Ethena price rose for two consecutive days as whales continued buying, and exchange balances dipped to their lowest point in months as USDe demonstrates ongoing stability.

Summary

- Ethena price has rebounded from the lowest point this month.

- The USDe stablecoin has maintained its peg this week.

- Whales and public figure investors have continued to accumulate.

Ethena (ENA) token rose to $0.4700, up by 210% from its lowest level this month. This rebound has brought its market cap to over $3.2 billion.

ENA price has rebounded after the USDe stablecoin maintained its peg, a week after it briefly dropped below $1 amid the crypto market crash.

The coin regained its peg after the developers shared data showing that it was overcollateralized. According to its website, USDe has a total supply of $12.18 billion against total reserves of $12.25 billion. These reserves are in the form of Bitcoin (BTC), Ethereum (ETH), and other liquid stablecoins.

ENA token also jumped after the latest partnership between Ethena and Conduit, a platform that powers 55% of chains on Ethereum. This partnership means that developers using Conduit now have access to Ethena’s infrastructure to build their own stablecoins.

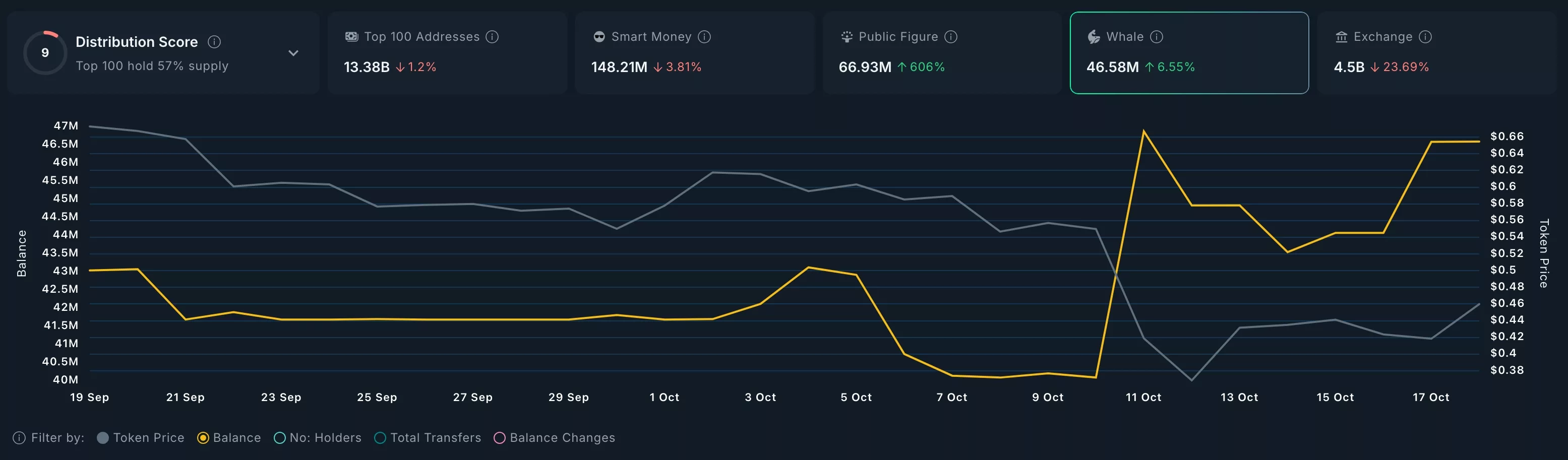

Ethena price has also rebounded, as on-chain data shows that whales have continued buying it. These investors now hold 46.6 million ENA tokens, up from 41.6 million on Oct. 1. Soaring whale holdings is usually a sign that experts expect the price to continue rising.

Investors like Arthur Hayes and Kain Warwick now hold 66.9 million coins, a 600% increase from the same period last month.

The ongoing accumulation has likely contributed to the plunging ENA tokens on exchanges. There are now 4.58 billion ENA tokens on exchanges, down from 4.94 billion on Oct. 7.

Falling exchange balances is a sign that investors are not selling their tokens, but are instead moving them to self-custody wallets.

Ethena price technical analysis

The daily timeframe chart shows that the ENA price formed a double-top pattern at $0.8538, its highest point in August and September.

Ethena token then crashed below the neckline at $0.6060 during the recent crash that pushed it to a low of $0.1475. It then bounced back and is hovering slightly below the psychological point at $0.50.

The most likely scenario is where the token rebounds and hits the key resistance at $0.6060, which is about 30% above the current level.

However, the risk is that the token could form a death cross pattern, which happens when the 50-day and 200-day Exponential Moving Averages cross each other. If this pattern forms, there is a risk that it will resume the downtrend and retest the year-to-date low of $0.1475.

What Is Ethena?

The Ethena token is a relatively new cryptocurrency that’s designed to provide price stability without relying on traditional collateral or centralized mechanisms.

Ethena utilizes a unique algorithmic approach that aims to stabilize its value through elastic supply and demand, making it different from other stablecoins like USDT or USDC, which are backed by fiat reserves.

Ethena was developed by Ethena Labs, a team focused on decentralized finance (DeFi) protocols.

The core idea behind the Ethena project is to create a stablecoin that can retain value stability without the need for centralized control or significant collateral backing.

Source link