over a quarter of its value since May and its broader network indicators sharply deteriorating, the sell-off highlights how speculative mania around meme tokens has bled into Solana’s fundamentals.

Still, technical signals offer a glimmer of optimism—if buyers return soon.

Solana dropped to $140, its lowest level since April 22, erasing over $22 billion in value as the market capitalization fell from $96 billion on May 23 to $74 billion.

SOL’s retreat has coincided with the recent dive of Solana meme coins, which have erased billions of value. CoinGecko data shows that these meme coins have a market capitalization of $9.29 billion, down from over $30 billion in January to $15 billion in May.

In the past seven days, most Solana meme coins have dived by double digits. Fartcoin (FARTCOIN) has dropped by 25% in this period, while Popcat (POPCAT) and Gigachad (GIGA) have fallen by over 20%.

The ongoing Solana meme coin retreat has negatively affected its ecosystem. For example, DeFi Llama data show that the transaction volume in its decentralized exchange protocols has dropped to $46 billion in June, down from $97 billion in May and $262 billion in January.

Meanwhile, Solana’s stablecoin network has deteriorated this month. Artemis data shows that the stablecoin transaction volume has dropped by over 68% in the last 30 days to $179.5 billion. The number of stablecoin transactions has plunged by 37%, while addresses have fallen by 20% to 3.2 million.

SOL price analysis as a bullish flag forms

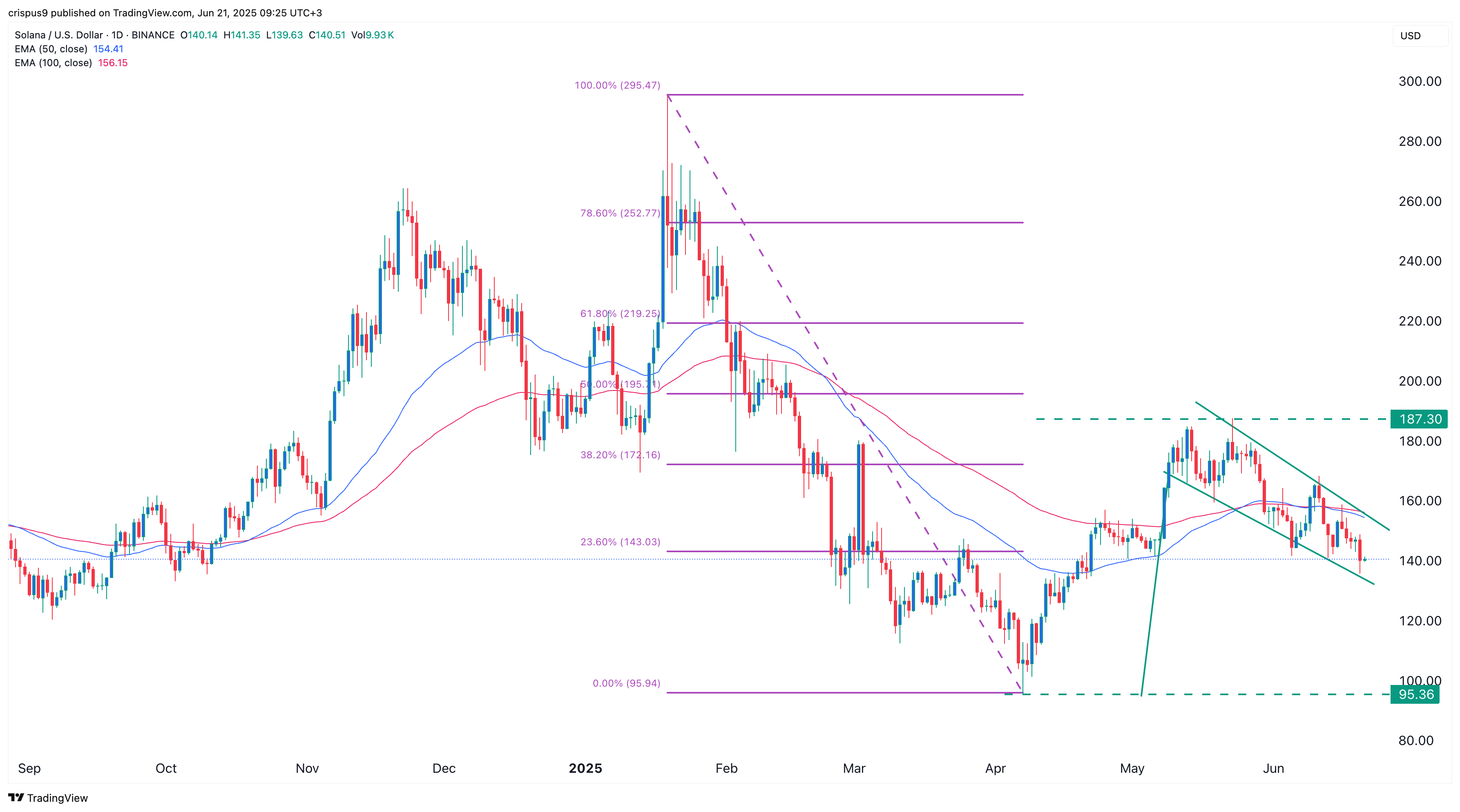

The daily chart shows that Solana price has tumbled from $187 in May to $140 today, June 21. The 50-day and 100-day moving averages have formed a mini death cross pattern, often leading to more downside.

It has also dropped below the 23.6% Fibonacci Retracement, while the Relative Strength Index and the MACD have pointed downwards, suggesting further retreat.

On the positive side, Solana has formed a bullish flag pattern, consisting of a vertical line and a descending channel. Therefore, there is hope that SOL price will bounce back in the next few weeks. Such a rebound will be confirmed if it rises above the 100-day moving average at $156, which coincides with the upper side of the flag channel.

Source link