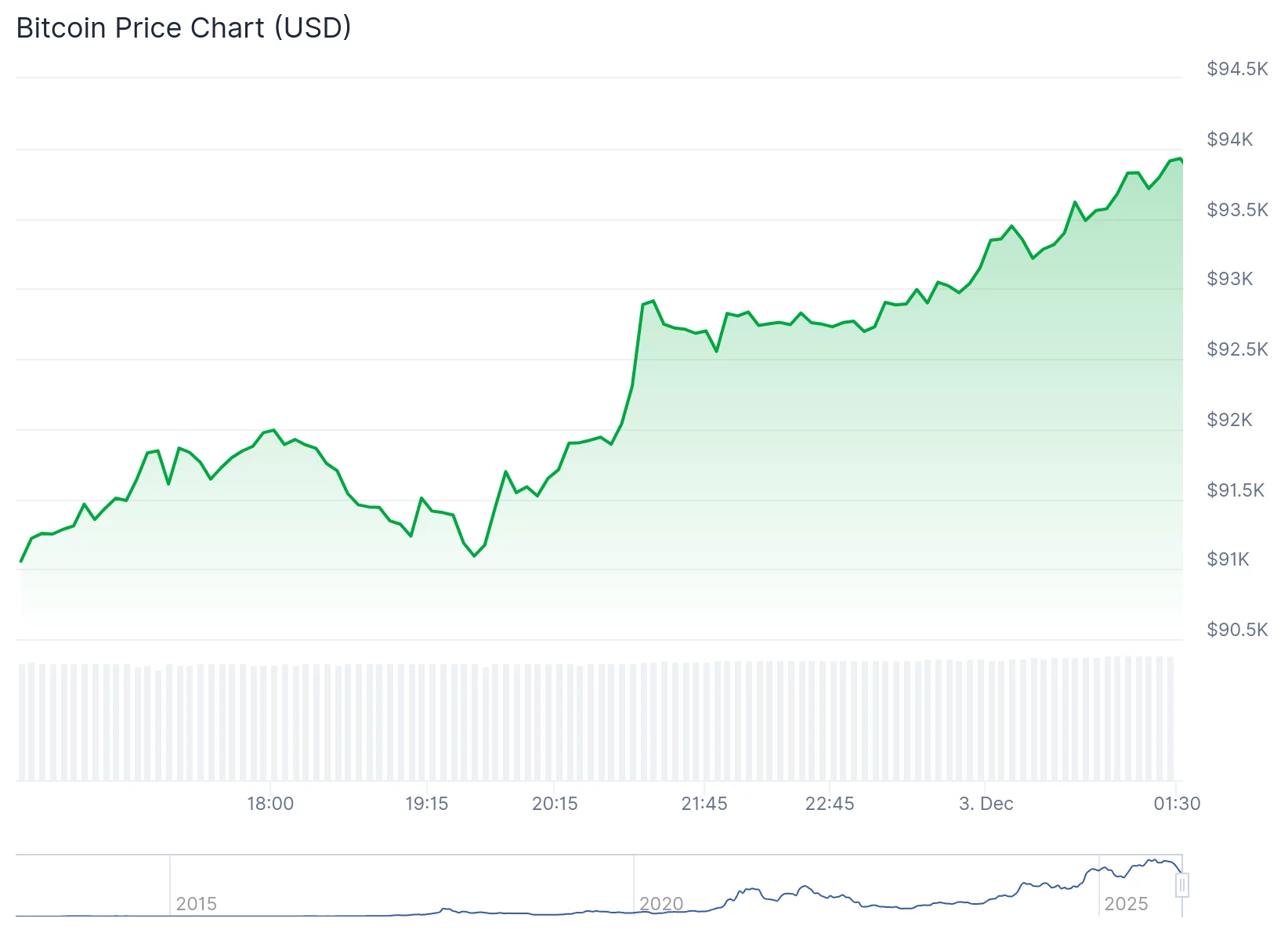

Coinbase Global Inc. got a welcome jolt Wednesday afternoon as Bitcoin sprang back above $93,000 — a reminder that Coinbase and the world’s largest cryptocurrency remain a co-dependent duo.

Summary

- Coinbase shares climbed on Wednesday as Bitcoin surged back to just under $94,000.

- Despite a recent downgrade, bullish sentiment remains, boosted by strong Q3 earnings and continued buying from Cathie Wood’s Ark Invest.

- Crypto-linked stocks are rebounding from a broader market pullback.

The stock closed at $276.92 per share on Wednesday, up over 5%.

The logic is simple: when Bitcoin rallies, people trade more. When people trade more, Coinbase earns more. And when Coinbase earns more, investors briefly forget about things like price targets and valuation multiples. It’s a beautiful cycle — at least on days when BTC is green.

Wednesday’s surge follows a choppy stretch in which Argus Research downgraded Coinbase to “Hold,” warning that the stock’s 39x 2026 earnings multiple was looking a little too spicy.

Coinbase investors shrugged. After all, the company just smashed third-quarter expectations with $1.50 EPS versus the $1.10 consensus, and Cathie Wood’s Ark Invest responded to the recent dip by backing up the truck: more than $7 million in fresh COIN shares loaded into its ETFs.

What’s next

Investors are also eyeing Dec. 17, when Coinbase is expected to unveil new products — possibly including a prediction market and even stock trading. Because why not add more features when you already have half of crypto Twitter living on your app?

Technically speaking, Coinbase still has some ground to recover. Shares remain about 13.9% below the 50-day moving average and 2.7% under the 200-day, reflecting the broader slump in crypto-linked equities. Ark, undeterred, has been scooping up not just Coinbase but also Block, Circle Internet Group, Bullish, Robinhood, and even its own Bitcoin ETF amid the downturn.

Bitcoin itself remains well off its record high from six weeks ago as thin liquidity and macro uncertainty continue to crimp trading volumes. See below.

But for now, with BTC bouncing and Coinbase riding shotgun, investors are getting at least a midweek reminder of how quickly sentiment — and stock charts — can turn in crypto land.

Source link