Summary

- XRP price is trading at around $2.64 with Federal Reserve’s interest rate decision expected tomorrow at 2PM eastern time and volatility likely to follow.

- Dovish policy on rates could trigger a breakout above $3.00 according to XRP price prediction analysts.

- On the other hand, a hawkish policy could see XRP pull back to $2.20, as higher rates discourage risk-on investment in assets like XRP.

XRP is trading near $2.64 as traders turn their attention to today’s Federal Reserve interest-rate decision, one of the most market-moving macro catalysts left this quarter.

Will a supportive Fed spark a breakout toward $3.00, or will a more cautious stance trigger a rejection back into the low $2 range?

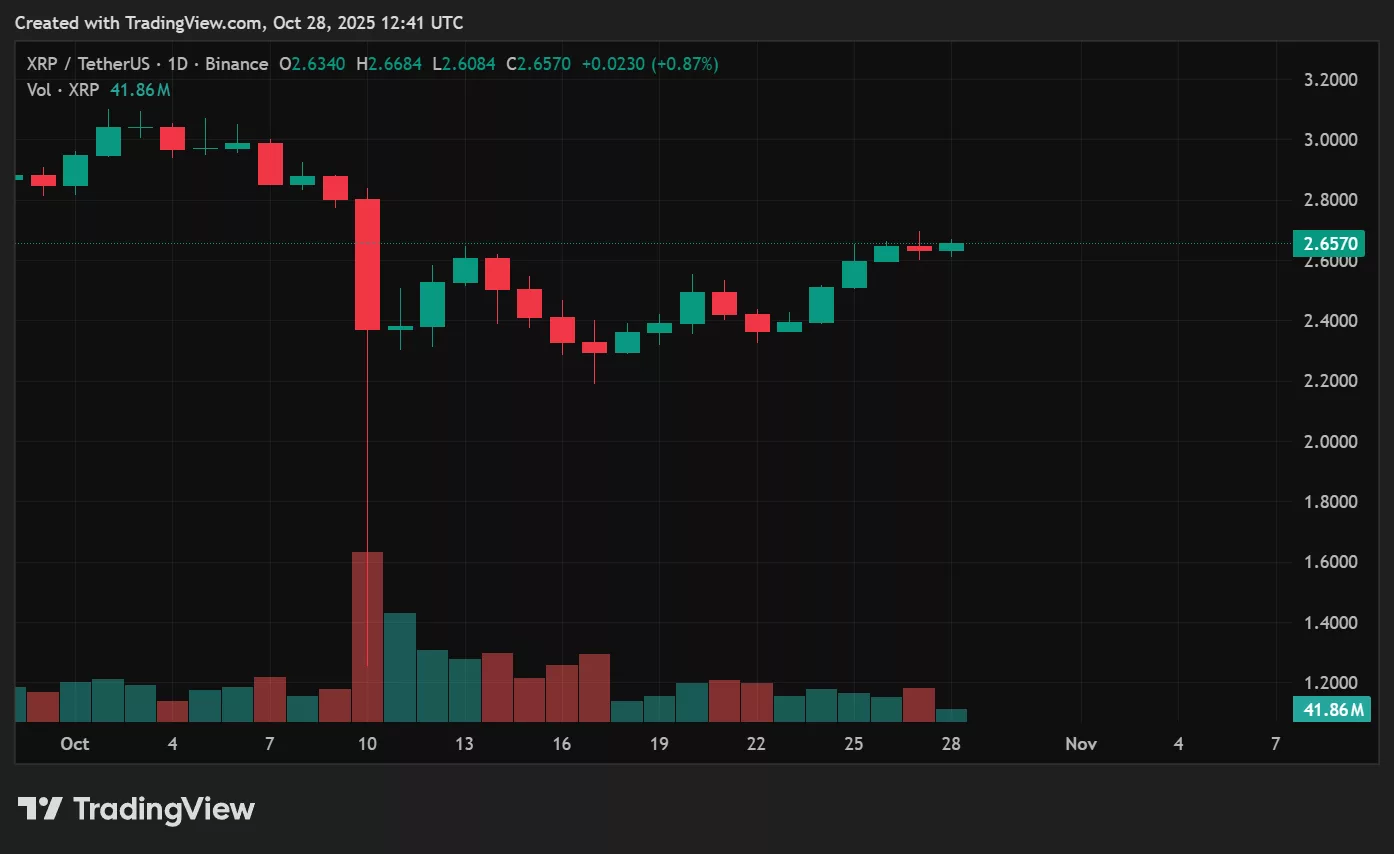

XRP price landscape on October 28th

XRP price has been ranging narrowly between $2.50 and $2.80, with attempts to break $3.00 thus far thwarted on the charts. Ripple (XRP) reclaimed its 200-day moving average around $2.60 recently, indicating underlying support. Spot volumes are down this week, but still indicate steady positioning rather than a selloff as traders still await clear signals from the market.

Sentiment will swing based on the Fed’s decision. If the Fed acknowledges cooling inflation and slower economic momentum by implementing rate increases, selling pressure on assets like XRP will likely increase. Other risk-on assets like BTC are also currently below recent breakout levels, with uncertainty around Fed rate policy a likely factor.

Upside case: Dovish Fed fuels breakout

If the Fed signals that rate cuts remain on the table or even pulls forward guidance into a more supportive stance, risk appetite could snap back quickly. In that scenario, XRP retesting $2.80–$3.00 becomes likely, and a clean daily close above resistance could extend gains toward $3.20–$3.50. The technical backdrop would strengthen considerably if buyers reclaim the $3 handle on accelerating volume, potentially flipping market structure bullish again.

Bear case for XRP price

A Fed message that emphasizes elevated inflation risks or delayed easing would likely pressure crypto broadly, especially high-beta altcoins. If XRP slips under $2.40, bullish confidence would fade, exposing deeper support near $2.20–$2.30. With derivatives positioning currently skewed toward leveraged longs, a downside move could unwind quickly if stops begin triggering.

XRP price prediction based on market data

At current levels, XRP sits at a macro inflection point. A dovish Fed could provide exactly the spark needed to finally break resistance and shift focus to $3.20–$3.50 targets. A hawkish surprise, however, risks sending XRP back to $2.20–$2.30 and resetting the broader recovery timeline.

The next few hours of policy commentary will likely determine whether XRP’s trajectory turns bullish or stalls out yet again.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link