Hedera’s HBAR token surged 22% today as investors reacted to its growing role in Nvidia’s efforts to enhance verifiable data integrity for AI systems.

The excitement kicked off after Anthony Rong, regional vice president of Engineering at Nvidia, shared a post on LinkedIn highlighting how the two teams are working together to bring AI and blockchain closer.

According to Rong, Hedera’s public ledger, known for being fast, secure, and energy-efficient, could play a key role in building trust in AI. The idea is to use Hedera to verify AI-generated data in real time, which is becoming more important as AI spreads across industries like healthcare, finance, supply chains, and autonomous vehicles.

He explained that Hedera makes it easy to track the origin of data, helping reduce misinformation, errors, and fraud in AI systems. Plus, its low energy use aligns with Nvidia’s push for sustainable, high-performance tech.

The news sent Hedera (HBAR) flying to an intraday high of $0.158 on April 8, lifting its market cap above $6.6 billion. Daily trading volume also surged over 53%, topping $551 million.

The bullish sentiment surrounding the AI-blockchain partnership also spilled over into other major players in the AI cryptocurrency sector, with tokens like Bittensor (TAO), Render (RENDER), Grass (GRASS), and Beldex (BDX) posting strong gains between 11–14%.

Adding fuel to the rally, The Hashgraph Group, a key backer of Hedera, announced a fresh investment in Indian agritech firm AgNext Technologies. The move will bring Hedera’s blockchain into AI-powered agri-solutions, which is aimed at enhancing trust and traceability in the food supply chain.

HBAR price analysis

On the 1-day USDT price chart, the HBAR price is currently testing the upper boundary of a falling wedge pattern it had formed since the beginning of March. In technical analysis, a breakout from such a pattern leads to more sustained gains ahead.

However, the bull-bear power (BBP) indicator, also called the Elder-Ray index, has been below the zero line since March 2, pointing to continued bearish pressure.

This indicator tracks the strength of buyers versus sellers, and staying in negative territory signals that the sellers still have the upper hand.

On top of that, the Aroon Down is at 92.86%, while the Aroon Up is at 0%, which means that selling pressure is clearly outweighing any buying activity at the moment.

While the indicators signal that bears are still in control, some analysts believe a reversal could be brewing if key levels hold.

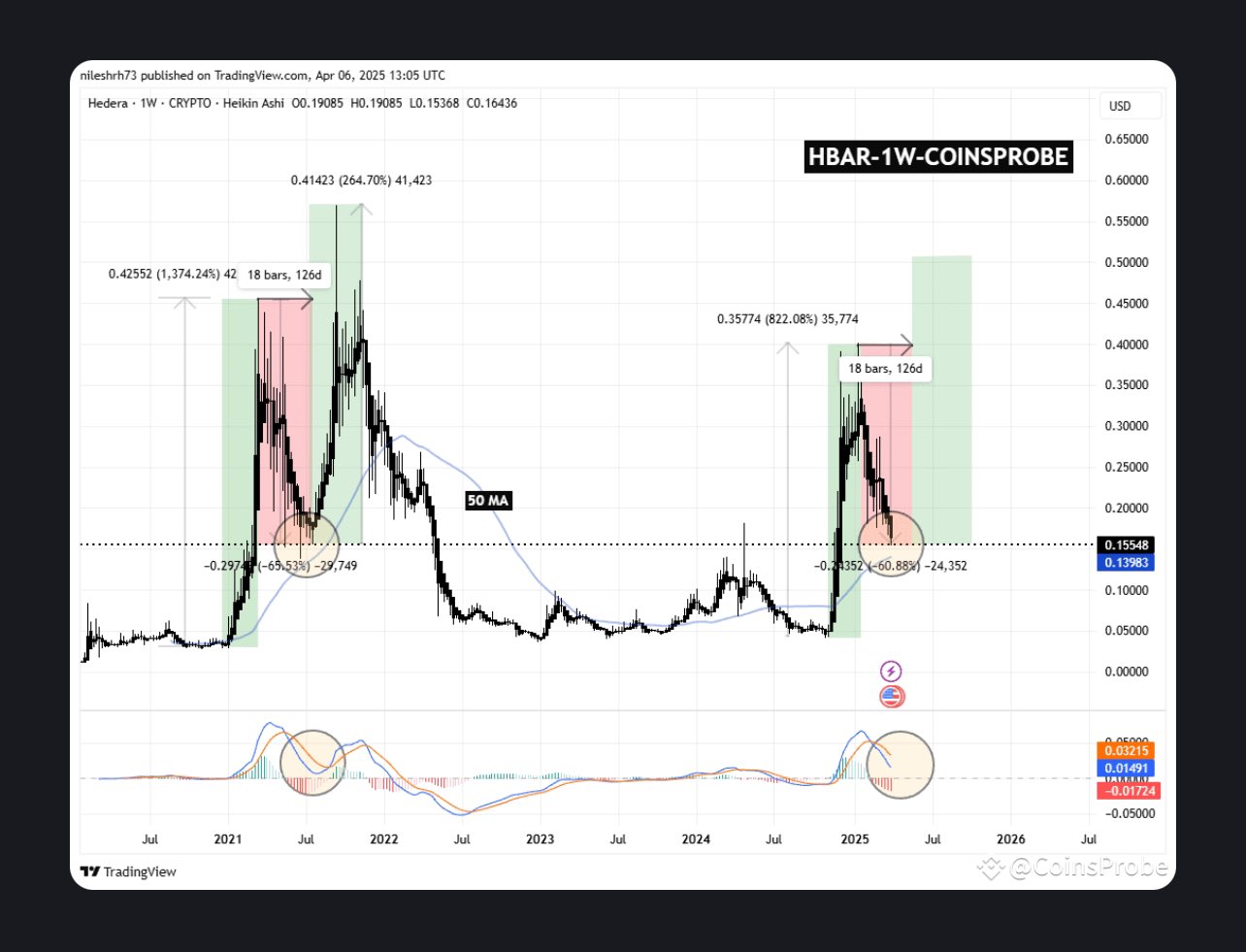

According to crypto analyst Sunovam, who shared a weekly chart of HBAR’s price action, past rallies have followed a familiar cycle: a parabolic run-up, a 60–65% correction, and then a period of consolidation before another major leg up.

The current setup is eerily similar, with HBAR now down over 58% from its recent peak and approaching historical support zones.

But for the bullish case to play out, the price needs to hold above the $0.14–$0.15 range, according to the analyst. Losing that level could drag it back toward the $0.10 region.

Also, the MACD on the weekly chart is nearing a potential crossover, but it hasn’t flipped bullish yet, meaning the momentum isn’t fully on the bulls’ side.

If buyers can reclaim $0.20 and push through $0.25, it could confirm the beginning of another rally phase, especially with the AI narrative heating up.

That said, HBAR’s next direction will also depend heavily on the broader crypto market. Bitcoin’s performance continues to act as the main barometer for altcoin strength. If BTC holds steady or rallies, it could create the right environment for HBAR and other AI tokens to shine.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link