The Federal Reserve cut rates by 25 basis points, lowering the target range to 4.0–4.25%.

Powell said it was ‘another step toward a more neutral policy stance’ and that policy was ‘not on a preset course’ — framing the move as a temporary adjustment to shifting conditions rather than the start of a full pivot.

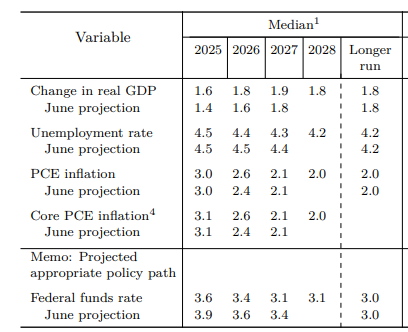

But the move came with inflation running above target for more than four years straight — the longest stretch since the late 1990s. And according to the Fed’s own September 2025 projections, PCE inflation is expected to remain above 2% until 2028, while the federal funds rate is forecast to decline from 3.6% in 2025 to 3.1% in 2027. Normally, higher rates are used to tame persistent inflation, but the Fed is charting a path of loosening policy instead.

From hawkish pledges to capitulation

Only weeks earlier at Jackson Hole, Powell wrapped himself in hawkish feathers, pledging: “Come what may, we will not allow a one-time increase in the price level to become an ongoing inflation problem.” That was supposed to be a red line, yet Powell has erased it himself with this cut. He called it risk management, but in reality it looks more like surrender. Of course, Powell defended the move, but markets heard dovishness, and risk assets surged.

Excess liquidity masks real risk

The credit market makes the absurdity blindingly obvious — junk debt trades like blue chips, as if risk had vanished. The U.S. high-yield spread — the extra yield investors demand to hold risky corporate debt instead of safe Treasuries — has collapsed to just 2.9%, near cycle lows, while CCC-rated junk debt, the riskiest tier, has fallen from 11.4% in April to only 7.9% today. Equity volatility remains muted: the Cboe Volatility Index (VIX) — Wall Street’s ‘fear gauge’ that tracks expected 30-day volatility in U.S. equities — is hovering near 16, well below its long-term average.

Even the Fed’s own gauge confirms it: the Chicago Fed’s National Financial Conditions Index (NFCI) stands at –0.56, signaling liquidity conditions looser than historical norms.

Institutions choose the Fed-independent hedge

Since March 2021, when inflation first breached the Fed’s 2% target, U.S. equities have soared. The Wilshire 5000 — the index tracking the entire stock market — now carries a market capitalization of about $66 trillion, up nearly 65% over the period.

But while equities have floated higher on Fed-supplied liquidity, Bitcoin has done even better, more than doubling in price over the same stretch — and unlike equities, Bitcoin’s appeal is anchored precisely in being outside the Fed’s orbit.

Bitcoin jumped to $117,000 on Sep 18, immediately after the Fed’s cut, but then retraced, weighed down by profit-taking, futures liquidations, and heavy options positioning. According to Glassnode, Bitcoin options open interest has surged to a record 500,000 BTC, with the September 26 expiry set to be the largest in history, amplifying short-term volatility.

Even as prices pulled back post-cut, institutional demand appeared resilient. Between September 18 and 22, Glassnode data shows that U.S. spot Bitcoin ETFs absorbed more than 7,000 BTC (nearly $850 million at prevailing prices). The result is that Fed’s uncertainty fuels more institutional activity — strengthening, not weakening, Bitcoin’s foothold.

A house divided against itself

Inside the Fed, the scene evokes the old warning — a house divided against itself cannot stand. September’s vote was the second meeting in a row without unanimous support, with seven of nineteen policymakers penciling in fewer cuts. The arrival of Stephen Miran on the Fed Board only added to the discord. A former strategist at Hudson Bay, an investment firm that traded FTX bankruptcy claims, Miran was the only governor who pushed for a sharper 0.5% cut. Although he failed to sway colleagues and Powell emphasized the committee acted with ‘a high degree of unity,’ the arrival of a policymaker with digital-asset experience and a bias toward looser liquidity conditions is unlikely to be without consequence.

Closing thought

Powell himself admitted: “There are no risk-free paths now. It’s not incredibly obvious what to do.” This lack of clarity is a risk on its own — one market wouldn’t hesitate to read as uncertainty and exploit. In this light, decentralized alternatives look far more credible, and Bitcoin offers the hedge investors need against both inflation and the monetary policy politicization. And while Powell calibrates, investors are shifting toward assets that don’t live or die with every wobble of Fed policy choices.

Source link