Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

In the United States, over the course of several years, policymakers have studied, debated, and issued multiple reports on whether the Federal Reserve Bank should create a central bank digital currency—a “digital dollar” without reaching a definitive course of action.

CBDCs are digital versions of traditional paper fiat currencies backed by governments and issued to promote economic inclusion and broader access to financial services with tokenized payment efficiency. CBCDs improve monetary policy in global payment systems in lieu of the increase in tokenized electronic payments and the decline in the use of cash by providing accountability and stability. They mitigate the risk of financial instability arising from the creation of unregulated private electronic payment instruments, such as meme/altcoins, tokenized assets or stablecoins, and corruption.

There are two types of CBDCs. A retail CBDC is used by the general public, and a wholesale CBDC is exclusively designed for interbank payments and securities transactions.

Vivek Raman, CEO of Etherealize.io, which connects financial institutions to the largest, secure, and open blockchain eco-friendly Ethereum ecosystem around the world told me:

“We don’t believe a CBDC will happen in the US under the new administration. A CBDC goes against the principles of decentralization and freedom, and it is better to have a marketplace of stablecoins and tokenized assets.”

The US CBDC ban

On Jan. 16, President Donald Trump’s Treasury nominee, Scott Bessent, who has since been confirmed as the 79th United States Secretary of the Treasury, testified before the Senate Finance Committee strongly opposing the introduction of a CBDC in the US. “I see no reason for the US to have a CBDC,” citing privacy and economic concerns.

Following Scott Bessent’s announcement, on Jan. 23, US President Donald Trump signed an executive order officially prohibiting the establishment, issuance, circulation, and use of CBDC in the US. As Rhett Shipp, CEO of Avant, an onchain stablecoin dollar provider, states:

“In my opinion, CBDC would end up hurting the US since it would reduce USD utility by increasing censorability and reducing privacy. Embracing stablecoins is the better path.”

CBDC development around the world

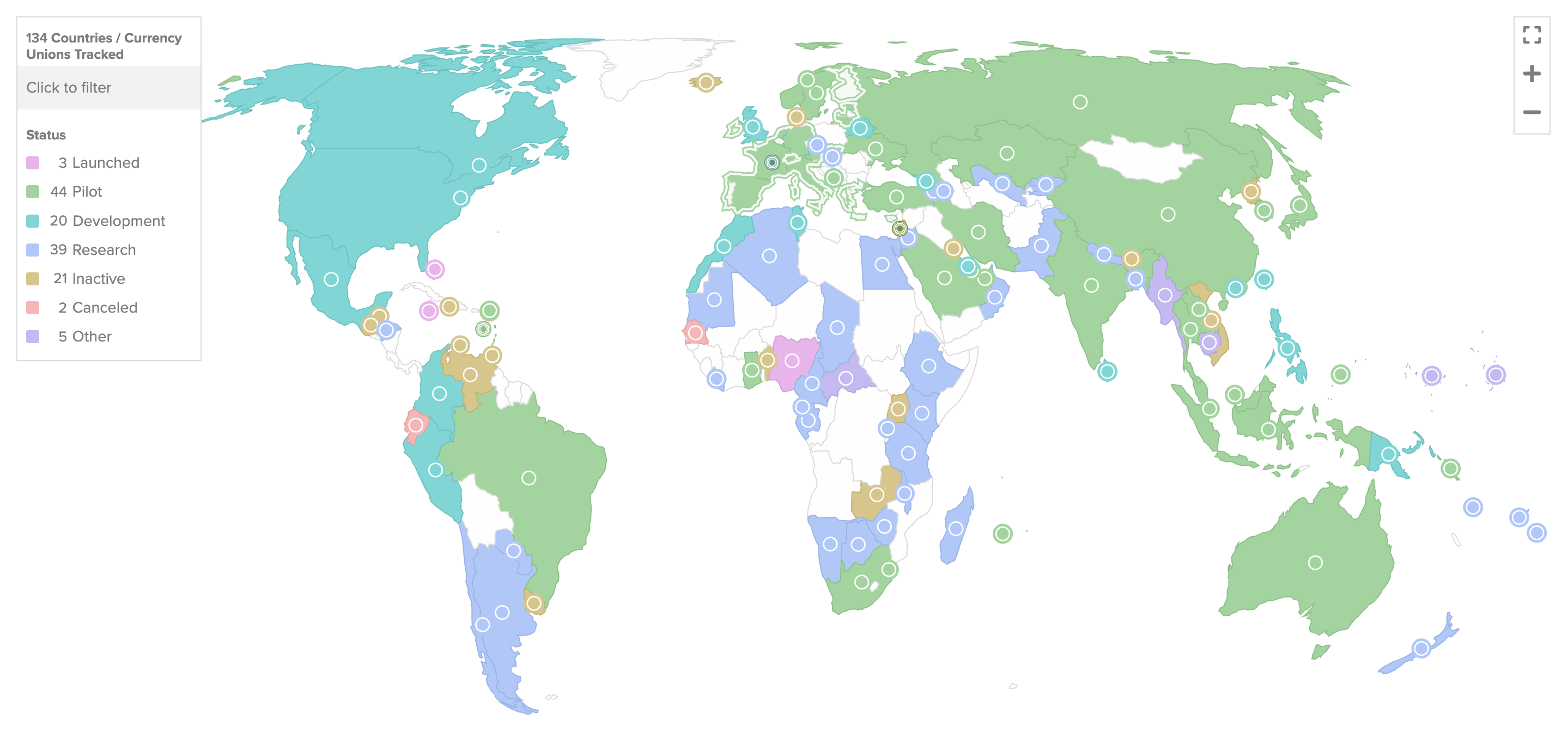

The global adoption rate of CBCDs has been monitored by the Atlantic Council’s tracker, which follows the CBDC developments in 134 countries that make up 98% of the global GDP. So far, 66 countries are exploring CBDCs, with China leading the way. Only three countries, including Nigeria, Jamaica, and Bahamas, have issued them.

These countries are working on the collaborative development of coordinated legislation to regulate the issuance and distribution of CBDC with international organizations’ recommendations (see: Sustainably Investing in Digital Assets Globally by Selva Ozelli, Introduction, p. 2). Nevertheless, the intricately interconnected CBDC ecosystem—comprising central banks, commercial banks, payment service providers, and technology vendors—faces an array of cybersecurity challenges, exacerbated by data use and privacy protection vulnerabilities, points out the IMF CBDC Virtual Handbook.

World’s most used CBDC—The e-CNY

China has been taking the global lead in developing domestic and cross-border tokenized payment networks via digital currencies. They began piloting the CBDC e-CNY program in 2019 with 260 million wallet users in 17 provincial-level regions, making it the most utilized CBDC pilot in the world. According to Lu Lei, deputy governor of the People’s Bank of China—the central bank of the People’s Republic of China—as of June 2024, China’s digital yuan has carried out transactions totaling 7 trillion yuan ($982 billion). This figure is nearly four times the 1.8 trillion yuan recorded by the end of June 2023.

This success of the e-CNY is attributable to the Chinese Government’s continuous efforts to expand the scope of the retail and wholesale CBDC transactions for increased adoption of the e-CNY. The use case has been broadened to include payments for different services such as payment for public transportation, income tax, stamp duties, and, more recently, an electronic version of red packets (Hongbo), the traditional Chinese way of gifting money (“Purpose Bound Digital Payments”).

However, China’s CBCD development efforts are not confined to the country. “In Asia and the Pacific, central banks in China, India, Indonesia, Thailand, Singapore, Japan, and the Republic of Korea are already piloting CBDCs,” explained Kanni Wignaraja, United Nations Assistant Secretary-General and UNDP Regional Director for Asia and the Pacific.

President Donald Trump’s move to ban CBDCs in the US is expected to impact “any retail CBDC projects in the next four years,” according to Yifan He, the founder of Red Date Technology. “But the point is that I don’t think any country can even develop a real retail CBDC in the next 10 years,” he explained to me.

Red Date Technology is a decentralized cloud infrastructure company headquartered in Hong Kong that has co-founded two companies that are taking the lead in global CBDC pilot programs:

- China’s Blockchain-Based Service Network (BSN), alongside government-owned firms and departments that connects different payment networks;

- The Universal Digital Payments Network (UDPN) that uses blockchain and smart contracts to create a decentralized messaging system and platform to enable cross-currency transfers and settlements of different digital currencies.

Last year, the UDPN established a digital currency sandbox for central banks and commercial banks such as Standard Chartered and Deutsche Bank to trial how a retail CBDC system might work, including quota management, circulation, and wallets. The system is designed to support a variety of retail and wholesale crossborder CBDC proof-of-concept (PoC); regulated stablecoins such as PayPal USD, Paxos Dollar, USDC, Hedera, and Tether; tokenized deposits as well as purpose-bound digital payments to interoperate from different countries.

Tim Bailey, the vice president of global business and operations for Red Date Technology, explained to me in an interview:

“Stablecoins and CBDCs are transforming digital payments, offering 24/7 transactions for businesses. As payments increasingly migrate on-chain through the adoption of stablecoins and CBDCs, the need to support emerging cross-chain payment rails has become clear. UDPN is a trailblazer in the field, offering PoC as a first step towards connecting digital payments within the greater digital currency ecosystem. The UDPN architecture allows us to integrate with virtually any digital currency system—whether it be CBCD, stablecoin, tokenized deposits, or purpose bound digital payments via a transaction node. It simplifies the adoption of digital currencies in a wide range of applications and reduces integration costs for financial institutions and central banks.”

EU’s wholesale CBDC initiative

The European Central Bank has been exploring CBDCs in different capacities since 2020, including a consumer-facing retail digital euro and wholesale cross-border settlement between central banks.

In response to the US’s CBDC ban, the ECB on Feb. 20 announced that it is expanding the development of its wholesale CBDC payment system to settle transactions between institutions to move towards an integrated tokenized financial infrastructure in two phases. In the first phase, the ECB will build a wholesale CBDC platform. In the second phase, the ECB will integrate the CBCD platform with systems, such as foreign currency exchange markets, so that CBDCs, tokenized deposits, and tokenized assets can interoperate seamlessly within a blockchain-based financial system based on a shared ledger or a suite of interconnected solutions. This initiative will require unifying standards and regulations, first at the level of the Eurozone, then perhaps at the global level for a more harmonized and integrated European financial ecosystem.

Conclusion

The Innovation Hub at the Bank for International Settlements, an international organization of central banks, continues to work with a range of countries on CBDC research and cross-border pilot projects with increased interest fueled by the disruption caused by COVID-19.

William Quigley, a cryptocurrency and blockchain investor and co-founder of WAX.io blockchain and stablecoin Tether (USDT), explains:

“Each country will adopt to tokenization of the financial sector and implement a CBDC at the retail and/or wholesale level at its own pace. It’s inopportune that in the US digitized fiat currency, CBDCs are often criticized due to privacy concerns, potential threats to individual autonomy. But the reality is that it is inevitable that the growth of privately issued digital assets and stablecoins will further disintermediate commercial banking institutions and central banks as people increasingly turn to tokenized alternatives and countries other than the US adopt CBDCs.”

Except for the US, 19 out of G20 nations—Argentina, Australia, Brazil, Britain, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkiye, plus the European Union—are developing advanced stage of CBDC programs. “The good news for those countries unfocused on CBDCs is that there is always a market for old paper money and ancient coins,” pointed out ancient coin dealer Ozgur Honc,a the founder of Bank Costa Auction House and the author of Catalog of Queen Elizabeth II Paper Money.

Source link