Space and Time token price lost momentum in the past few days as its volume and futures open interest stalls.

Summary

- Space and Time token has pulled back after the Grayscale fund news lost momentum.

- The volume in the spot market and futures open interest has dropped recently.

- Technicals point to more SXT price surge if it holds a crucial support.

Space and Time (SXT) price was trading at $0.096 on Monday, July 28, down by 25% from the highest point this month. This pullback has brought its market capitalization to over $134 million.

Space and Time jumped by over 115% between its lowest level in June and its highest point this month after Grayscale launched a new SXT trust, allowing Wall Street investors to invest in it.

The recent retreat is happening because the Grayscale fund’s news momentum has faded. Indeed, third-party data shows that SXT’s daily volume has dropped to $35 million, down from over $50 million earlier this month. Most of its volume was on Binance, Gate, and MEXC.

The same happened in the futures market, where its open interest continued falling. It had an open interest of $15 million on Monday, down from this month’s high of $27 million.

Space and Time is a blockchain created to deliver verifiable, real-time database processing for smart contracts, artificial intelligence, and decentralized applications. It addresses trust and scalability issues by enabling applications to query both on-chain and off-chain data at scale.

Space and Time offers solutions like proof of SQL, decentralized data warehouse, and a validator network. It made headlines in May after Microsoft added it to its Frabric analytics platform.

SXT price technical analysis

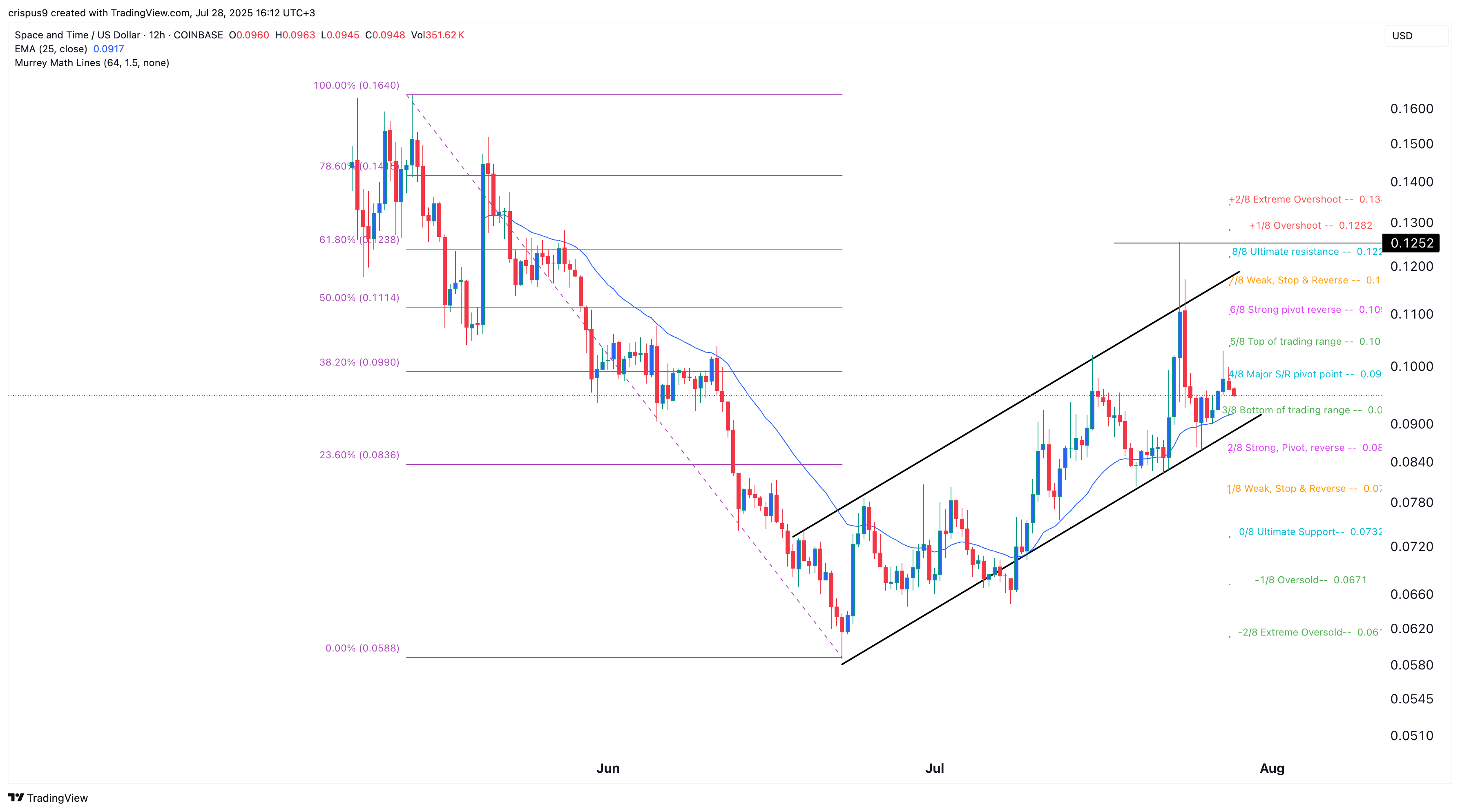

The daily chart shows that the SXT crypto price started to rebound on June 22 when it bottomed at $0.0588. It soared by 112% to a high of $0.1250, its highest point since May and the 61.8% Fibonacci Retracement level.

SXT price then pulled back to $0.095, slightly above the lower side of the ascending channel. It has also remained above the 25-period Exponential Moving Average.

Space and Time has moved slightly below the major S/R pivot point of the Murrey Math Line. Therefore, the token’s outlook is bullish as long as it is above the 25-period moving average and the lower side of the channel. If this happens, the token may rebound and retest the psychological point at $0.110.

A drop below the lower side of the channel will point to more downside, potentially to the ultimate support at $0.0732.

Source link