Traders descended into a panic after LP provider Cetus appeared to be drained of $11 million worth of SUI from its liquidity pool. The team claimed it was an oracle bug, not an exploit.

According to its most recent post, the Cetus team has temporarily halted their smart contracts to prevent any more losses after it detected an incident on its liquidity platform. The team claims that it is currently investigating the root cause of the alleged breach.

“A further investigation statement will be made soon. We are grateful for your patience,” said the protocol.

At around 11:00 UTC, traders noticed that the liquidity pool for the liquidity provider Cetus was being drained of tokens, bringing the token supply count to zero. Based on the screenshot circulating online, tokens on the protocol’s leaderboard, including AXOL, SUIRI, HIPPO, among others, plummeted as low as 92% to at least 75% below the initial prices.

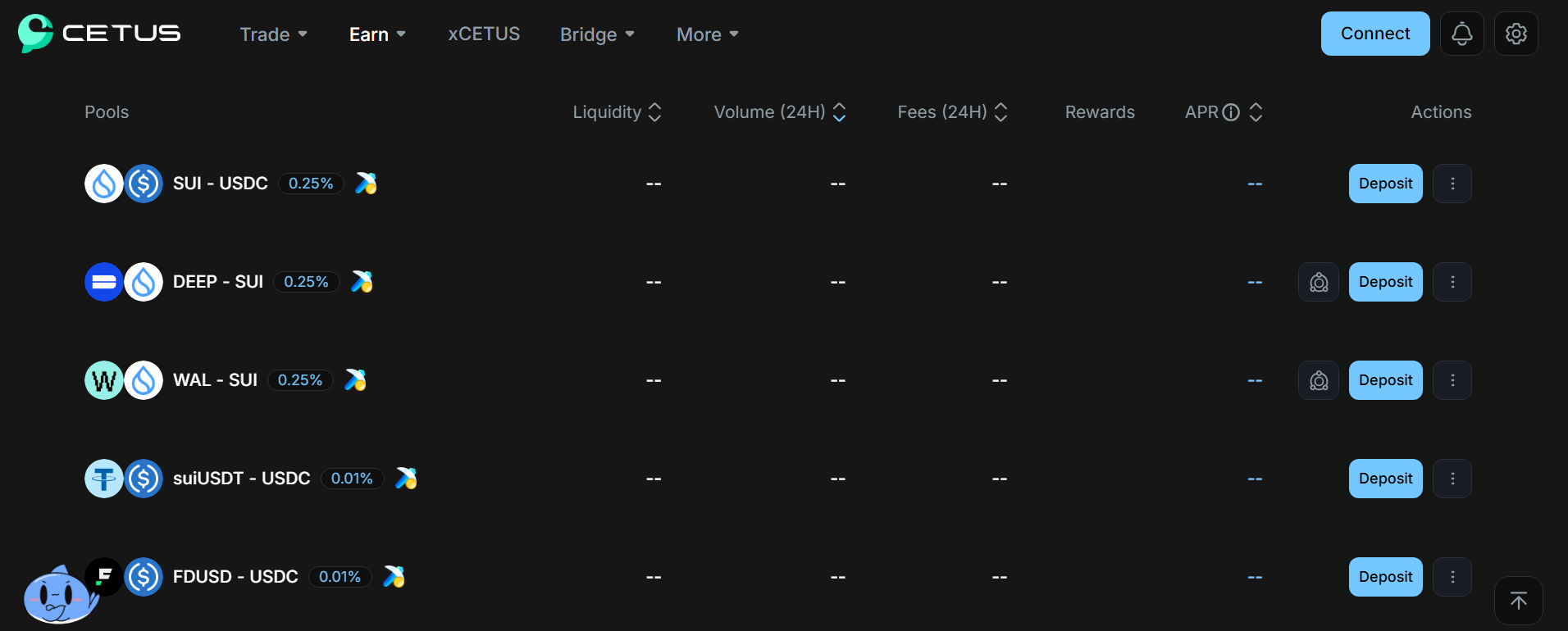

At the moment, the platform remains dormant after smart contracts were paused, with all liquidity pools showing no numbers for its trading pairs.

Despite news of the liquidity drain and the panic related to it circulating online, the SUI (SUI) token still saw modest gains. In the past 24 hours, it has gone up by 3.15%, reaching $4 per token. Its daily trading volume has increased by 112% compared to the previous trading day, reaching nearly $2.5 billion.

In the past month, the token has been on an ongoing rally, going up by nearly 75%.

Some traders who are members of the Discord server for Cetus have shared screenshots of messages from Cetus admins and developers. One of the members, Figure.Cetus, told traders to remain calm and that the team will publish an announcement soon.

Figure.Cetus claimed that the liquidity provider was not hacked, instead the liquidity drain was due to a bug within the liquidity provider’s oracle.

In crypto liquidity pools, oracles serve to connect the pool’s smart contracts to external data sources, such as real-world asset prices or market conditions. This allows the pool to provide accurate pricing, trade execution, and other features based on the external information it receives.

At press time, the Cetus protocol team has yet to publish an official statement regarding its investigations. In addition, smart contracts are still temporarily paused.

Source link