XRP price rose for the third consecutive day on Monday as most altcoins attempted to bounce back.

Summary

- XRP price has formed the rare cup-and-handle pattern.

- The pattern signals to more gains, potentially to $5.2.

- XXRP and UXRP ETFs are attracting substantial investor inflows.

Ripple (XRP) token jumped to $3.25, up by almost 10% from its lowest level last month and 100% above its April lows. The token has formed the highly bullish cup-and-handle pattern, pointing to an eventual rally to $5.

XRP price technical analysis

The daily chart shows that the XRP price bottomed at $1.6173 in April as most altcoins plunged following Donald Trump’s Liberation Day speech.

It then started a slow comeback, eventually soaring to a record high of $3.6552 this month. On the positive side, there are signs that the token has more upside to go despite last week’s retreat.

XRP has remained above the 50-day and 200-day Exponential Moving Averages, a sign that bulls remain in control. Most importantly, the recent pullback was part of the formation of the handle section of the cup-and-handle pattern, one of the most common continuation signs.

The distance between the cup’s upper side at $3.39 and its lower side at $1.6173 is about 52%. Measuring the same distance from the cup’s upper side gives it a target of $5.1783. This target is about 60% above the current level.

The bullish XRP price forecast will remain as long as it is above the crucial support level at $2.6470, its highest swing on May 12 this year.

Key catalysts for Ripple jump

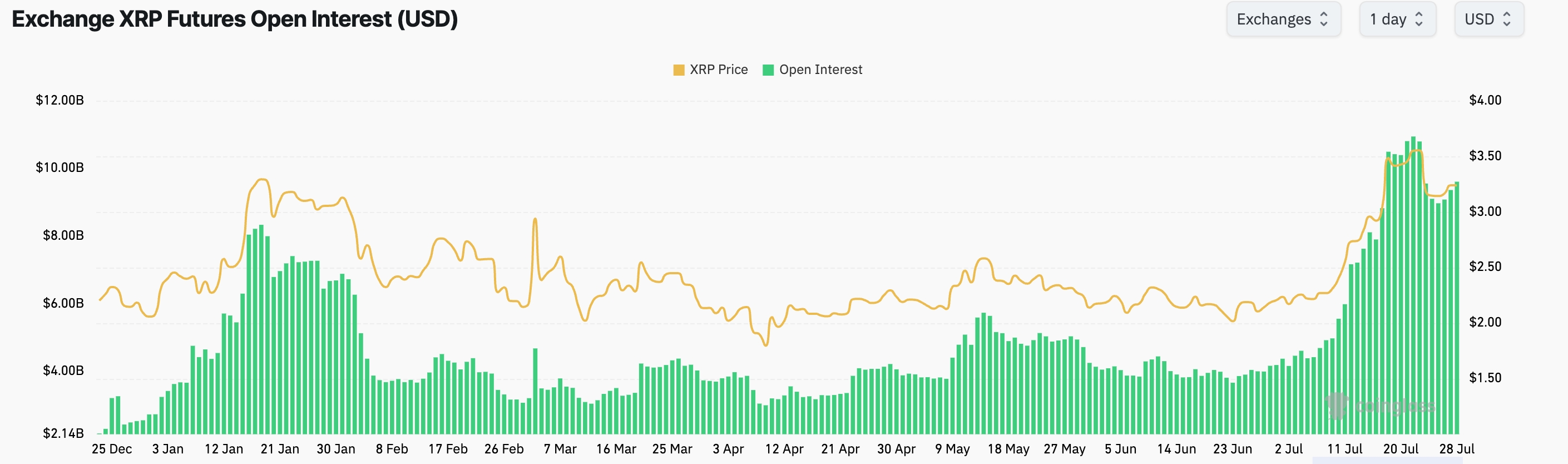

XRP price has numerous catalysts that may drive its price above $5 in the coming weeks or months. First, there are signs that the coin has adequate demand as the futures open interest has remained above $9 billion in the past few weeks. This is notable as XRP’s open interest fell to below $4 billion in June.

Second, data shows that XRP’s futures weighted funding rate has remained in the green since June. A positive funding rate is a sign that investors expect the future price will be higher than where it is today.

Third, there are signs that there will be strong demand for XRP ETFs once approved by the SEC as most analysts expect. The existing derivatives-based ETFs like Teucrium’s XXRP and ProShares UXRP are doing well, with their assets soaring to $383 million and $95 million, respectively.

Further, XRP price will benefit from the ongoing Ripple USD (RLUSD) stablecoin market share gain. It has accumulated over $550 million in assets and is catching up with PayPal’s PYUSD.

Source link